Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find solution d Test Questions national Course Scenarios an Directions The first two scenarios do not require you to notes for each scenario answer the

Find solution

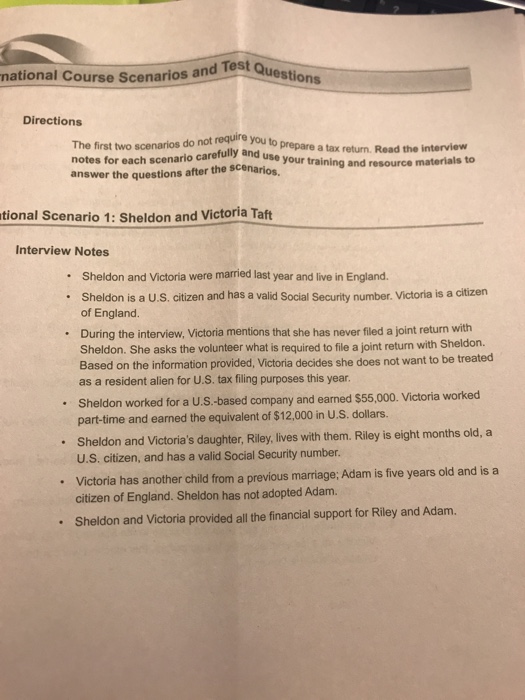

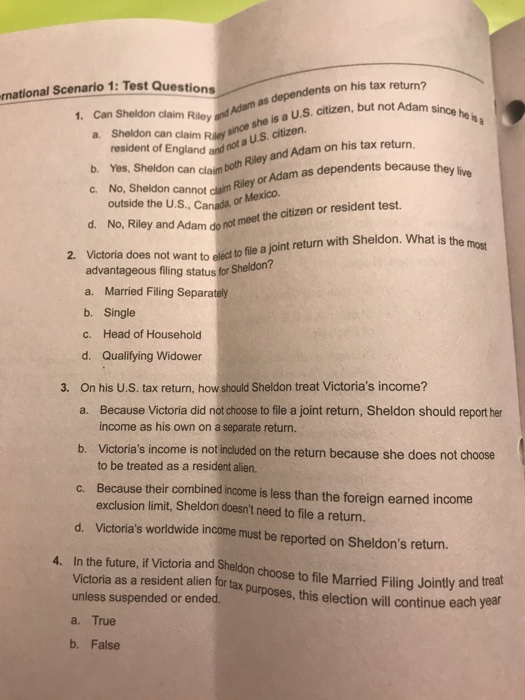

d Test Questions national Course Scenarios an Directions The first two scenarios do not require you to notes for each scenario answer the questions after the scenarios, traii prepare a tax return. Read the in resource materials to tional Scenario 1: Sheldon and Victoria Taft Interview Notes Sheldon and Victoria were married last year and live in England. . Sheldon is a U.S. citizen and has a valid Social Security number. Victoria is a citizern of England. During the interview, Victoria mentions that she has never filed a joint return with Sheldon. She asks the volunteer what is required to file a joint return with Sheldon. Based on the information provided, Victoria decides she does not want to be treated as a resident alien for U.S. tax filing purposes this year. . Sheldon worked for a U.S.-based company and earned $55,000. Victoria worked part-time and earned the equivalent of $12,000 in U.S. dollars. Sheldon and Victoria's daughter, Riley, lives with them. Riley is eight months old, a U.S. citizen, and has a valid Social Security number. Victoria has another child from a previous marriage: Adam is five years old and is a citizen of England. Sheldon has not adopted Adam. Sheldon and Victoria provided all the financial support for Riley and Adam

d Test Questions national Course Scenarios an Directions The first two scenarios do not require you to notes for each scenario answer the questions after the scenarios, traii prepare a tax return. Read the in resource materials to tional Scenario 1: Sheldon and Victoria Taft Interview Notes Sheldon and Victoria were married last year and live in England. . Sheldon is a U.S. citizen and has a valid Social Security number. Victoria is a citizern of England. During the interview, Victoria mentions that she has never filed a joint return with Sheldon. She asks the volunteer what is required to file a joint return with Sheldon. Based on the information provided, Victoria decides she does not want to be treated as a resident alien for U.S. tax filing purposes this year. . Sheldon worked for a U.S.-based company and earned $55,000. Victoria worked part-time and earned the equivalent of $12,000 in U.S. dollars. Sheldon and Victoria's daughter, Riley, lives with them. Riley is eight months old, a U.S. citizen, and has a valid Social Security number. Victoria has another child from a previous marriage: Adam is five years old and is a citizen of England. Sheldon has not adopted Adam. Sheldon and Victoria provided all the financial support for Riley and Adam

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started