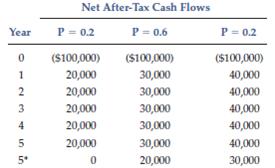

The staff of Porter Manufacturing has estimated the following net after-tax cash flows and probabilities for a new manufacturing process: Line 0 gives the cost

The staff of Porter Manufacturing has estimated the following net after-tax cash flows and probabilities for a new manufacturing process:

Line 0 gives the cost of the process, Lines 1 through 5 give operating cash flows, and Line 5* contains the estimated salvage values. Porter’s cost of capital for an average-risk project is 10%.

a. Assume that the project has average risk. Find the project’s expected NPV. (Hint: Use expected values for the net cash flow in each year.)

b. Find the best-case and worst-case NPVs. What is the probability of occurrence of the worst case if the cash flows are perfectly dependent (perfectly positively correlated) over time? If they are independent over time?

c. Assume that all the cash flows are perfectly positively correlated, that is, there are only three possible cash flow streams over time: (1) the worst case, (2) the most likely, or base, case, and (3) the best case, with probabilities of 0.2, 0.6, and 0.2, respectively. These cases are represented by each of the columns in the table. Find the expected NPV, its standard deviation, and its coefficient of variation.

Net After-Tax Cash Flows P = 0.2 P = 0.6 P = 0.2 Year (S100,000) (S100,000) ($100,000) 1 20,000 30,000 40,000 20,000 30,000 40,000 3 20,000 30,000 40,000 4 20,000 30,000 40,000 20,000 30,000 40,000 20,000 30,000 in in

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Company Ps staff found some aftertax cash flows They are not sure with the exact figures Thus they s...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started