Answered step by step

Verified Expert Solution

Question

1 Approved Answer

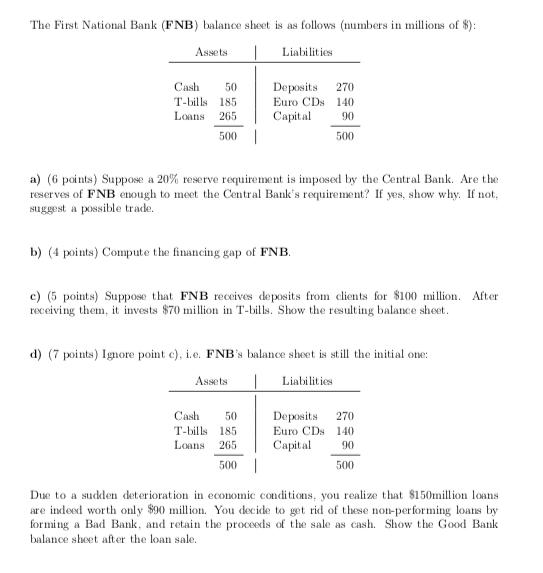

The First National Bank (FNB) balance sheet is as follows (numbers in millions of $): Assets Liabilities Cash 50 T-bills 185 Loans 265 500

The First National Bank (FNB) balance sheet is as follows (numbers in millions of $): Assets Liabilities Cash 50 T-bills 185 Loans 265 500 | Deposits 270 140 a) (6 points) Suppose a 20% reserve requirement is imposed by the Central Bank. Are the reserves of FNB enough to meet the Central Bank's requirement? If yes, show why. If not, suggest a possible trade. b) (4 points) Compute the financing gap of FNB. Euro CDs Capital Assets c) (5 points) Suppose that FNB receives deposits from clients for $100 million. After receiving them, it invests $70 million in T-bills. Show the resulting balance sheet. Cash 50 T-bills 185 Loans 265 90 500 d) (7 points) Ignore point c), i.e. FNB's balance sheet is still the initial one: T Liabilities 500 | Deposits 270 Euro CDs 140 Capital 90 500 Due to a sudden deterioration in economic conditions, you realize that $150million loans are indeed worth only $90 million. You decide to get rid of these non-performing loans by- forming a Bad Bank, and retain the proceeds of the sale as cash. Show the Good Bank balance sheet after the loan sale.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Central bank imposed reserve requirement ratio to be 20 Here the reserve requirement agai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started