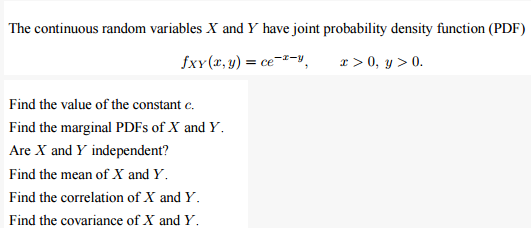

Question: Find the coefficient of corellation. fThe continuous random variables X and Y have joint probability density function (PDF) fxy(x, y) = ce-F-y 130,120. Find the

Find the coefficient of corellation.

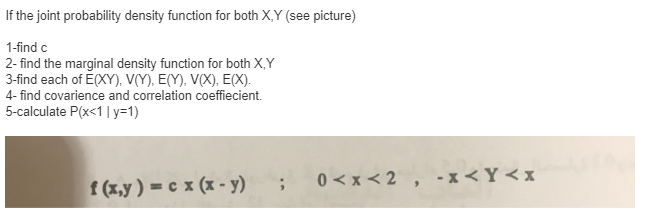

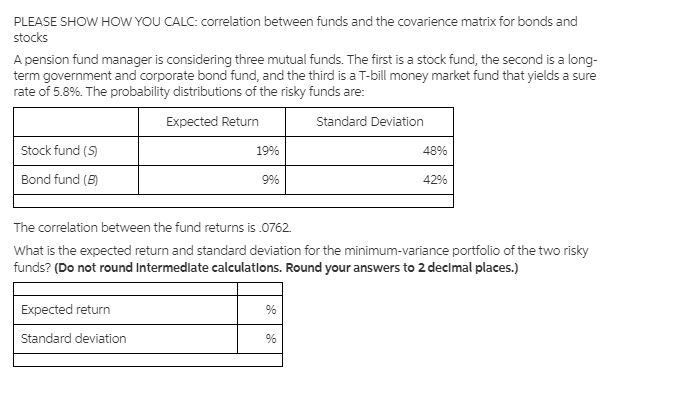

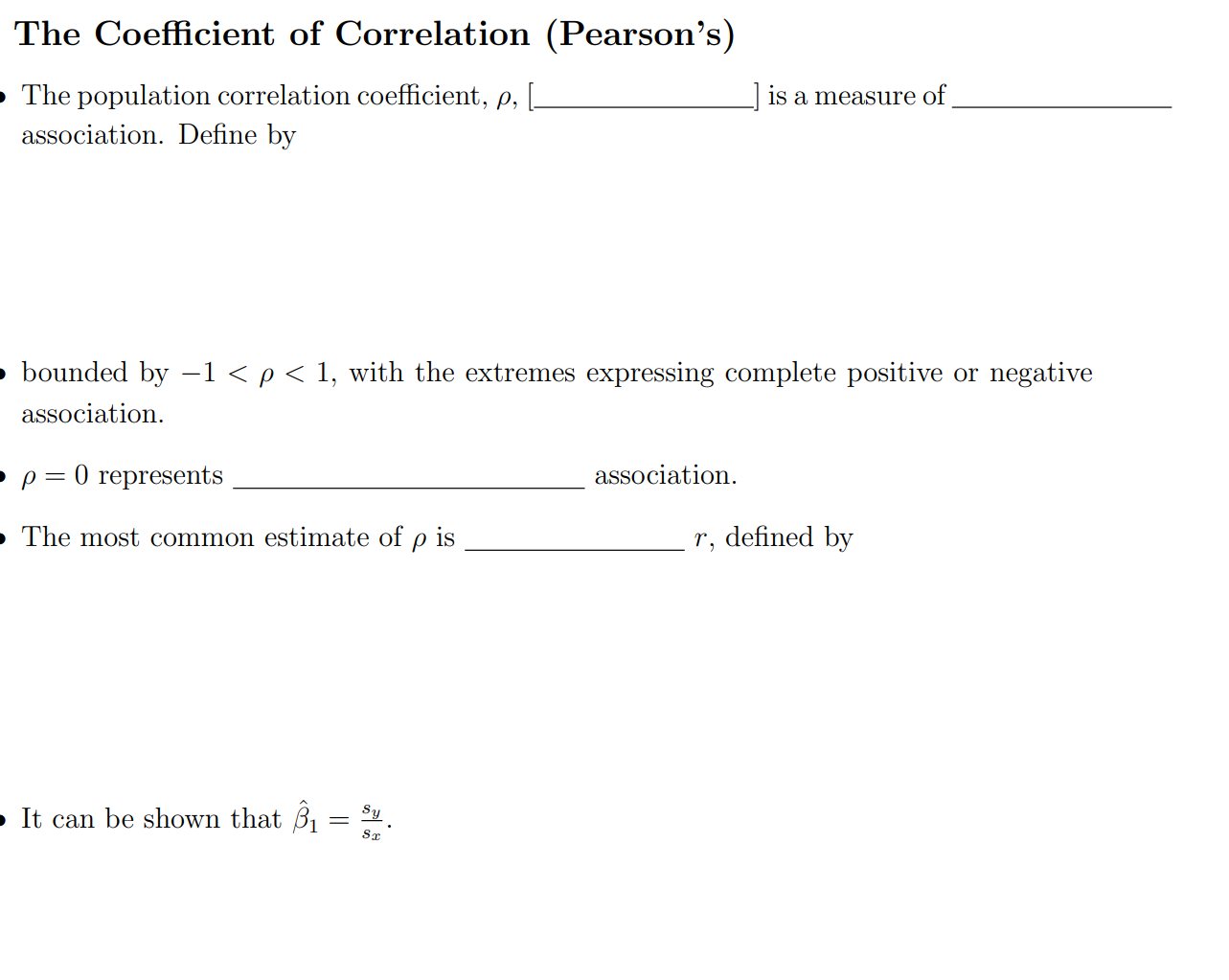

\fThe continuous random variables X and Y have joint probability density function (PDF) fxy(x, y) = ce-F-y 130,120. Find the value of the constant c. Find the marginal PDFs of X and Y. Are X and Y independent? Find the mean of X and Y. Find the correlation of X and Y. Find the covariance of X and Y.PLEASE SHOW HOW YOU CALC: correlation between funds and the covarience matrix for bonds and stocks A pension fund manager is considering three mutual funds. The rst is a stock fund: the second is a long- term government and corporate bond fund, and the third is a Tbill monev market fund that yields a sure rate of 5.5%. The probability.r distributions of the risky funds are: _ Expected Retum Standard Deviation Stock fund [5) 19% 48% The correlation between the fund returns is .OTr'EJ'. What is the expected retum and standard deviation for the minimumvariance portfolio ofthe two risky funds? [Do not round Intermediate calculations. Hound your answers to 2 decimal places] _ Expected return Standard deviation The Coefficient of Correlation (Pearson's) The population correlation coefficient, p, [ is a measure of association. Define by bounded by -1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts