Answered step by step

Verified Expert Solution

Question

1 Approved Answer

find the correct answers for part B and D. Everything with a green check is already correct, use that to your advantage instead of trying

find the correct answers for part B and D. Everything with a green check is already correct, use that to your advantage instead of trying to reinvent the wheel and solve what has already been solved (like the last guy that wasted one of my monthly questions). PLEASE SET UP ANSWERS IN A TABLE SO THEY ARE EASY TO DISTINGUISH!! Thank you.

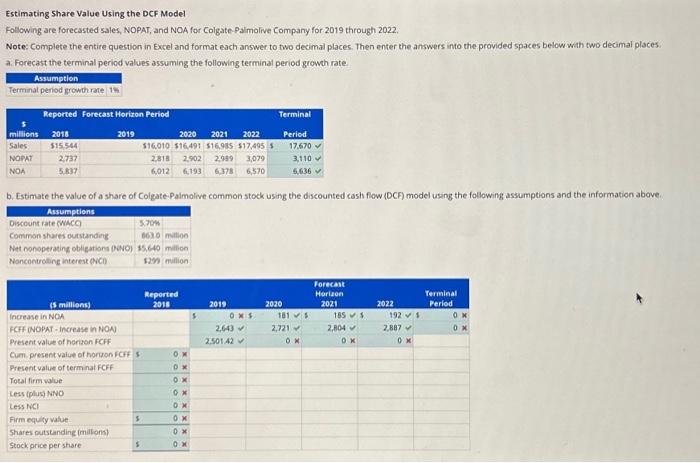

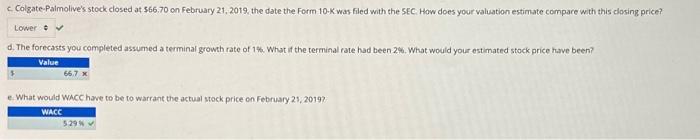

Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. a. Forecast the terminal period values assuming the following terminal period groweh rate. c. Colgate-Palmolive's stock closed at $66.70 on February 21,2019 , the date the Form 10K was filed with the SEC. How does your valuation estimate compare with this closing price? d. The forecasts you completed assumed a terminal growh rate of 1%. What if the terminal rate had been 2%. What would your estimated stock price have been? e. What would WAcC have to be to warrant the actual stock price on February 21,2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started