Answered step by step

Verified Expert Solution

Question

1 Approved Answer

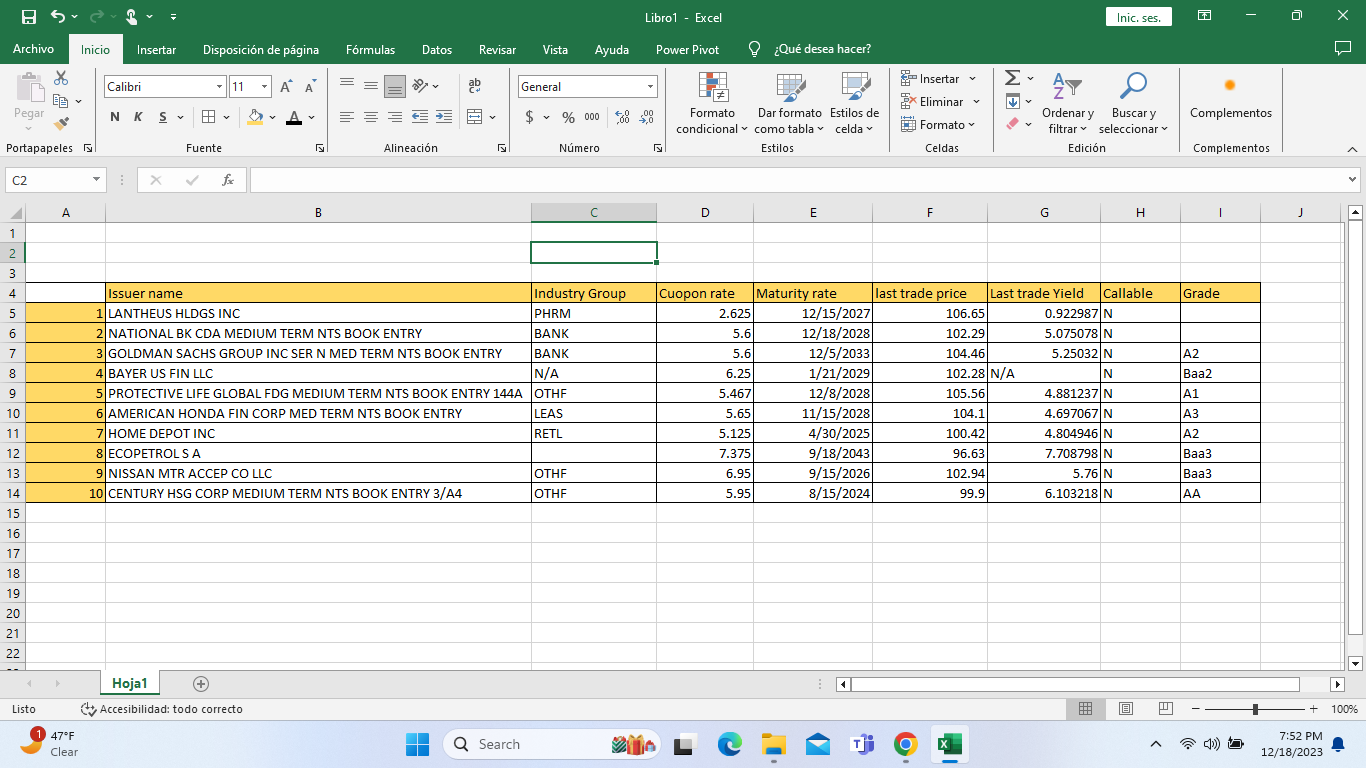

Find the credit ratings for each of your bonds, and enter that into Excel next to each bond in a new column. Part of this

Find the credit ratings for each of your bonds, and enter that into Excel next to each bond in a new column. Part of this assignment is testing your resourcefullness. Google has been available for several decades and going from student to professional means finding the answers for yourself often times.

Do a google search to find a post covid or is ok table that gives historical default rates and recoveries, by rating grade. Add this information to a new tab on your Excel workbook. The table should show the average default rates over a period of time for example

For each of your bonds, calculate expected default percent loss as default probabilityrecovery rate You will need to use the default rates and recovery rates that match each bond's rating.

Calculate the overall expected loss to your portfolio as the weighted average of the expected default percent loss. Use the bond prices from when you formed the portfolio as the weights.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started