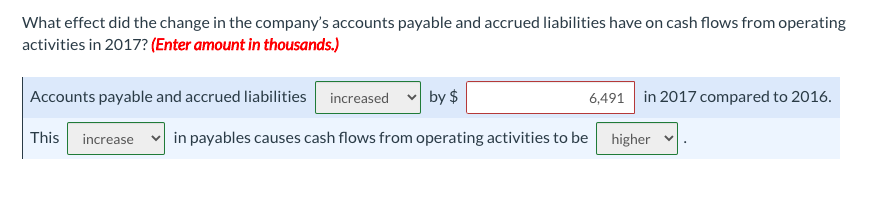

Find the difference in accounts payable and accrued liabilities using the information above.

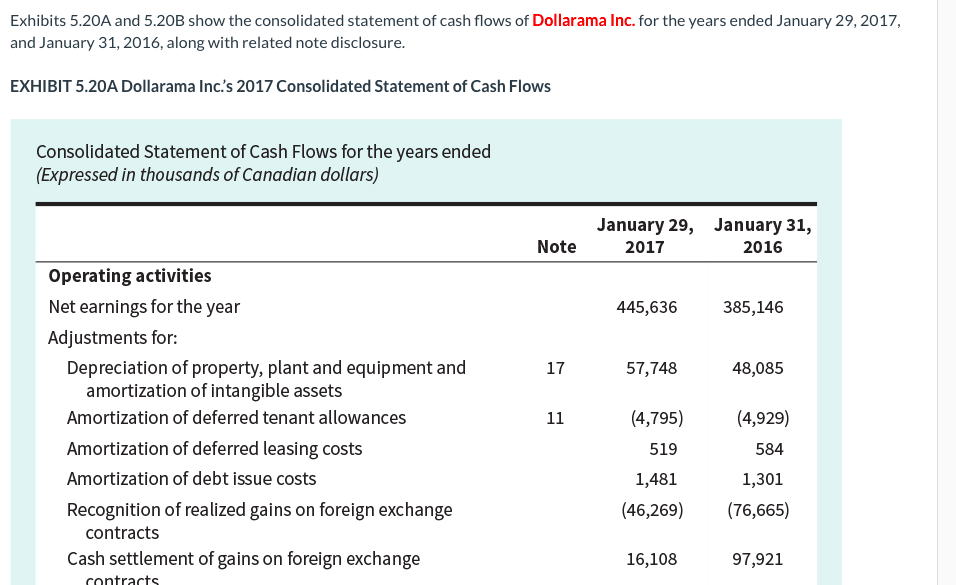

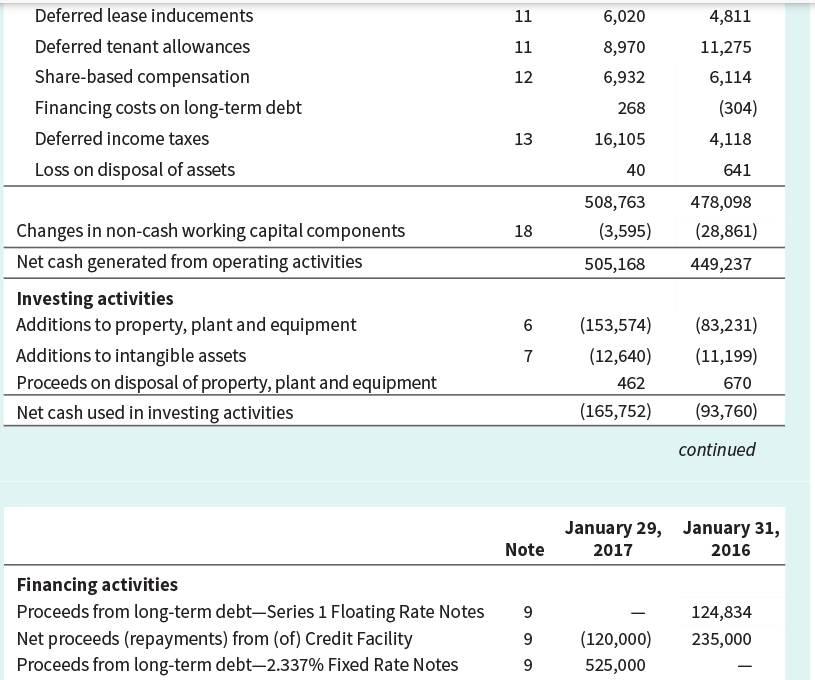

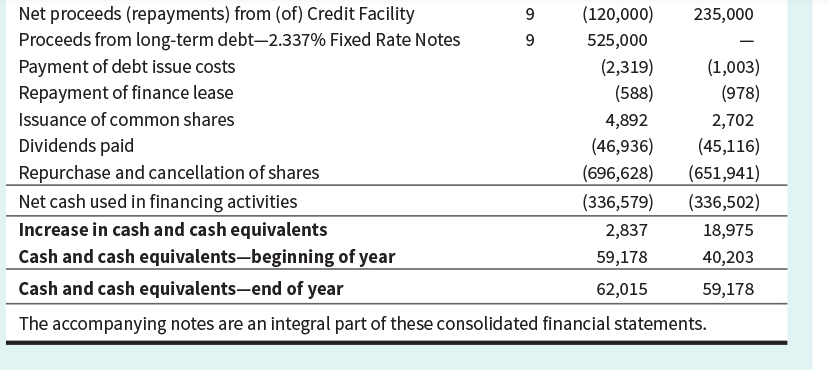

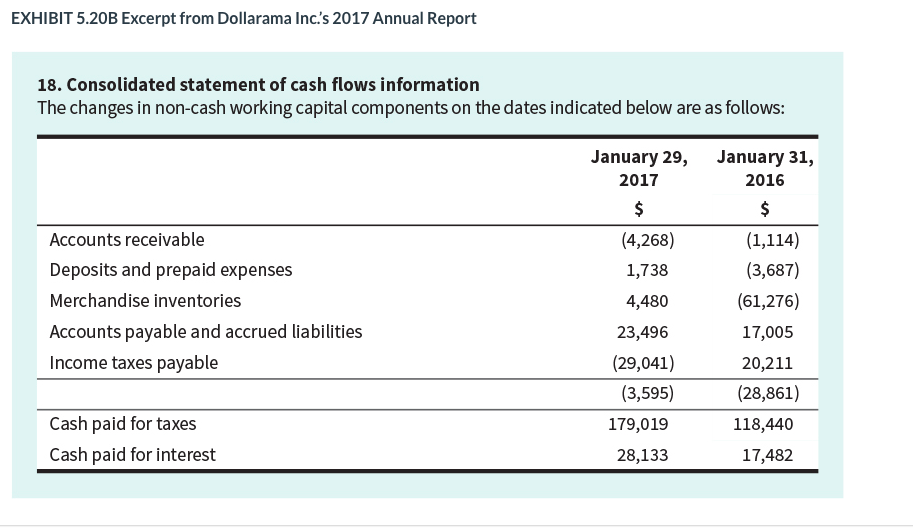

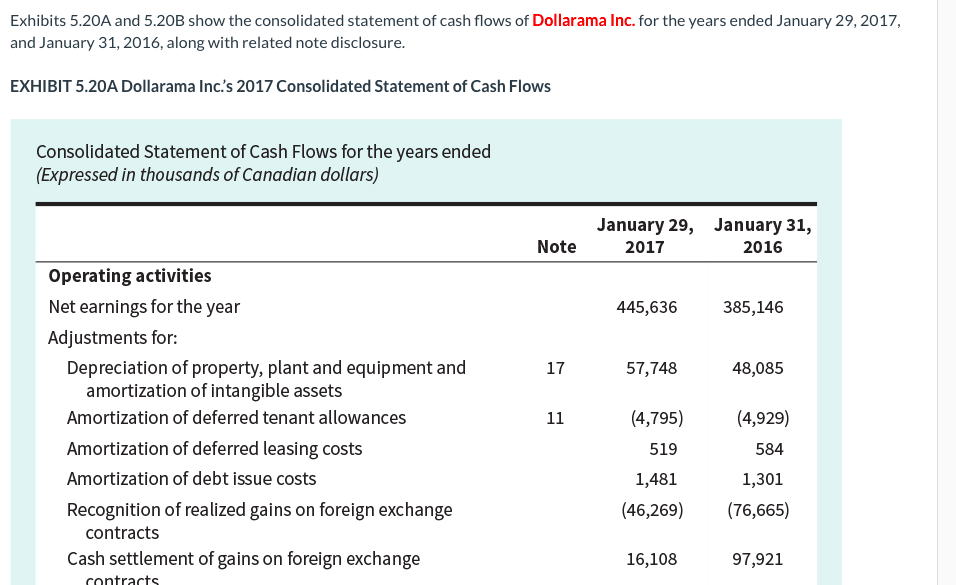

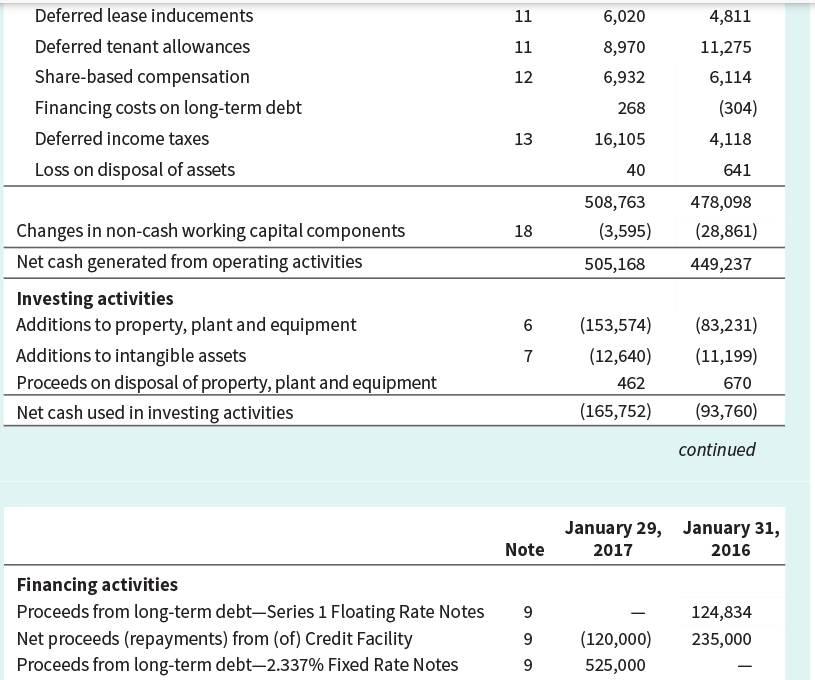

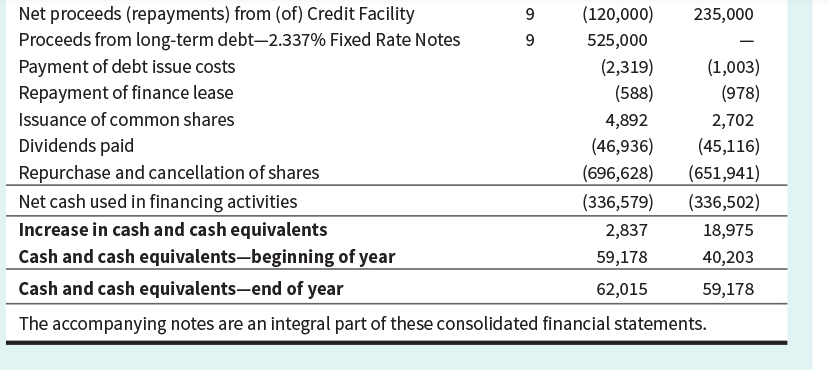

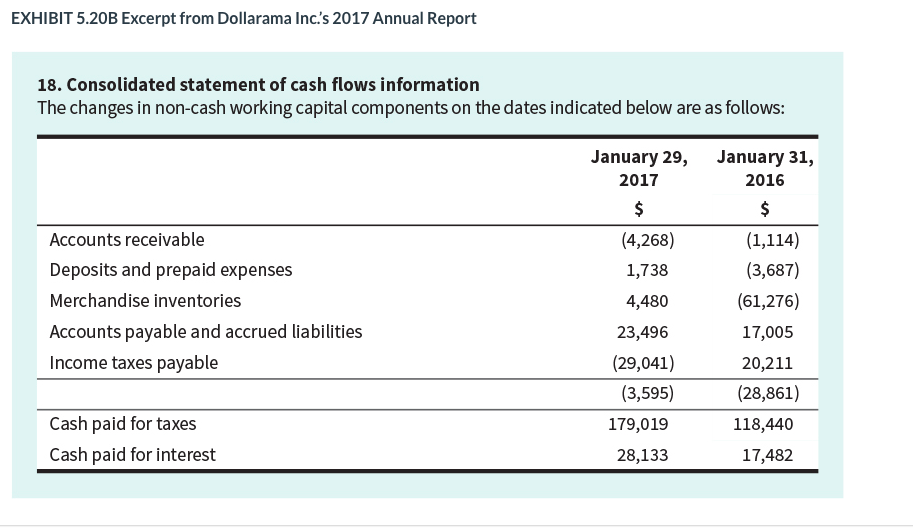

Exhibits 5.20A and 5.20B show the consolidated statement of cash flows of Dollarama Inc. for the years ended January 29, 2017, and January 31, 2016, along with related note disclosure. EXHIBIT 5.20A Dollarama Inc.'s 2017 Consolidated Statement of Cash Flows Consolidated Statement of Cash Flows for the years ended (Expressed in thousands of Canadian dollars) Note January 29, January 31, 2017 2016 445,636 385,146 17 57,748 48,085 Operating activities Net earnings for the year Adjustments for: Depreciation of property, plant and equipment and amortization of intangible assets Amortization of deferred tenant allowances Amortization of deferred leasing costs Amortization of debt issue costs Recognition of realized gains on foreign exchange contracts Cash settlement of gains on foreign exchange contracts 11 (4,795) (4,929) 519 584 1,301 1,481 (46,269) (76,665) 16,108 97,921 11 11 12 Deferred lease inducements Deferred tenant allowances Share-based compensation Financing costs on long-term debt Deferred income taxes Loss on disposal of assets 6,020 8,970 6,932 268 16,105 40 4,811 11,275 6,114 (304) 4,118 13 641 508,763 (3,595) 505,168 478,098 (28,861) 18 449,237 Changes in non-cash working capital components Net cash generated from operating activities Investing activities Additions to property, plant and equipment Additions to intangible assets Proceeds on disposal of property, plant and equipment Net cash used in investing activities 09 6 7 (153,574) (12,640) 462 (165,752) (83,231) (11,199) 670 (93,760) continued January 29, January 31, 2017 2016 Note Financing activities Proceeds from long-term debt-Series 1 Floating Rate Notes Net proceeds (repayments) from (of) Credit Facility Proceeds from long-term debt-2.337% Fixed Rate Notes 9 9 9 124,834 235,000 (120,000) 525,000 Net proceeds (repayments) from (of) Credit Facility 9 (120,000) 235,000 Proceeds from long-term debt-2.337% Fixed Rate Notes 9 525,000 Payment of debt issue costs (2,319) (1,003) Repayment of finance lease (588) (978) Issuance of common shares 4,892 2,702 Dividends paid (46,936) (45,116) Repurchase and cancellation of shares (696,628) (651,941) Net cash used in financing activities (336,579) (336,502) Increase in cash and cash equivalents 2,837 18,975 Cash and cash equivalents-beginning of year 59,178 40,203 Cash and cash equivalents-end of year 62,015 59,178 The accompanying notes are an integral part of these consolidated financial statements. EXHIBIT 5.200 Excerpt from Dollarama Inc.'s 2017 Annual Report 18. Consolidated statement of cash flows information The changes in non-cash working capital components on the dates indicated below are as follows: Accounts receivable Deposits and prepaid expenses Merchandise inventories Accounts payable and accrued liabilities Income taxes payable January 29, January 31, 2017 2016 $ $ (4,268) (1,114) 1,738 (3,687) 4,480 (61,276) 23,496 17,005 (29,041) 20,211 (3,595) (28,861) 179,019 118,440 28,133 17,482 Cash paid for taxes Cash paid for interest What effect did the change in the company's accounts payable and accrued liabilities have on cash flows from operating activities in 2017? (Enter amount in thousands.) Accounts payable and accrued liabilities increased by $ 6,491 in 2017 compared to 2016. This increase in payables causes cash flows from operating activities to be higher