Answered step by step

Verified Expert Solution

Question

1 Approved Answer

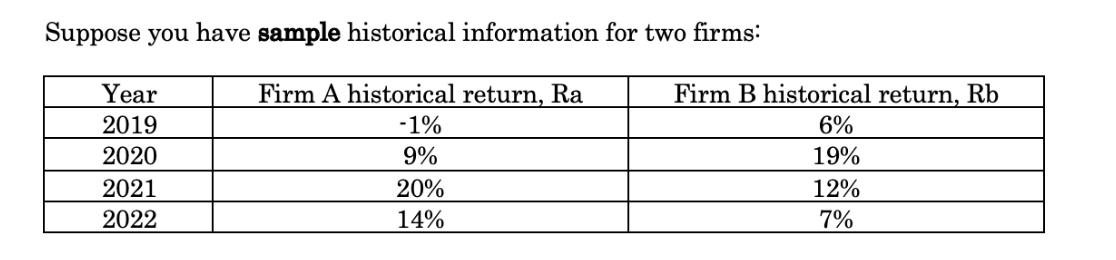

Find the following ex-post measures: Arithmetic average return of Firm A Geometric average return of Firm A Expected return of Firm A Variance of

Find the following ex-post measures:

- Arithmetic average return of Firm A

- Geometric average return of Firm A

- Expected return of Firm A

- Variance of Firm A's returns

- Standard deviation of Firm A's returns

- 95.44% of the time, the stock's return will vary between _______% and ________%

- Find the covariance between Firm A and Firm B's returns

- Find the coefficient of correlation between the two stocks

- What is the expected return of the risky portfolio, if you invest 20% in Firm A and the remaining 80% in Firm B?

- What is the risk (as measured by st. dev.) of the risky portfolio, P?

- What is the expected return on the complete portfolio, C, if you decide to invest 30% of your money into a risk-free asset offering 5% return, and the remaining 70% into the risky portfolio, P?

- What is the risk (as measured by st. dev.) of the complete portfolio?

- What is the Sharpe ratio of the Complete portfolio?

- What is the Treynor ratio of Firm A if its beta is 0.92?

Suppose you have sample historical information for two firms: Year 2019 2020 2021 2022 Firm A historical return, Ra -1% 9% 20% 14% Firm B historical return, Rb 6% 19% 12% 7%

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the requested expost measures we will use the historical return data provided for Firm A and Firm B Firm A Historical Returns 2019 1 2020 9 2021 20 2022 14 Firm B Historical Returns 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started