Question

Find the future value of $10 received today and deposited for 2 years at 5%. (b)Find the present value of $10 to be received 2

Find the future value of $10 received today and deposited for 2 years at 5%.

(b)Find the present value of $10 to be received 2 years from now, assuming an opportunity cost of 5%.

(c)Find the future value of an ordinary annuity of $10 each year for 2 years, deposited at 5%.

(d)Find the present value of an ordinary annuity of $10 each year for 2 years, deposited at 5%.

Exercise 4.2. Present and Future Values—Mixed Stream

(a)Find the present value of $500 received at the end of year 1, $400 received at the end of year 2, and $300 received at the end of year 3, assuming an opportunity cost of 7%.

(b)Find the future value of $500 received at the end of year 1, $400 received at the end of year 2, and $300 received at the end of year 3, assuming an opportunity cost of 7%.

Exercise 4.3. Loan Payment

Find the actual end-of-period loan payment in each of the following situations.

(a)Jennifer borrows $15,000 for a new car. The terms of the loan are 12% interest with monthly payments for 2 years.

(b)Anderson Equipment purchases a new lathe for $35,000. The lathe is financed with a bank loan with an interest rate of 7%, to be repaid in 5 equal annual installments.

Exercise 4.4. Amortization Schedule

Prepare an amortization schedule for a $100,000 loan with an interest rate of 8%, to be repaid in four equal annual installments.

Exercise 4.5. Present Value—Mixed Stream

Find the present value of the following stream of cash flows, assuming the firm's opportunity cost is 20%.

Years Amount

1-6 $2300

7-10 $58,000

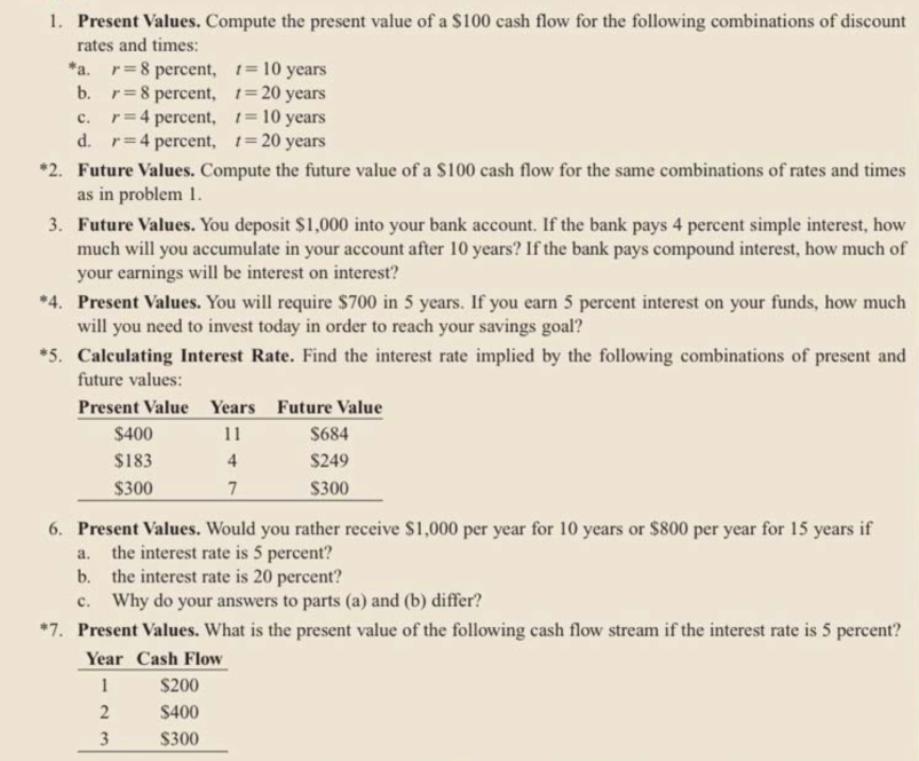

1. Present Values. Compute the present value of a $100 cash flow for the following combinations of discount rates and times: *a. r=8 percent, b. r=8 percent, C. r=4 percent, 1= 10 years d. r=4 percent, 1= 20 years 1= 10 years 1= 20 years *2. Future Values. Compute the future value of a $100 cash flow for the same combinations of rates and times as in problem 1. 3. Future Values. You deposit $1,000 into your bank account. If the bank pays 4 percent simple interest, how much will you accumulate in your account after 10 years? If the bank pays compound interest, how much of your earnings will be interest on interest? *4. Present Values. You will require $700 in 5 years. If you earn 5 percent interest on your funds, how much will you need to invest today in order to reach your savings goal? *5. Calculating Interest Rate. Find the interest rate implied by the following combinations of present and future values: Present Value $400 $183 $300 Years Future Value 11 4 7 $200 $400 $300 $684 $249 $300 6. Present Values. Would you rather receive $1,000 per year for 10 years or $800 per year for 15 years if a. the interest rate is 5 percent? b. the interest rate is 20 percent? c. Why do your answers to parts (a) and (b) differ? *7. Present Values. What is the present value of the following cash flow stream if the interest rate is 5 percent? Year Cash Flow 1 2 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets address each part of your homework step by step a The future value FV of an amount P invested t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started