Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find the future value of the following ordinary annuity. Periodic Payment Payment Interval $1450 1 month Term 13 years Interest Rate 10% Conversion Period

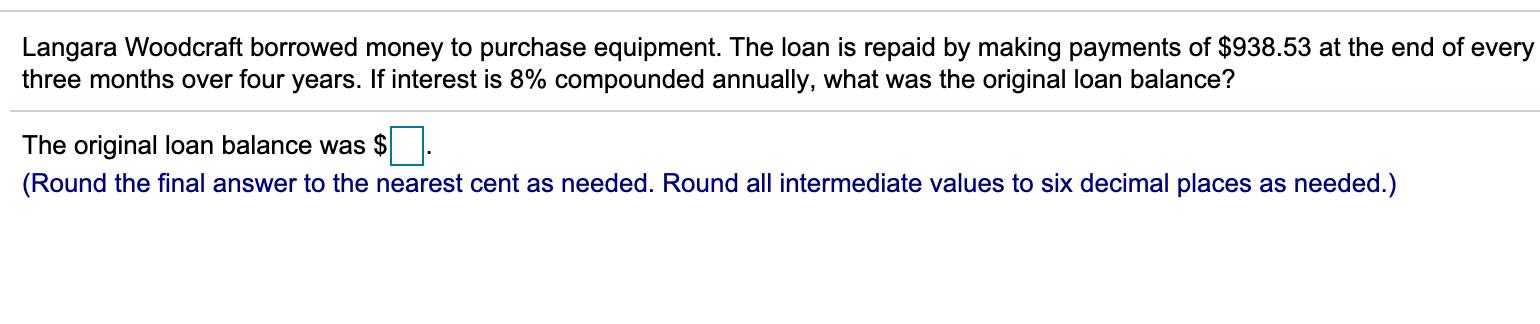

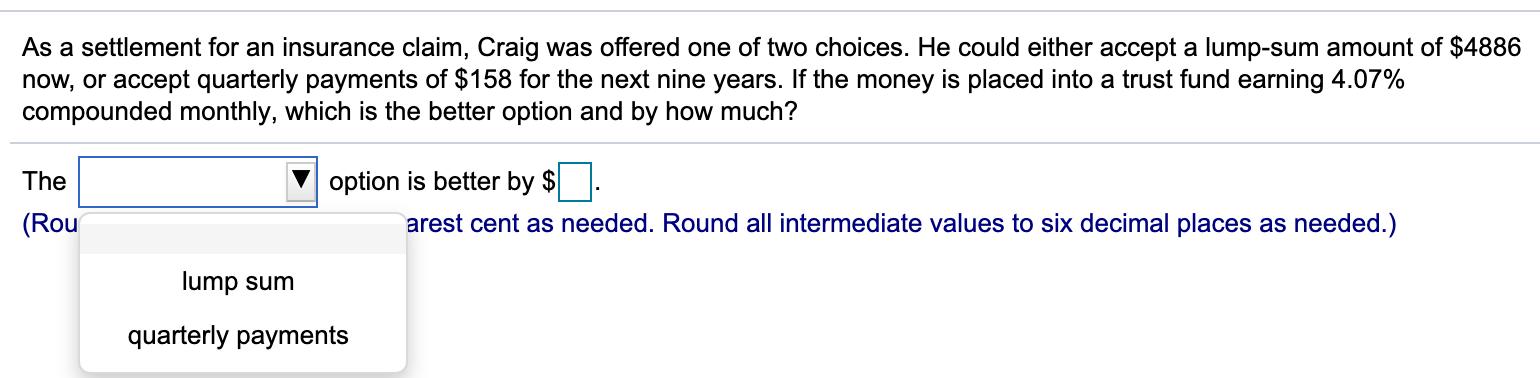

Find the future value of the following ordinary annuity. Periodic Payment Payment Interval $1450 1 month Term 13 years Interest Rate 10% Conversion Period annually The future value is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Langara Woodcraft borrowed money to purchase equipment. The loan is repaid by making payments of $938.53 at the end of every three months over four years. If interest is 8% compounded annually, what was the original loan balance? The original loan balance was $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) As a settlement for an insurance claim, Craig was offered one of two choices. He could either accept a lump-sum amount of $4886 now, or accept quarterly payments of $158 for the next nine years. If the money is placed into a trust fund earning 4.07% compounded monthly, which is the better option and by how much? The (Rou option is better by $ arest cent as needed. Round all intermediate values to six decimal places as needed.) lump sum quarterly payments

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve these financial problems one by one Find the future value of the ordinary annuity Given Periodic Payment 1450 Payment Interval 1 month Term ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started