Answered step by step

Verified Expert Solution

Question

1 Approved Answer

find the net present value Toying With Nature wants to take advantage of children's current fascination with dinosaurs by adding several scale-model dinosaurs to its

find the net present value

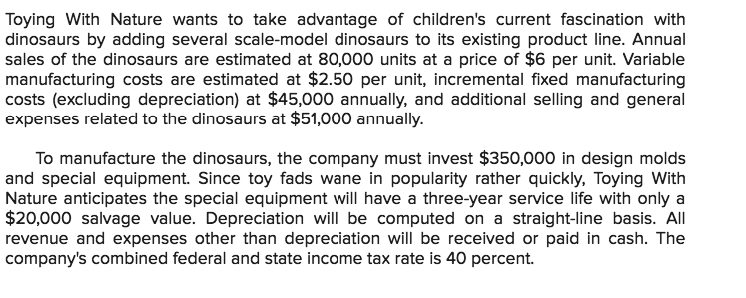

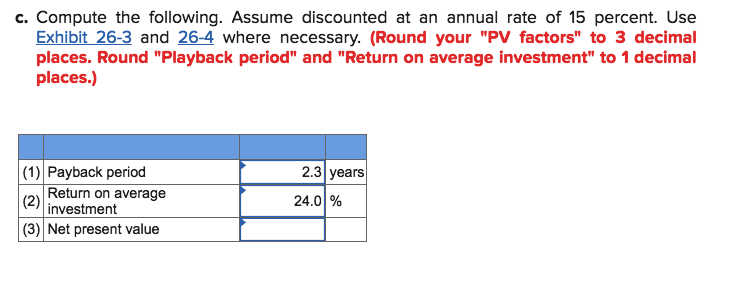

Toying With Nature wants to take advantage of children's current fascination with dinosaurs by adding several scale-model dinosaurs to its existing product line. Annual sales of the dinosaurs are estimated at 80,000 units at a price of $6 per unit. Variable manufacturing costs are estimated at $2.50 per unit, incremental fixed manufacturing costs (excluding depreciation) at $45,000 annually, and additional selling and general expenses related to the dinosaurs at $51,000 annually. To manufacture the dinosaurs, the company must invest $350,000 in design molds and special equipment. Since toy fads wane in popularity rather quickly, Toying With Nature anticipates the special equipment will have a three-year service life with only a $20,000 salvage value. Depreciation will be computed on a straight-line basis. All revenue and expenses other than depreciation will be received or paid in cash. The company's combined federal and state income tax rate is 40 percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started