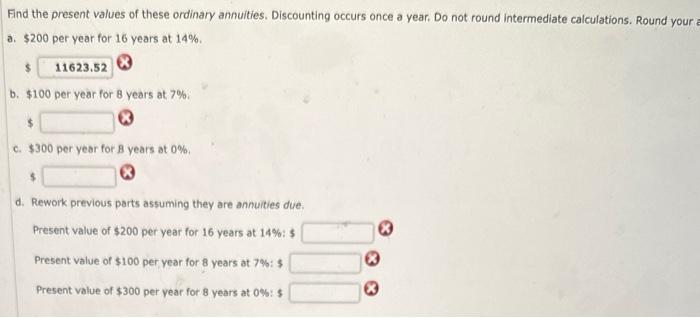

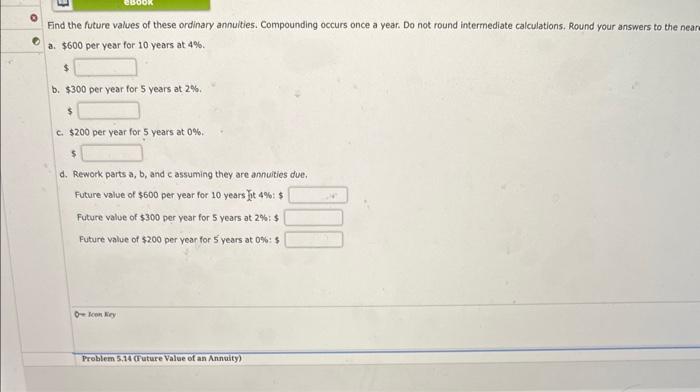

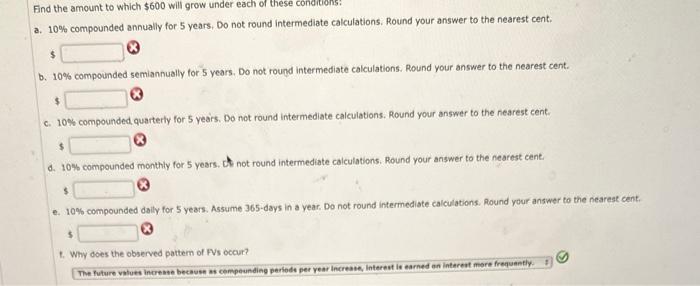

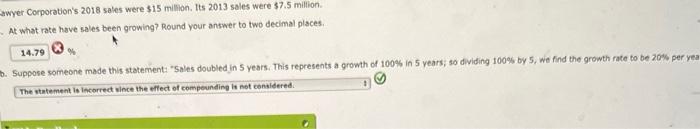

Find the present values of these ordinary annuities. Discounting occurs once a year. Do not round intermediate calculations. Round your a. $200 per year for 16 years at 14%. b. $100 per year for 8 years at 7%. c. $300 per year for 8 years at 0%. d. Rework previous parts assuming they are annuities due. Present value of $200 per year for 16 years at 14%:$ Present value of $100 per year for 8 years at 7% : $ Present value of $300 per year for 8 years at 0%:$ End the future values of these ordinary annuities. Compounding occurs once a year. Do not round intermediate calculations. Round your answers to the near a. $600 per year for 10 years at 4%. b. $300 per year for 5 years at 2%. $ c. $200 per year for 5 years at 0%. d. Rework parts a, b, and e assuming they are annuities due, Future value of $600 per year for 10 years t 4\%: $ Future value of $300 per year for 5 years at 2% : $ Future value of $200 per year for 5 years at 0\%: $ konko Froblem 5,14 (ruture value of an Annaity) a. 10% compounded annually for 5 years, Do not round intermediate calculations. Round your answer to the nearest cent. b. 10% compounded semiannually for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. c. 10% compounded quarterly for 5 years. Do not round intermediate calculations. Round your answer to the nearest cent. d. 10% compounded monthly for 5 years. Dh not round intermediate calculations. Round your answer to the nearest cent. e. 10% compounded dally for 5 years. Assume 365 -days in a year. Do not round intermediate calculations. Round your answer to the nearest cent. 1. Why does the observed pattem of FVs occur? awyer Corporation's 2018 sales were $15 millon. Its 2013 sales were $7.5 milion. At what rate hove sales been growing? Round your answer to two decimal plsces. Suboose someone made this statement. "Sales doubled in 5 years. This represents a growth of 100% in 5 years; so dividing 100% by 5 , we find the growth rate to be 20 th per ye: What is the present value of a security that will pay $25,000 in 20 years if securities of equal risk pay 3% annually? Do not roung Vour parents will retire in 15 yeass. They currentiy have $260,000 saved, and they think they will need $900,000 at retirement. What annual interest rate must they earn to reach their goal, astuming they any additional fondss kound your anower to tao decimal places. Hite reedtack