Answered step by step

Verified Expert Solution

Question

1 Approved Answer

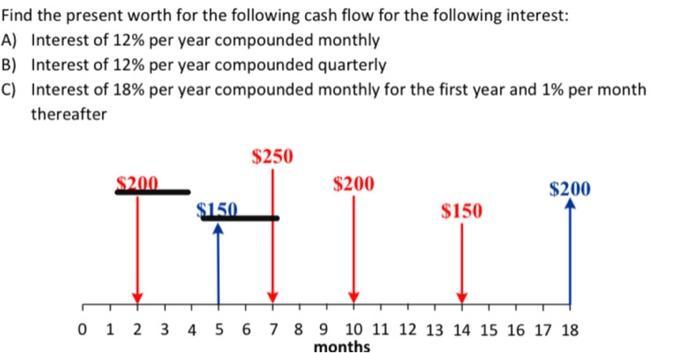

Find the present worth for the following cash flow for the following interest: A) Interest of 12% per year compounded monthly B) Interest of

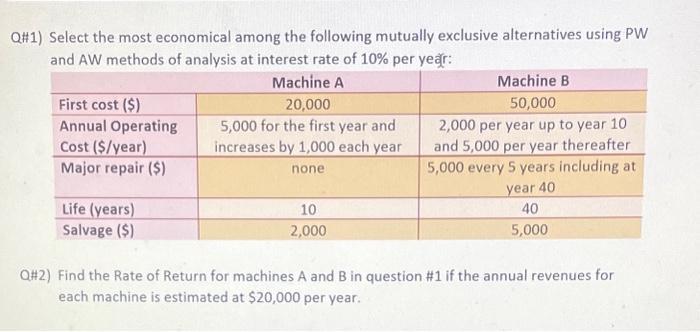

Find the present worth for the following cash flow for the following interest: A) Interest of 12% per year compounded monthly B) Interest of 12% per year compounded quarterly C) Interest of 18% per year compounded monthly for the first year and 1% per month thereafter $200 $150 $250 $200 $150 $200 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 months Q#1) Select the most economical among the following mutually exclusive alternatives using PW and AW methods of analysis at interest rate of 10% per year: Machine A 20,000 First cost ($) Annual Operating Cost ($/year) Major repair ($) Life (years) Salvag ($) 5,000 for the first year and increases by 1,000 each year none 10 2,000 Machine B 50,000 2,000 per year up to year 10 and 5,000 per year thereafter 5,000 every 5 years including at year 40 40 5,000 Q#2) Find the Rate of Return for machines A and B in question #1 if the annual revenues for each machine is estimated at $20,000 per year.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started