Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find the price on 2/1/22 of a 10-year zero coupon bond with face value of $100. That is, what is the market price that you

Find the price on 2/1/22 of a 10-year zero coupon bond with face value of $100. That is, what is the market price that you would have needed to pay 2/1/22 for a bond (backed by the Treasury) that pays you $100 on 2/1/2032?

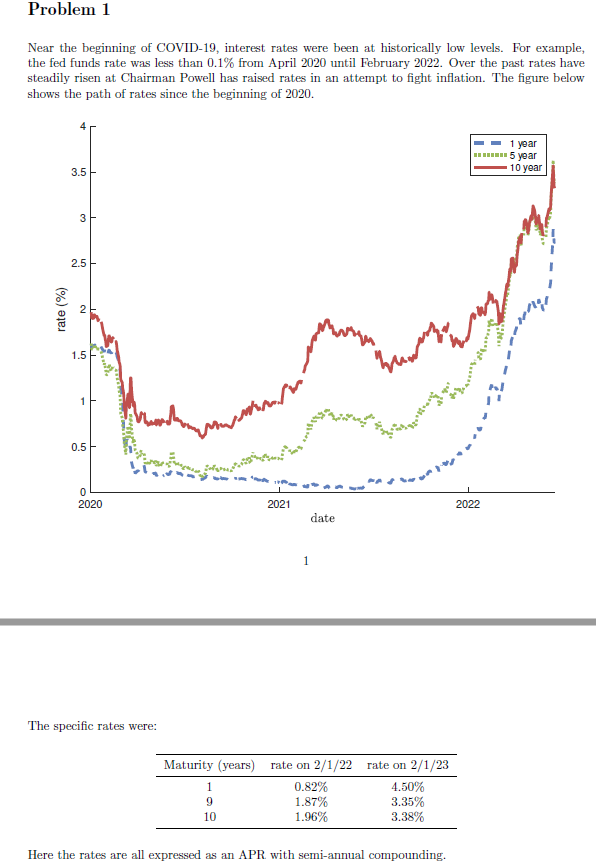

Problem 1 Near the beginning of COVID-19, interest rates were been at historically low levels. For example, the fed funds rate was less than 0.1% from April 2020 until February 2022. Over the past rates have steadily risen at Chairman Powell has raised rates in an attempt to fight inflation. The figure below shows the path of rates since the beginning of 2020. 3.5 rate (%) 2 2.5 in 1.5 0.5 1 3 0 2020 2021 2022 date 1 The specific rates were: Maturity (years) rate on 2/1/22 rate on 2/1/23 1 0.82% 4.50% 9 1.87% 3.35% 10 1.96% 3.38% Here the rates are all expressed as an APR with semi-annual compounding. 1 year 5 year 10 year

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started