Question: Find the risk-neutral probabilities and zero cost date 0 forward prices (for settlement at date 1) for the stock in exercise 7.2. As in that

Find the risk-neutral probabilities and zero cost date 0 forward prices (for settlement at date 1) for the stock in exercise 7.2. As in that exercise, assume a risk-free rate of 15% per period.

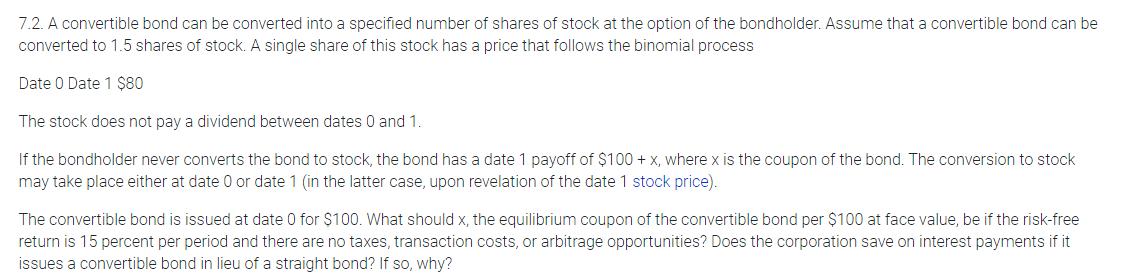

7.2. A convertible bond can be converted into a specified number of shares of stock at the option of the bondholder. Assume that a convertible bond can be converted to 1.5 shares of stock. A single share of this stock has a price that follows the binomial process Date 0 Date 1 $80 The stock does not pay a dividend between dates 0 and 1. If the bondholder never converts the bond to stock, the bond has a date 1 payoff of $100 + X, where x is the coupon of the bond. The conversion to stock may take place either at date 0 or date 1 (in the latter case, upon revelation of the date 1 stock price). The convertible bond is issued at date 0 for $100. What should x, the equilibrium coupon of the convertible bond per $100 at face value, be if the risk-free return is 15 percent per period and there are no taxes, transaction costs, or arbitrage opportunities? Does the corporation save on interest payments if it issues a convertible bond in lieu of a straight bond? If so, why?

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Answer Hazardneutral probabilities are possibilities of possible future effects that have been adjusted for risk They may be used to calculate anticipated asset values those chances are used for figur... View full answer

Get step-by-step solutions from verified subject matter experts