Answered step by step

Verified Expert Solution

Question

1 Approved Answer

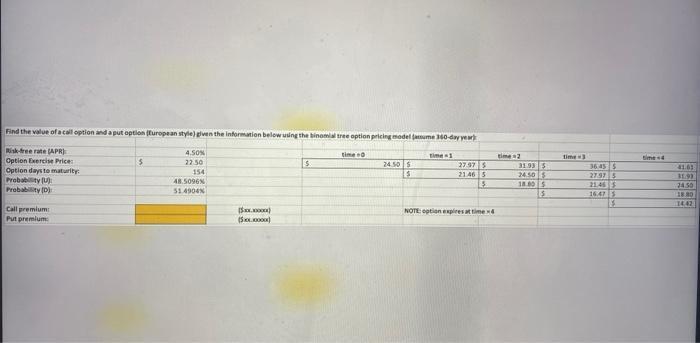

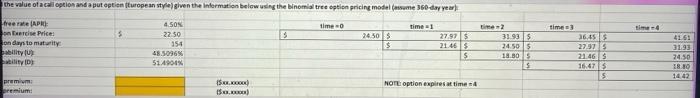

Find the value of a call option and a put option (European style) given the information below using the binomial tree option pricing model

Find the value of a call option and a put option (European style) given the information below using the binomial tree option pricing model famume 360-day year Risk-free rate (APR) Option Exercise Price: Option days to maturity Probability (U Probability (D) Call premium: Put premium $ 4.50% 22.50 154 48.5096% 51.4904% xxxxxx) (5xxxxxx) S time 24.50 5 5 Time 27.97 $ 21.46 5 5 NOTE: option expires at time x4 time2 31.93 $ 24.50 $ 18.80 S 15 time-3 36.45 $ 27.97 5 21.45 S 16.47 $ |$ 4 41.61 31.93 24.50 18.80 3442) the value of a call option and a put option (European style) given the information below using the binomial tree option pricing model (assume 360-day year) free rate (APR): on Exercise Price: on days to maturity ability (U ability (D premium premium: $ 4.50% 22.50 154 48.5096% 51.4904% ($xxx.xxxxxx) (5xx.xxxx) 5 time=0 24.50 $ $ time=1 27.97 $ 21.46 $ $ NOTE: option expires at time time2 31.93 5 24.50 5 18.80 $ S time 3 36.45 $ 27.97 $ 21.46 $ 16.47 $ $ time-4 41.61 31.93 24.50 18.80 14.42

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To find the value of the call option and put option using the binomial tree option pricing model we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started