Answered step by step

Verified Expert Solution

Question

1 Approved Answer

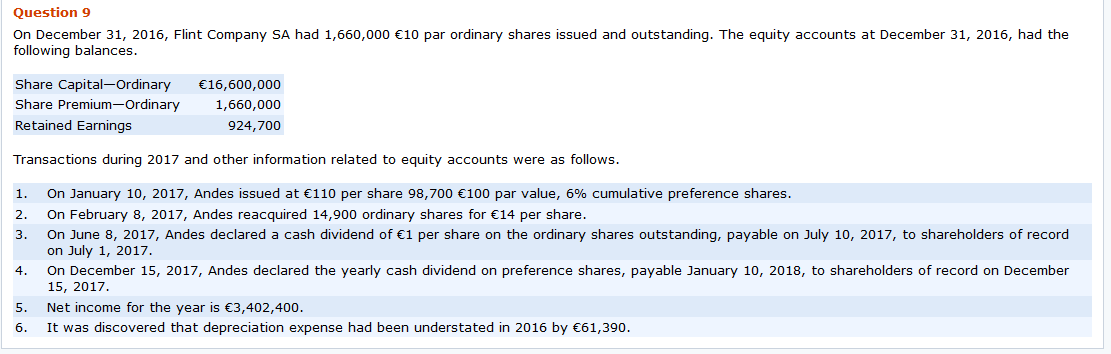

FIND THIS NUMBER!!! Question 9 On December 31, 2016, Flint Company SA had 1,660,000 10 par ordinary shares issued and outstanding. The equity accounts at

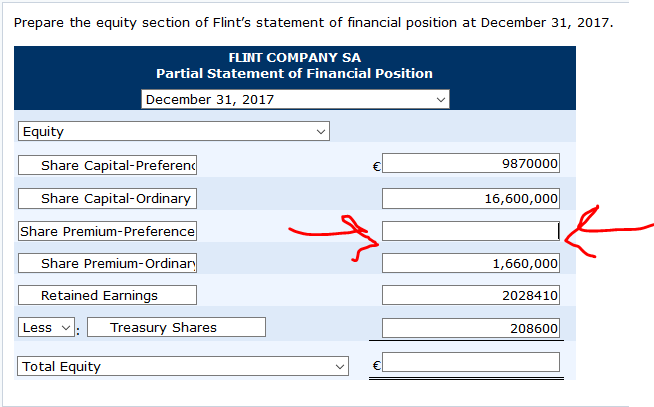

FIND THIS NUMBER!!!

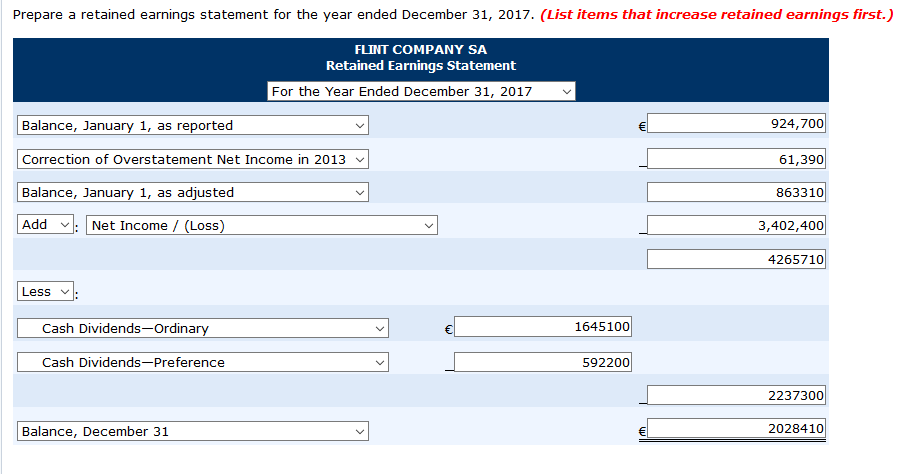

Question 9 On December 31, 2016, Flint Company SA had 1,660,000 10 par ordinary shares issued and outstanding. The equity accounts at December 31, 2016, had the following balances. Share Capital-Ordinary Share Premium-Ordinary Retained Earnings 16,600,000 1,660,000 924,700 Transactions during 2017 and other information related to equity accounts were as follows. 1. 2. 3. On January 10, 2017, Andes issued at 110 per share 98,700 100 par value, 6% cumulative preference shares. On February 8, 2017, Andes reacquired 14,900 ordinary shares for 14 per share. On June 8, 2017, Andes declared a cash dividend of 1 per share on the ordinary shares outstanding, payable on July 10, 2017, to shareholders of record on July 1, 2017. On December 15, 2017, Andes declared the yearly cash dividend on preference shares, payable January 10, 2018, to shareholders of record on December 15, 2017. Net income for the year is 3,402,400. It was discovered that depreciation expense had been understated in 2016 by 61,390. 4. 01 5. 6. Prepare a retained earnings statement for the year ended December 31, 2017. (List items that increase retained earnings first.) FLINT COMPANY SA Retained Earnings Statement For the Year Ended December 31, 2017 V Balance, January 1, as reported 924,700 Correction of Overstatement Net Income in 2013 61,390 Balance, January 1, as adjusted 863310 Add : Net Income / (Loss) 3,402,400 4265710 Less : Cash Dividends-Ordinary 1645100 Cash Dividends-Preference 592200 2237300 Balance, December 31 2028410 Prepare the equity section of Flint's statement of financial position at December 31, 2017. FLINT COMPANY SA Partial Statement of Financial Position December 31, 2017 Equity Share Capital-Preferend 9870000 Share Capital-Ordinary 16,600,000 Share Premium-Preference Share Premium-Ordinary 1,660,000 2028410 Retained Earnings Less : Treasury Shares 208600 Total EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started