Answered step by step

Verified Expert Solution

Question

1 Approved Answer

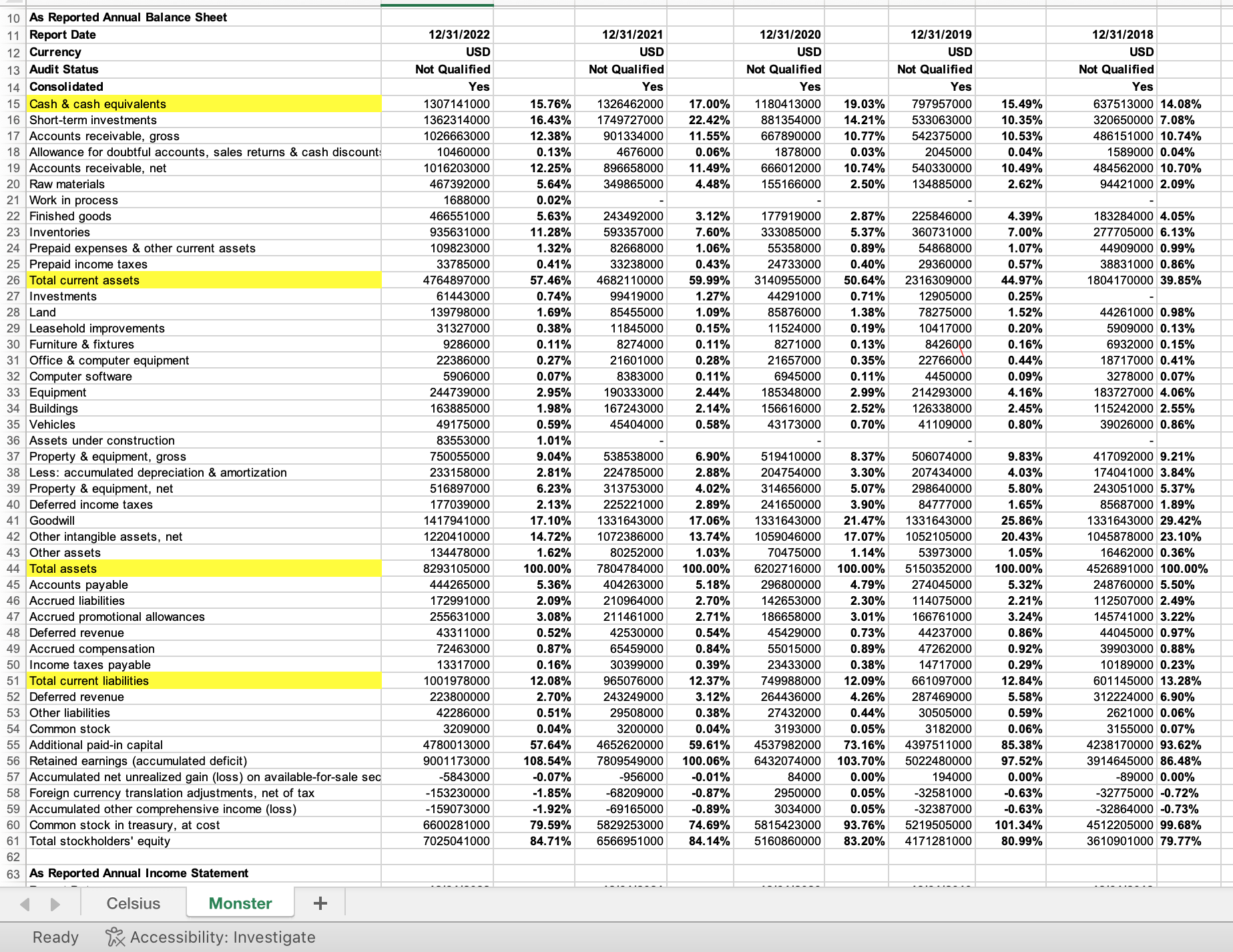

find total liabilities and stockholders' equity deficit a 10 As Reported Annual Balance Sheet 11 Report Date 12 Currency 13 Audit Status 14 Consolidated 15

find total liabilities and stockholders' equity deficit a

10 As Reported Annual Balance Sheet 11 Report Date 12 Currency 13 Audit Status 14 Consolidated 15 Cash & cash equivalents 16 Short-term investments 17 Accounts receivable, gross 18 Allowance for doubtful accounts, sales returns & cash discount: 19 Accounts receivable, net 20 Raw materials 21 Work in process 22 Finished goods 23 Inventories 12/31/2022 USD Not Qualified 12/31/2021 USD 12/31/2020 USD 12/31/2019 USD Not Qualified Not Qualified Yes Yes Yes 1307141000 1362314000 1026663000 10460000 1016203000 467392000 1688000 466551000 935631000 24 Prepaid expenses & other current assets 25 Prepaid income taxes 26 Total current assets 27 Investments 28 Land 29 Leasehold improvements 30 Furniture & fixtures 31 Office & computer equipment 32 Computer software 33 Equipment 34 Buildings 35 Vehicles 36 Assets under construction 109823000 33785000 4764897000 61443000 139798000 15.76% 16.43% 12.38% 0.13% 12.25% 5.64% 0.02% 5.63% 11.28% 1.32% 0.41% 57.46% 0.74% 1.69% 1326462000 17.00% 1749727000 22.42% 901334000 11.55% 4676000 0.06% 896658000 11.49% 349865000 4.48% 1180413000 19.03% 881354000 14.21% 667890000 10.77% 1878000 0.03% 666012000 10.74% 155166000 2.50% Not Qualified Yes 797957000 533063000 542375000 2045000 540330000 134885000 12/31/2018 USD Not Qualified Yes 15.49% 637513000 14.08% 10.35% 320650000 7.08% 10.53% 0.04% 10.49% 2.62% 486151000 10.74% 1589000 0.04% 484562000 10.70% 94421000 2.09% 31327000 0.38% 243492000 3.12% 593357000 7.60% 82668000 1.06% 33238000 0.43% 4682110000 59.99% 99419000 1.27% 85455000 1.09% 11845000 0.15% 9286000 0.11% 8274000 0.11% 22386000 0.27% 21601000 0.28% 177919000 2.87% 333085000 5.37% 55358000 0.89% 24733000 0.40% 3140955000 50.64% 44291000 0.71% 85876000 1.38% 11524000 0.19% 8271000 0.13% 21657000 0.35% 225846000 360731000 54868000 4.39% 7.00% 1.07% 183284000 4.05% 277705000 6.13% 44909000 0.99% 29360000 2316309000 12905000 78275000 10417000 0.57% 44.97% 0.25% 1.52% 38831000 0.86% 1804170000 39.85% 44261000 0.98% 0.20% 5909000 0.13% 8426000 0.16% 6932000 0.15% 22766000 5906000 0.07% 8383000 0.11% 6945000 0.11% 4450000 244739000 2.95% 190333000 2.44% 163885000 1.98% 49175000 0.59% 167243000 45404000 2.14% 0.58% 185348000 156616000 43173000 2.99% 2.52% 0.70% 214293000 126338000 41109000 0.44% 0.09% 4.16% 2.45% 0.80% 18717000 0.41% 3278000 0.07% 183727000 4.06% 115242000 2.55% 39026000 0.86% 83553000 1.01% 37 Property & equipment, gross 750055000 9.04% 38 Less: accumulated depreciation & amortization 233158000 2.81% 39 Property & equipment, net 516897000 40 Deferred income taxes 41 Goodwill 43 Other assets 44 Total assets 177039000 1417941000 6.23% 2.13% 17.10% 42 Other intangible assets, net 1220410000 14.72% 45 Accounts payable 134478000 8293105000 444265000 1.62% 100.00% 5.36% 46 Accrued liabilities 172991000 2.09% 47 Accrued promotional allowances 255631000 3.08% 48 Deferred revenue 43311000 0.52% 49 Accrued compensation 72463000 50 Income taxes payable 13317000 0.87% 0.16% 51 Total current liabilities 1001978000 12.08% 52 Deferred revenue 53 Other liabilities 223800000 2.70% 42286000 0.51% 54 Common stock 55 Additional paid-in capital 56 Retained earnings (accumulated deficit) 3209000 0.04% 4780013000 57.64% 9001173000 108.54% 7809549000 57 Accumulated net unrealized gain (loss) on available-for-sale sec 58 Foreign currency translation adjustments, net of tax 59 Accumulated other comprehensive income (loss) -5843000 -153230000 -159073000 60 Common stock in treasury, at cost 61 Total stockholders' equity 62 63 As Reported Annual Income Statement 6600281000 7025041000 538538000 6.90% 224785000 2.88% 313753000 4.02% 225221000 2.89% 1331643000 17.06% 1072386000 13.74% 80252000 1.03% 7804784000 100.00% 404263000 5.18% 210964000 2.70% 211461000 2.71% 42530000 0.54% 65459000 0.84% 30399000 0.39% 965076000 12.37% 243249000 3.12% 29508000 0.38% 3200000 0.04% 4652620000 59.61% 100.06% -0.07% -956000 -0.01% -1.85% -68209000 -0.87% -1.92% -69165000 -0.89% 79.59% 5829253000 74.69% 519410000 204754000 314656000 241650000 1331643000 1059046000 70475000 6202716000 296800000 142653000 186658000 45429000 0.73% 55015000 0.89% 23433000 0.38% 749988000 12.09% 264436000 4.26% 27432000 0.44% 3193000 0.05% 4537982000 73.16% 6432074000 8.37% 506074000 3.30% 207434000 5.07% 298640000 3.90% 84777000 21.47% 1331643000 17.07% 1052105000 1.14% 53973000 100.00% 5150352000 4.79% 274045000 2.30% 114075000 3.01% 9.83% 4.03% 417092000 9.21% 174041000 3.84% 5.80% 243051000 5.37% 1.65% 25.86% 20.43% 85687000 1.89% 1331643000 29.42% 1045878000 23.10% 1.05% 100.00% 16462000 0.36% 4526891000 100.00% 5.32% 248760000 5.50% 2.21% 112507000 2.49% 166761000 3.24% 145741000 3.22% 44237000 0.86% 44045000 0.97% 103.70% 47262000 14717000 661097000 287469000 30505000 3182000 4397511000 5022480000 0.92% 39903000 0.88% 0.29% 12.84% 5.58% 0.59% 0.06% 85.38% 10189000 0.23% 601145000 13.28% 312224000 6.90% 2621000 0.06% 3155000 0.07% 97.52% 84000 2950000 3034000 5815423000 84.71% 6566951000 84.14% 5160860000 83.20% 0.00% 0.05% 0.05% 93.76% 194000 0.00% 4238170000 93.62% 3914645000 86.48% -89000 0.00% -32581000 -32387000 -0.63% -32775000 -0.72% 5219505000 4171281000 -0.63% 101.34% -32864000 -0.73% 4512205000 99.68% 80.99% 3610901000 79.77% Celsius Ready Monster Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started