Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fine Company acquired an intangible asset in January 2020. The Patent was originally recorded at a cost of $100,000. The patent is being amortized by

Fine Company acquired an intangible asset in January 2020. The Patent was originally recorded at a cost of $100,000. The patent is being amortized by the straight-line method over a useful life of 10 years with no residual value. Fine Company has a December 31 year end. Due to changes in the industry, in 2024, Fine Company decided to review its intangible assets for possible impairment after making amortization entries. It will make the impairment entry (if needed) as part of its annual closing process. It gathered the following information: Patent Estimated future cash flows $40,000Fair value 42,000

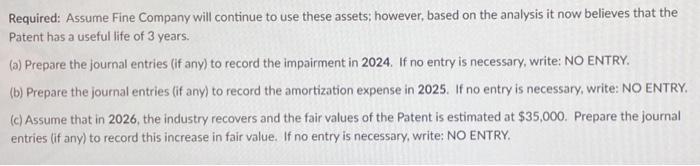

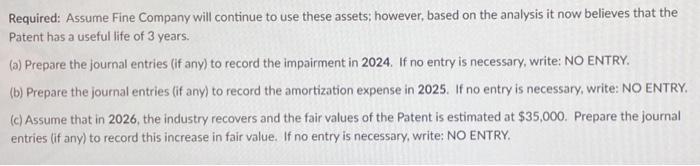

Required: Assume Fine Company will continue to use these assets; however, based on the analysis it now believes that the Patent has a useful life of 3 years. (a) Prepare the journal entries (if any) to record the impairment in 2024. If no entry is necessary, write: NO ENTRY. (b) Prepare the journal entries (if any) to record the amortization expense in 2025. If no entry is necessary, write: NO ENTRY. (c) Assume that in 2026, the industry recovers and the fair values of the Patent is estimated at $35,000. Prepare the journal entries (if any) to record this increase in fair value. If no entry is necessary, write: NO ENTRY.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER ATTACHED IMAGE WN1 Calculation of Book value of Patent at the end of year 2024 before impa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started