finish the following tasks for April.

1. Static-budget variance for operating income.

2. Prepare a flexible budget for operating income

3. Flexible budget variance analysis

4. Sales-volume variance for operating income

5. Price and usage variances for direct materials

6. Price and efficiency variances for direct manufacturing labour.

7. Variable manufacturing overhead spending variance

8. Variable manufacturing overhead efficiency variance

9. Fixed manufacturing overhead spending variance

look at the picture!!!)

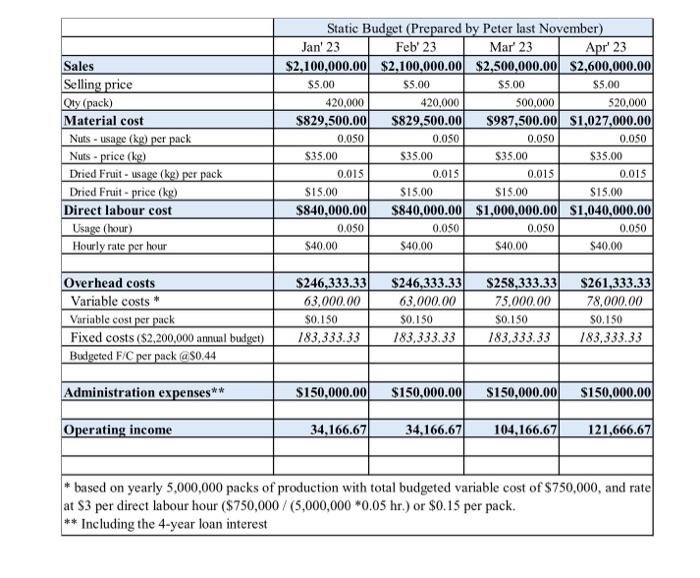

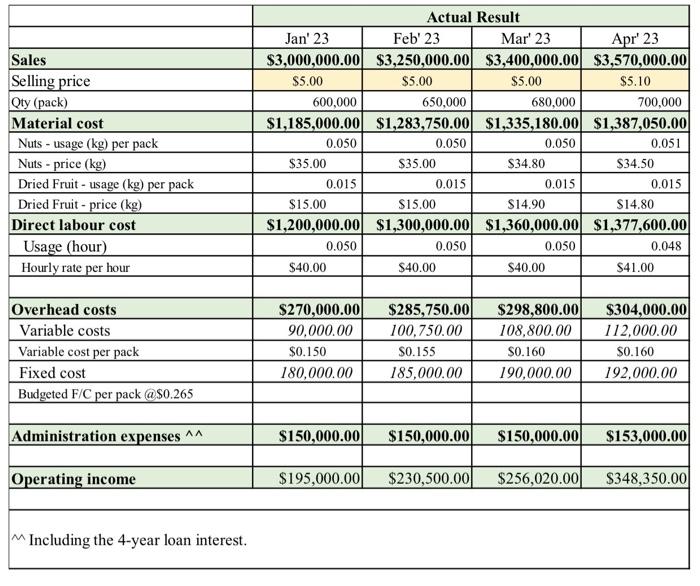

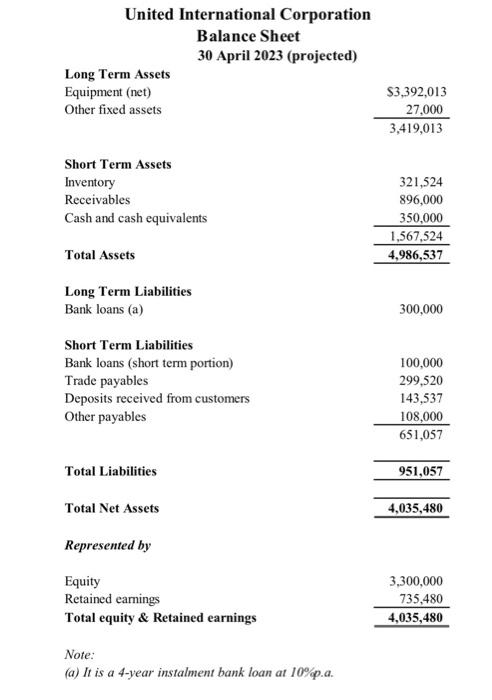

- Including the 4-year loan interest United International Corporation Balance Sheet 30 April 2023 (projected) Long Term Assets Equipment (net) Other fixed assets $3,392,01327,0003,419,013 Short Term Assets Inventory Receivables Cash and cash equivalents Total Assets Long Term Liabilities Bank loans (a) 300,000 Short Term Liabilities Bankloans(shorttermportion)100,000 Trade payables 299,520 Deposits received from customers 143,537108,000651,057 Total Liabilities Total Net Assets 951,0574,035,480 Represented by Equity Retained earnings Total equity \& Retained earnings 3,300,000735,4804,035,480 Note: (a) It is a 4-year instalment bank loan at 10\%p.a. United International Corporation (UIC) is a food processing factory, specializing in distributing of healthy snacks to food distributors and major grocery stores. It produces a single product called PoweNack "Powerhack TM ", which is a package of healthy food mixed with dried fruit and nuts. The product is widely recognized by consumers and always the top 3 best selling snacks in most supermarkets. The company owns a production facility located in Greater Bay Area (GBA) and distributes the product to its customers through contracting logistic companies. It sources the raw materials (i.e. dried fruit and nuts) from both local and international suppliers. The suppliers have been business partners with the company for many years and maintain a very close relationship. All of them have signed long-term contracts allowing the company to purchase the materials at contracted price throughout the contract periods, any subsequent price changes in price must mutually agreed. The process is relatively simple, it consists of roasting nuts, mixing dried fruit and nuts, weighting, and packaging. All the processes are carried out in-house facility and they start production input and finish the output on the same day, no WIP is expected at the end of the day. The standard material usage and mix are preset, each pack of "PowerNack" contains equal amount and mix of materials. Benefiting from product simplicity, the operations and administration of the company are simple and cost effective. It only has a small number of employees (workers and office staff) and operates in a production facility owned by the company. The company is not at the forefront of the food processing industry, but its business model is sustainable. Except for the impact of Covid-19 in the past 3 years, the company constantly reports both top line and bottom growth each year since inception. The company mainly uses automatic processing systems for roasting, packaging, and inspection. Production overhead costs are allocated to the product based on direct labour hours. costs which are related to direct labour activity. The fixed overhead costs include depreciation on production facility and equipment leasing costs and plant manager's salaries. Effective management control and operational excellence are always the management concern, the company uses budgeting as a management tool for control and continuing operation improvement. The company prepares operating budgets and cash budget annually and treats the budgeting as an important corporate exercise. The business had been hard hit during the Covid-19 period with slow consumer demand caused by city lockdown and health control measures. Fortunately, the ex-cost controller did well in budgeting and appropriately planned the operations and cashflow. The company safely passed through the tough time. After the ease of the health control system last December in China coupled with the travel restrictions being removed by foreign countries, local economy and consumer demand are rapidly recovered. UIC witnessed the recovery from its business performance in first and second quarters result. The operating income shows a substantial favourable variance in the past few months as compared to the budget. The current budget (year 2023) was compiled by the previous budget officer (cost controller) in November 2022. Lulu, a newly graduated with an accounting degree, joined the company as cost controller on 1st April in place of Peter who retired in March. In a recent monthly management meeting, Lulu reported the operating result, and variance analysis for the month of April 2023. During the meeting, UIC's CEO, Dr. Tom Tong queried about the large variances in each line item of the income statement and why each amount was significantly higher than the budget. Lulu responded to the management that the variances she reported should be correct, it was because all figures and calculations have been double checked. The variances represented the differences between the budgets and the actual result. The income statement was completed by the accounting manager and the budget was prepared by the previous cost controller. After the meeting, Tom Tong sought advice about his concerns from his close friend Yangyang, who is a partner of a well-known business consulting firm. Yangyang advised Tom that Lulu might use static budget to compare the actual result, which may be the major cause of those large variances in each item where the budget was done during Covid-19 period. It might not anticipate recent recovery and consumer demand. According to his understanding, most businesses in the country have performed better than same period last year and their original budgets. He further commented that if Lulu had prepared a flexible budget for the comparison, the actual result would have not normally shown significant variances in as he saw. With the advice from Yangyang, Tom Tong started thinking how he could obtain the appropriate costing information and analysis to control operations by using the budget. After a few days research and seeking consultations from other business friends, he came up with a plan to address the issues. Matters considered by Tom Tong - Lulu should take the Yang's advice to rework the April variance analysis and submit to the management with a revised report. - The original budget was prepared last year, but economic and business environment have significantly changed than the time when the budget was prepared. The original budget may not be able to provide a guide for the future periods' operation. And most importantly, the standards, such as price, efficiency or usage and spending, used in the original budget may not be correct. The large increase in the scale of business operation (production and sales) should also affect the standard to some extent. Tom asked Lulu to revise the budget for the remining period of the year (i.e. May to December). In consideration of her workload and inexperienced in budgeting, Tom suggested Lulu to do a revised budget for the coming three months (May to July) first and leave the remaining months to be completed later in summer. - Prepare monthly cash budget for three months - May to July based on the revised budget. Lulu did a self reflection after the management meeting. She consulted her subordinates about the issues and also called her predecessor (Peter) for help. She really wanted to find out the reason for answering the questions raised by the CEO in the management meeting. To work on that she collected more relevant information for review. - Extract Budget info for the year of 2023 (Appendix 1) - Income Statement for the period from Jan to April 2023 (Actual result) (Appendix 2) - Balance sheet as of 30 April 2023 (projected) (Appendix 3) The CEO further reviewed the budgeting and business development in the past few months with Lulu. Both agreed that they should ask Peter to work part-time consultant for two months tat would help Lulu to get familiar with the budgeting and variance analysis. In particular, he could help Lulu to redo the April variance report and compile a revised budget as suggested by Tom. The revised budget should incorporate the significant economic and policy changes that rendering some parameters in the original budget not suitable to be a base for flexible budget. Tom suggested a to-do list to Lulu to complete. - Including the 4-year loan interest United International Corporation Balance Sheet 30 April 2023 (projected) Long Term Assets Equipment (net) Other fixed assets $3,392,01327,0003,419,013 Short Term Assets Inventory Receivables Cash and cash equivalents Total Assets Long Term Liabilities Bank loans (a) 300,000 Short Term Liabilities Bankloans(shorttermportion)100,000 Trade payables 299,520 Deposits received from customers 143,537108,000651,057 Total Liabilities Total Net Assets 951,0574,035,480 Represented by Equity Retained earnings Total equity \& Retained earnings 3,300,000735,4804,035,480 Note: (a) It is a 4-year instalment bank loan at 10\%p.a. United International Corporation (UIC) is a food processing factory, specializing in distributing of healthy snacks to food distributors and major grocery stores. It produces a single product called PoweNack "Powerhack TM ", which is a package of healthy food mixed with dried fruit and nuts. The product is widely recognized by consumers and always the top 3 best selling snacks in most supermarkets. The company owns a production facility located in Greater Bay Area (GBA) and distributes the product to its customers through contracting logistic companies. It sources the raw materials (i.e. dried fruit and nuts) from both local and international suppliers. The suppliers have been business partners with the company for many years and maintain a very close relationship. All of them have signed long-term contracts allowing the company to purchase the materials at contracted price throughout the contract periods, any subsequent price changes in price must mutually agreed. The process is relatively simple, it consists of roasting nuts, mixing dried fruit and nuts, weighting, and packaging. All the processes are carried out in-house facility and they start production input and finish the output on the same day, no WIP is expected at the end of the day. The standard material usage and mix are preset, each pack of "PowerNack" contains equal amount and mix of materials. Benefiting from product simplicity, the operations and administration of the company are simple and cost effective. It only has a small number of employees (workers and office staff) and operates in a production facility owned by the company. The company is not at the forefront of the food processing industry, but its business model is sustainable. Except for the impact of Covid-19 in the past 3 years, the company constantly reports both top line and bottom growth each year since inception. The company mainly uses automatic processing systems for roasting, packaging, and inspection. Production overhead costs are allocated to the product based on direct labour hours. costs which are related to direct labour activity. The fixed overhead costs include depreciation on production facility and equipment leasing costs and plant manager's salaries. Effective management control and operational excellence are always the management concern, the company uses budgeting as a management tool for control and continuing operation improvement. The company prepares operating budgets and cash budget annually and treats the budgeting as an important corporate exercise. The business had been hard hit during the Covid-19 period with slow consumer demand caused by city lockdown and health control measures. Fortunately, the ex-cost controller did well in budgeting and appropriately planned the operations and cashflow. The company safely passed through the tough time. After the ease of the health control system last December in China coupled with the travel restrictions being removed by foreign countries, local economy and consumer demand are rapidly recovered. UIC witnessed the recovery from its business performance in first and second quarters result. The operating income shows a substantial favourable variance in the past few months as compared to the budget. The current budget (year 2023) was compiled by the previous budget officer (cost controller) in November 2022. Lulu, a newly graduated with an accounting degree, joined the company as cost controller on 1st April in place of Peter who retired in March. In a recent monthly management meeting, Lulu reported the operating result, and variance analysis for the month of April 2023. During the meeting, UIC's CEO, Dr. Tom Tong queried about the large variances in each line item of the income statement and why each amount was significantly higher than the budget. Lulu responded to the management that the variances she reported should be correct, it was because all figures and calculations have been double checked. The variances represented the differences between the budgets and the actual result. The income statement was completed by the accounting manager and the budget was prepared by the previous cost controller. After the meeting, Tom Tong sought advice about his concerns from his close friend Yangyang, who is a partner of a well-known business consulting firm. Yangyang advised Tom that Lulu might use static budget to compare the actual result, which may be the major cause of those large variances in each item where the budget was done during Covid-19 period. It might not anticipate recent recovery and consumer demand. According to his understanding, most businesses in the country have performed better than same period last year and their original budgets. He further commented that if Lulu had prepared a flexible budget for the comparison, the actual result would have not normally shown significant variances in as he saw. With the advice from Yangyang, Tom Tong started thinking how he could obtain the appropriate costing information and analysis to control operations by using the budget. After a few days research and seeking consultations from other business friends, he came up with a plan to address the issues. Matters considered by Tom Tong - Lulu should take the Yang's advice to rework the April variance analysis and submit to the management with a revised report. - The original budget was prepared last year, but economic and business environment have significantly changed than the time when the budget was prepared. The original budget may not be able to provide a guide for the future periods' operation. And most importantly, the standards, such as price, efficiency or usage and spending, used in the original budget may not be correct. The large increase in the scale of business operation (production and sales) should also affect the standard to some extent. Tom asked Lulu to revise the budget for the remining period of the year (i.e. May to December). In consideration of her workload and inexperienced in budgeting, Tom suggested Lulu to do a revised budget for the coming three months (May to July) first and leave the remaining months to be completed later in summer. - Prepare monthly cash budget for three months - May to July based on the revised budget. Lulu did a self reflection after the management meeting. She consulted her subordinates about the issues and also called her predecessor (Peter) for help. She really wanted to find out the reason for answering the questions raised by the CEO in the management meeting. To work on that she collected more relevant information for review. - Extract Budget info for the year of 2023 (Appendix 1) - Income Statement for the period from Jan to April 2023 (Actual result) (Appendix 2) - Balance sheet as of 30 April 2023 (projected) (Appendix 3) The CEO further reviewed the budgeting and business development in the past few months with Lulu. Both agreed that they should ask Peter to work part-time consultant for two months tat would help Lulu to get familiar with the budgeting and variance analysis. In particular, he could help Lulu to redo the April variance report and compile a revised budget as suggested by Tom. The revised budget should incorporate the significant economic and policy changes that rendering some parameters in the original budget not suitable to be a base for flexible budget. Tom suggested a to-do list to Lulu to complete