Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Finished but I feel I messed something up, would like verification) Using a Comparative Balance Sheet and a current Income Statement, prepare a Statement of

(Finished but I feel I messed something up, would like verification) Using a Comparative Balance Sheet and a current Income Statement, prepare a Statement of Cash Flows using the Direct Method and the Indirect Method

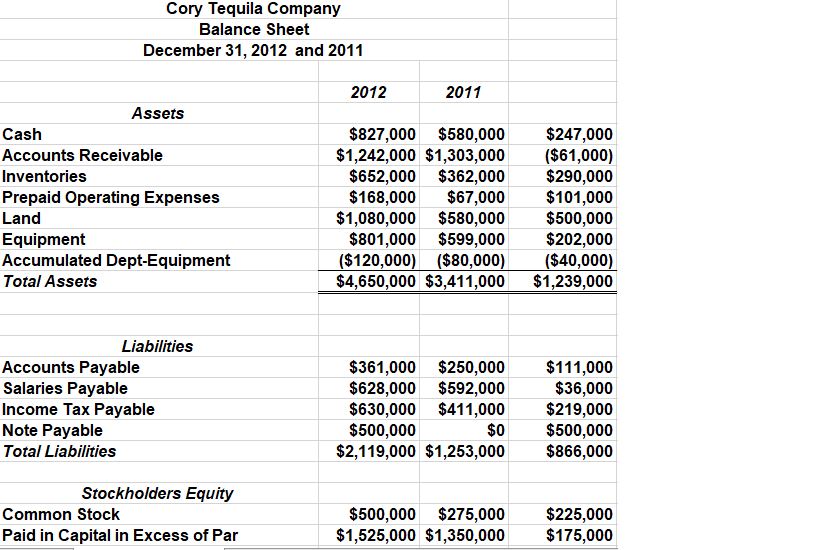

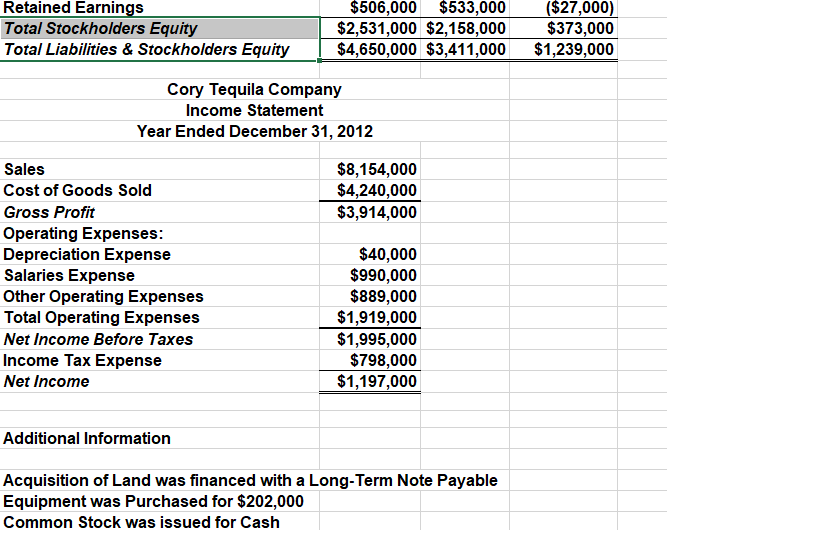

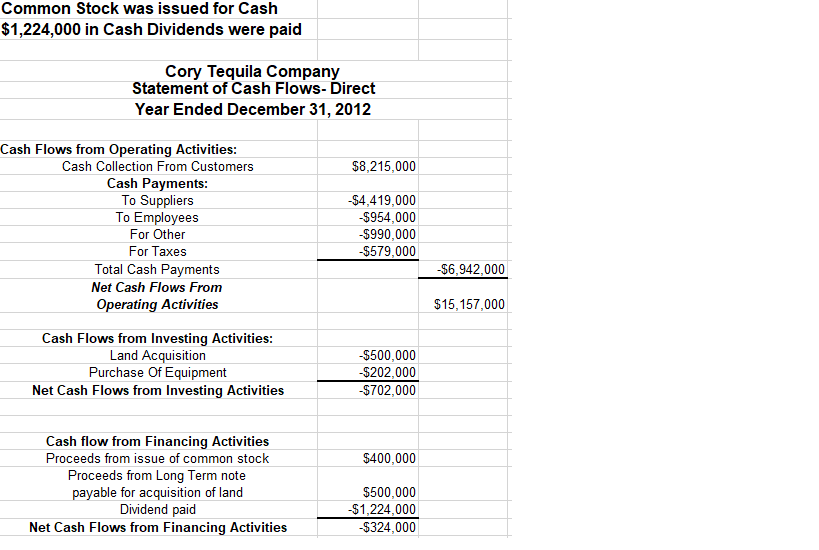

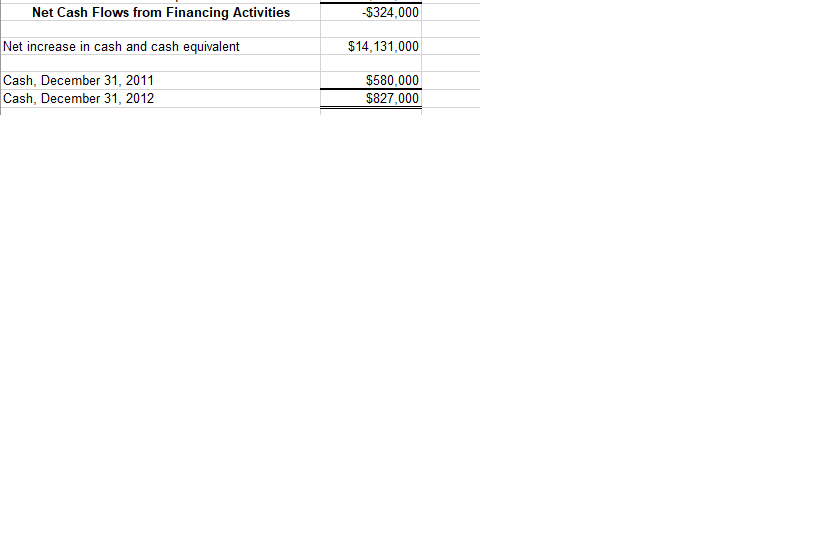

Cory Tequila Company Balance Sheet December 31, 2012 and 2011 2012 2011 Assets Cash Accounts Receivable Inventories Prepaid Operating Expenses Land Equipment Accumulated Dept-Equipment Total Assets $827,000 $580,000 $1,242,000 $1,303,000 $652,000 $362,000 $168,000 $67,000 $1,080,000 $580,000 $801,000 $599,000 ($120,000) ($80,000) $4,650,000 $3,411,000 $247,000 ($61,000) $290,000 $101,000 $500,000 $202,000 ($40,000) $1,239,000 Liabilities Accounts Payable Salaries Payable Income Tax Payable Note Payable Total Liabilities $361,000 $250,000 $628,000 $592,000 $630,000 $411,000 $500,000 $0 $2,119,000 $1,253,000 $111,000 $36,000 $219,000 $500,000 $866,000 Stockholders Equity Common Stock Paid in Capital in Excess of Par $500,000 $275,000 $1,525,000 $1,350,000 $225,000 $175,000 Retained Earnings Total Stockholders Equity Total Liabilities & Stockholders Equity $506,000 $533,000 $2,531,000 $2,158,000 $4,650,000 $3,411,000 ($27,000) $373,000 $1,239,000 Cory Tequila Company Income Statement Year Ended December 31, 2012 $8,154,000 $4,240,000 $3,914,000 Sales Cost of Goods Sold Gross Profit Operating Expenses: Depreciation Expense Salaries Expense Other Operating Expenses Total Operating Expenses Net Income Before Taxes Income Tax Expense Net Income $40,000 $990,000 $889,000 $1,919,000 $1,995,000 $798,000 $1,197,000 Additional Information Acquisition of Land was financed with a Long-Term Note Payable Equipment was Purchased for $202,000 Common Stock was issued for Cash Common Stock was issued for Cash $1,224,000 in Cash Dividends were paid Cory Tequila Company Statement of Cash Flows- Direct Year Ended December 31, 2012 $8,215,000 Cash Flows from Operating Activities: Cash Collection From Customers Cash Payments: To Suppliers To Employees For Other For Taxes Total Cash Payments Net Cash Flows From Operating Activities -$4,419,000 -$954,000 $990,000 $579,000 $6,942,000 $15,157,000 Cash Flows from Investing Activities: Land Acquisition Purchase Of Equipment Net Cash Flows from Investing Activities -$500,000 -$202,000 -$702,000 $400,000 Cash flow from Financing Activities Proceeds from issue of common stock Proceeds from Long Term note payable for acquisition of land Dividend paid Net Cash Flows from Financing Activities $500,000 $1,224,000 -$324,000 Net Cash Flows from Financing Activities $324,000 Net increase in cash and cash equivalent $14,131,000 Cash, December 31, 2011 Cash, December 31, 2012 $580,000 $827,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started