Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexican food, which enjoys a large following in the U.S. states

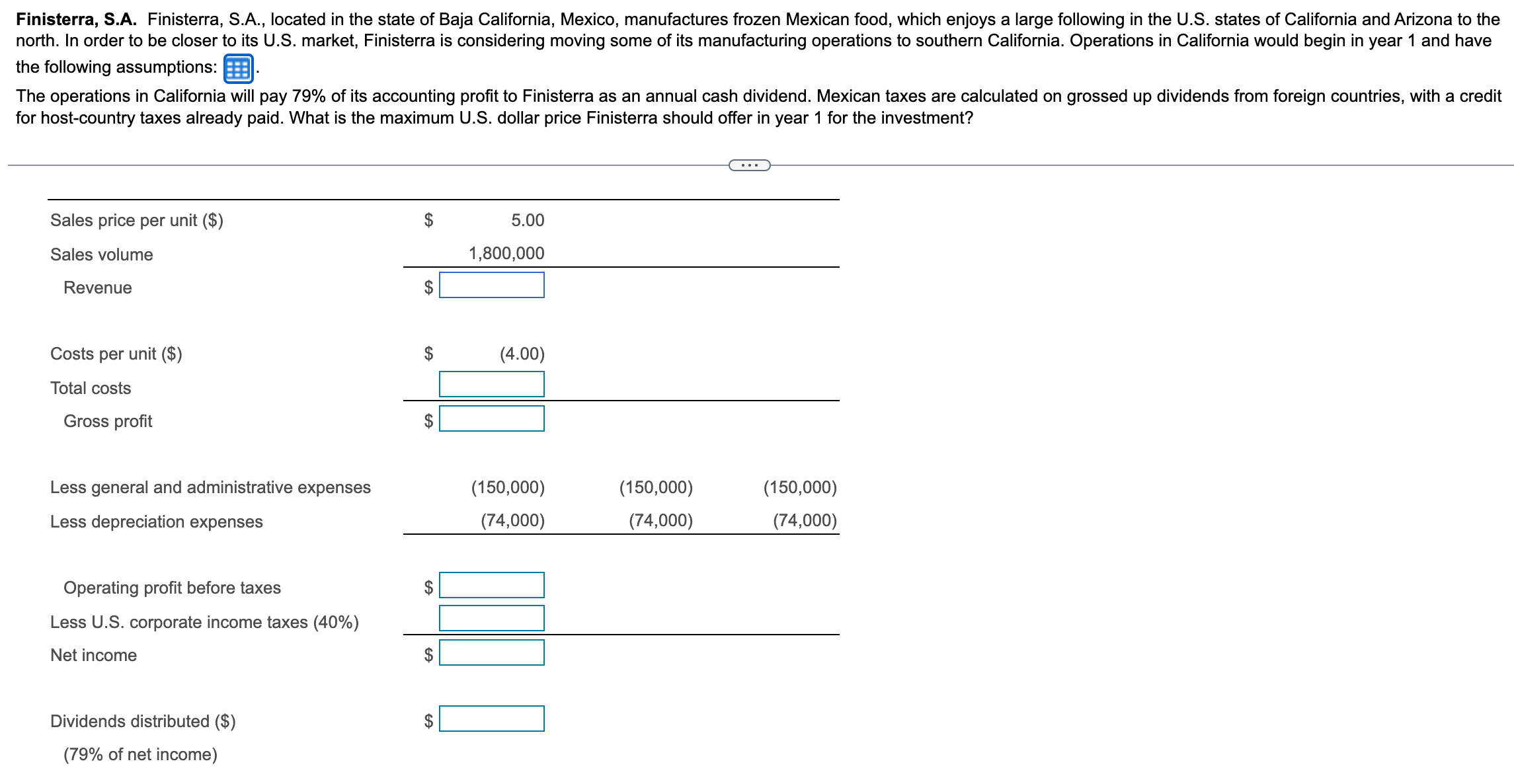

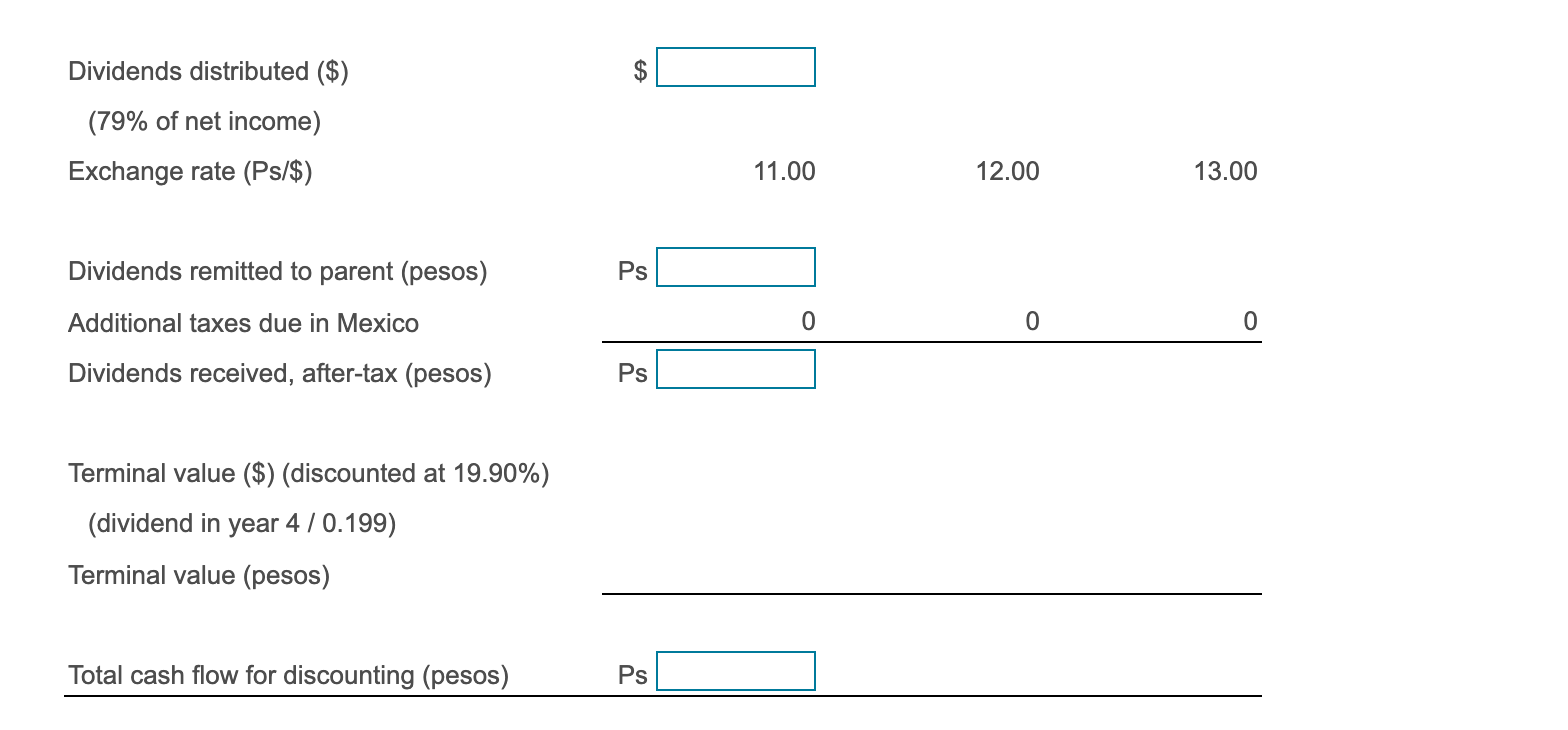

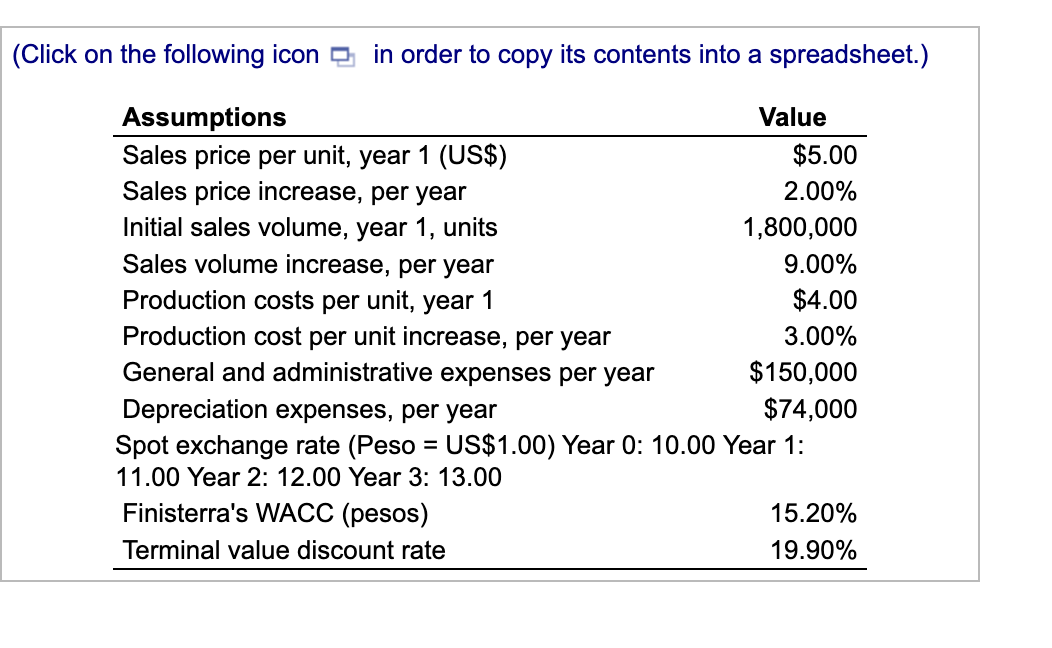

Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexican food, which enjoys a large following in the U.S. states of California and Arizona to the north. In order to be closer to its U.S. market, Finisterra is considering moving some of its manufacturing operations to southern California. Operations in California would begin in year 1 and have the following assumptions: The operations in California will pay 79% of its accounting profit to Finisterra as an annual cash dividend. Mexican taxes are calculated on grossed up dividends from foreign countries, with a credit for host-country taxes already paid. What is the maximum U.S. dollar price Finisterra should offer in year 1 for the investment? Dividends distributed (\$) ( 79% of net income) Exchange rate (Ps/\$) 11.0012.0013.00 Dividends remitted to parent (pesos) Ps Additional taxes due in Mexico Dividends received, after-tax (pesos) \begin{tabular}{lrll} & 0 & 0 & 0 \\ \hline Ps & & \end{tabular} Terminal value (\$) (discounted at 19.90\%) (dividend in year 4/0.199 ) Terminal value (pesos) Total cash flow for discounting (pesos) Ps Click on the following icon in order to copy its contents into a spreadsheet.)

Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexican food, which enjoys a large following in the U.S. states of California and Arizona to the north. In order to be closer to its U.S. market, Finisterra is considering moving some of its manufacturing operations to southern California. Operations in California would begin in year 1 and have the following assumptions: The operations in California will pay 79% of its accounting profit to Finisterra as an annual cash dividend. Mexican taxes are calculated on grossed up dividends from foreign countries, with a credit for host-country taxes already paid. What is the maximum U.S. dollar price Finisterra should offer in year 1 for the investment? Dividends distributed (\$) ( 79% of net income) Exchange rate (Ps/\$) 11.0012.0013.00 Dividends remitted to parent (pesos) Ps Additional taxes due in Mexico Dividends received, after-tax (pesos) \begin{tabular}{lrll} & 0 & 0 & 0 \\ \hline Ps & & \end{tabular} Terminal value (\$) (discounted at 19.90\%) (dividend in year 4/0.199 ) Terminal value (pesos) Total cash flow for discounting (pesos) Ps Click on the following icon in order to copy its contents into a spreadsheet.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started