Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finite horizon model with premium over book value Catapult Company has a current book value of $ 3 1 per share. As the result of

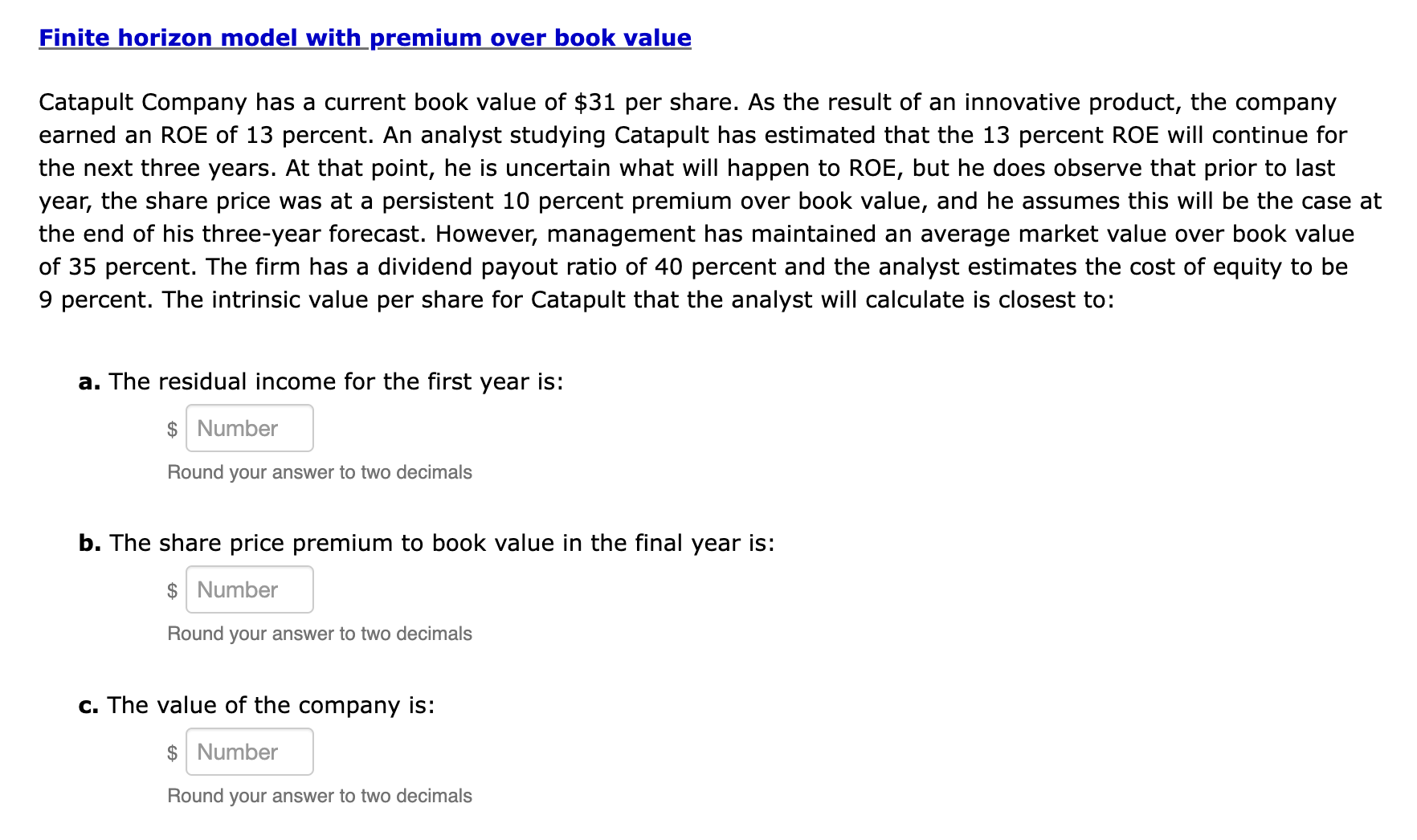

Finite horizon model with premium over book value Catapult Company has a current book value of $ per share. As the result of an innovative product, the company earned an ROE of percent. An analyst studying Catapult has estimated that the percent ROE will continue for the next three years. At that point, he is uncertain what will happen to ROE, but he does observe that prior to last year, the share price was at a persistent percent premium over book value, and he assumes this will be the case at the end of his threeyear forecast. However, management has maintained an average market value over book value of percent. The firm has a dividend payout ratio of percent and the analyst estimates the cost of equity to be percent. The intrinsic value per share for Catapult that the analyst will calculate is closest to: a The residual income for the first year is: $ Round your answer to two decimals b The share price premium to book value in the final year is: $ Round your answer to two decimals c The value of the company is: $ Round your answer to two decimals

Finite horizon model with premium over book value

Catapult Company has a current book value of $ per share. As the result of an innovative product, the company

earned an ROE of percent. An analyst studying Catapult has estimated that the percent ROE will continue for

the next three years. At that point, he is uncertain what will happen to ROE, but he does observe that prior to last

year, the share price was at a persistent percent premium over book value, and he assumes this will be the case at

the end of his threeyear forecast. However, management has maintained an average market value over book value

of percent. The firm has a dividend payout ratio of percent and the analyst estimates the cost of equity to be

percent. The intrinsic value per share for Catapult that the analyst will calculate is closest to:

a The residual income for the first year is:

$

Round your answer to two decimals

b The share price premium to book value in the final year is:

$

Round your answer to two decimals

c The value of the company is:

$

Round your answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started