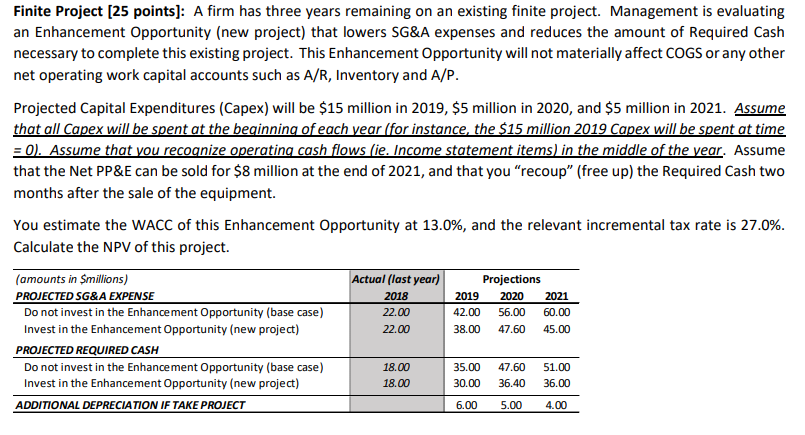

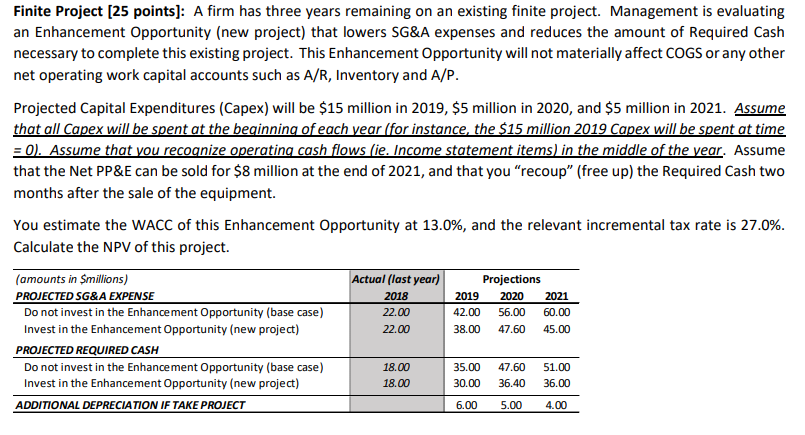

Finite Project (25 points]: A firm has three years remaining on an existing finite project. Management is evaluating an Enhancement Opportunity (new project) that lowers SG&A expenses and reduces the amount of Required Cash necessary to complete this existing project. This Enhancement Opportunity will not materially affect COGS or any other net operating work capital accounts such as A/R, Inventory and A/P. Projected Capital Expenditures (Capex) will be $15 million in 2019, $5 million in 2020, and $5 million in 2021. Assume that all Capex will be spent at the beginning of each year (for instance, the $15 million 2019 Capex will be spent at time = 0). Assume that you recognize operating cash flows (ie. Income statement items in the middle of the vear. Assume that the Net PP&E can be sold for $8 million at the end of 2021, and that you "recoup" (free up) the Required Cash two months after the sale of the equipment. You estimate the WACC of this Enhancement Opportunity at 13.0%, and the relevant incremental tax rate is 27.0%. Calculate the NPV of this project. Actual (last year) 2018 22.00 22.00 Projections 2019 2020 2021 42.00 56.00 60.00 38.00 47.60 45.00 (amounts in Smillions) PROJECTED SG&A EXPENSE Do not invest in the Enhancement Opportunity (base case) Invest in the Enhancement Opportunity (new project) PROJECTED REQUIRED CASH Do not invest in the Enhancement Opportunity (base case) Invest in the Enhancement Opportunity (new project) ADDITIONAL DEPRECIATION IF TAKE PROJECT 18.00 18.00 35.00 30.00 6.00 47.60 36.40 5.00 51.00 36.00 4.00 Finite Project (25 points]: A firm has three years remaining on an existing finite project. Management is evaluating an Enhancement Opportunity (new project) that lowers SG&A expenses and reduces the amount of Required Cash necessary to complete this existing project. This Enhancement Opportunity will not materially affect COGS or any other net operating work capital accounts such as A/R, Inventory and A/P. Projected Capital Expenditures (Capex) will be $15 million in 2019, $5 million in 2020, and $5 million in 2021. Assume that all Capex will be spent at the beginning of each year (for instance, the $15 million 2019 Capex will be spent at time = 0). Assume that you recognize operating cash flows (ie. Income statement items in the middle of the vear. Assume that the Net PP&E can be sold for $8 million at the end of 2021, and that you "recoup" (free up) the Required Cash two months after the sale of the equipment. You estimate the WACC of this Enhancement Opportunity at 13.0%, and the relevant incremental tax rate is 27.0%. Calculate the NPV of this project. Actual (last year) 2018 22.00 22.00 Projections 2019 2020 2021 42.00 56.00 60.00 38.00 47.60 45.00 (amounts in Smillions) PROJECTED SG&A EXPENSE Do not invest in the Enhancement Opportunity (base case) Invest in the Enhancement Opportunity (new project) PROJECTED REQUIRED CASH Do not invest in the Enhancement Opportunity (base case) Invest in the Enhancement Opportunity (new project) ADDITIONAL DEPRECIATION IF TAKE PROJECT 18.00 18.00 35.00 30.00 6.00 47.60 36.40 5.00 51.00 36.00 4.00