Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIR is a measure of time-series trends of a set of firs' major fimdamentals (eg, earnings, ROE, ROA. net pavout ratio, etc.) High FIR are

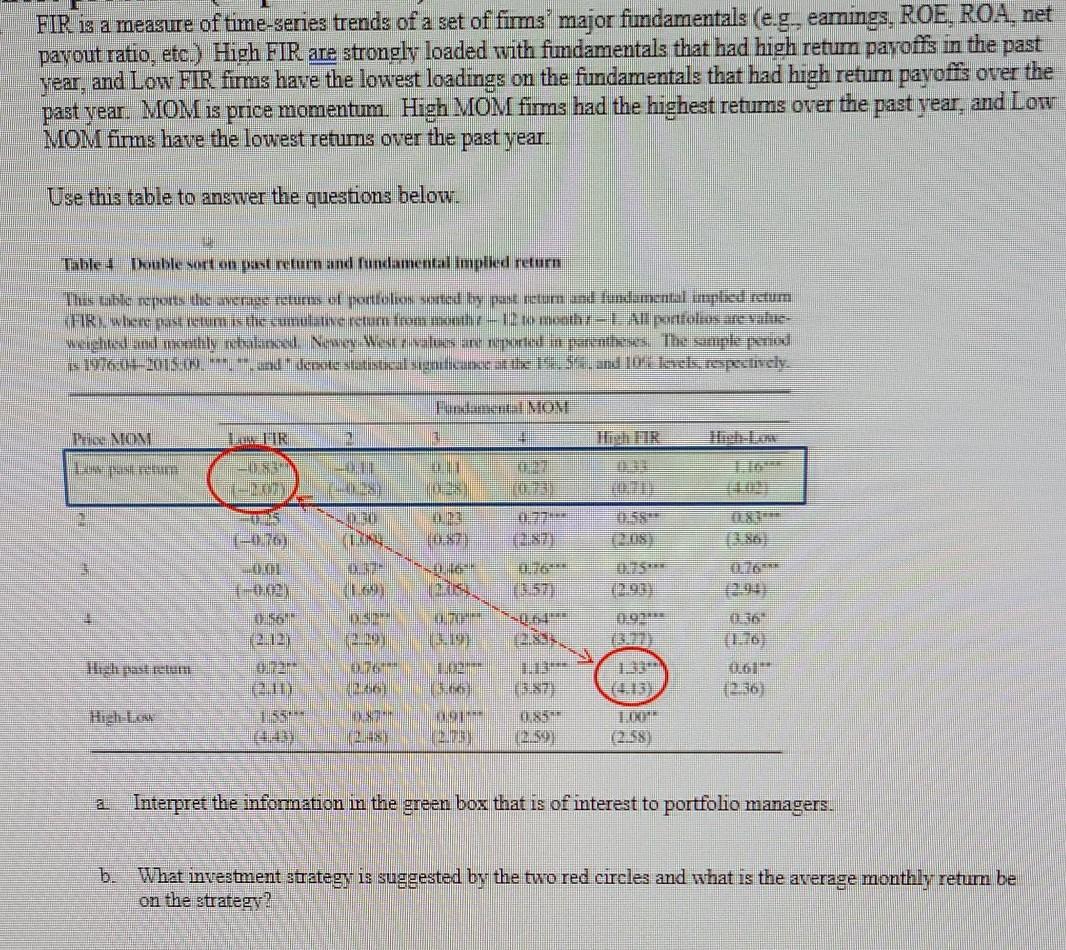

FIR is a measure of time-series trends of a set of firs' major fimdamentals (eg, earnings, ROE, ROA. net pavout ratio, etc.) High FIR are strongly loaded with fundamentals that had high retum payoffs in the past year, and Low FIR firms have the lowest loadings on the fundamentals that had high retum payoffs over the past year. MOM is price momentum. High MOM fims had the highest retums over the past year, and Low NOM fims have the lowest retums over the past year. Use this table to answer the questions below. Tablet Double sort on pa return and fundamental Implied return Th.s tublo report the average retums of portfolios sented by past return and fundamental umplied retum KHIR where cum se cumulate retum Troms - 1. to month: - Ventolos e value weighted and moothly retualangal New West values and reported in parte. The sample pened 19760#-2018 **** and demate statusucalienticuatu 1.94.. and I'll ply Punanental MOM MON - 15 -0.20) 0972 (27) EROS 2016- UN 06 56 12.12 12.36 0135 12:59) (2.58) & Interpret the information in the green box that is of interest to portfolio managers. B What investment strategy is suggested by the two red circles and what is the average monthly return be on the strategy? FIR is a measure of time-series trends of a set of firs' major fimdamentals (eg, earnings, ROE, ROA. net pavout ratio, etc.) High FIR are strongly loaded with fundamentals that had high retum payoffs in the past year, and Low FIR firms have the lowest loadings on the fundamentals that had high retum payoffs over the past year. MOM is price momentum. High MOM fims had the highest retums over the past year, and Low NOM fims have the lowest retums over the past year. Use this table to answer the questions below. Tablet Double sort on pa return and fundamental Implied return Th.s tublo report the average retums of portfolios sented by past return and fundamental umplied retum KHIR where cum se cumulate retum Troms - 1. to month: - Ventolos e value weighted and moothly retualangal New West values and reported in parte. The sample pened 19760#-2018 **** and demate statusucalienticuatu 1.94.. and I'll ply Punanental MOM MON - 15 -0.20) 0972 (27) EROS 2016- UN 06 56 12.12 12.36 0135 12:59) (2.58) & Interpret the information in the green box that is of interest to portfolio managers. B What investment strategy is suggested by the two red circles and what is the average monthly return be on the strategy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started