Firm B wants to hire Ms. Ali to manage its advertising department. The firm offered Ms. Ali a three-year employment contract under which it will

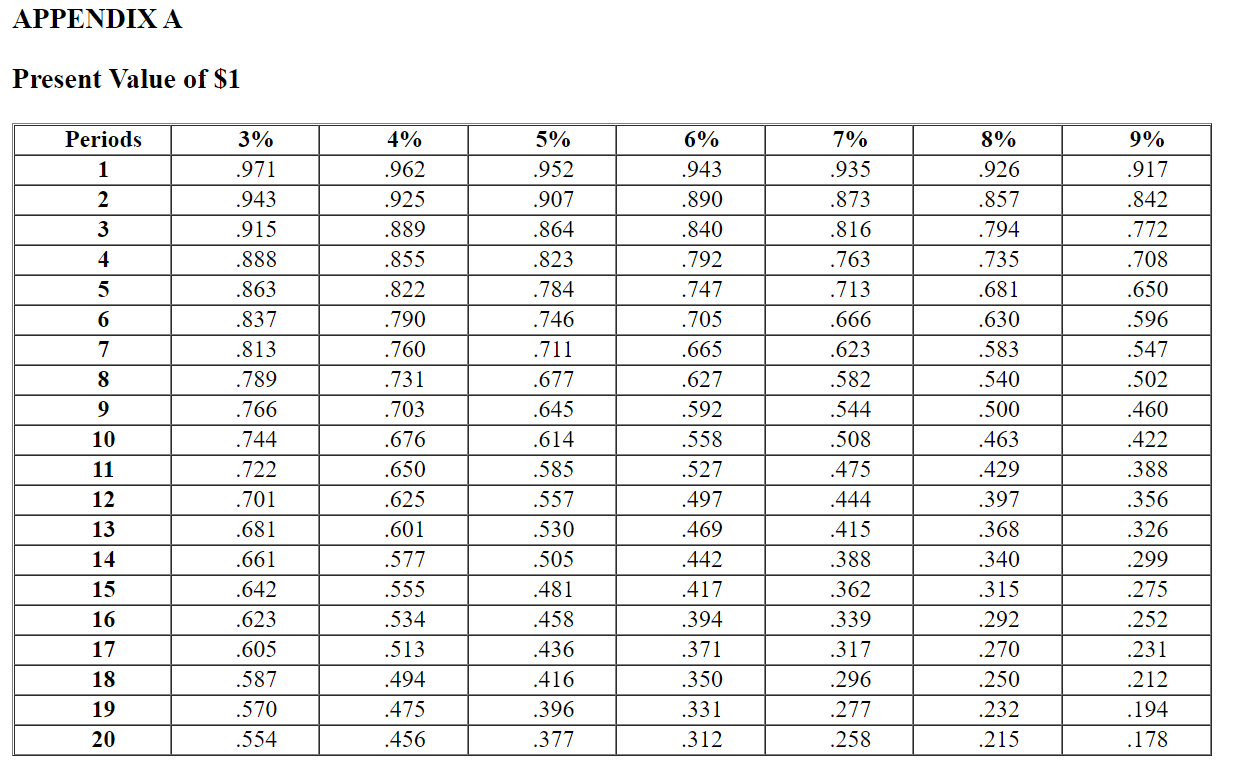

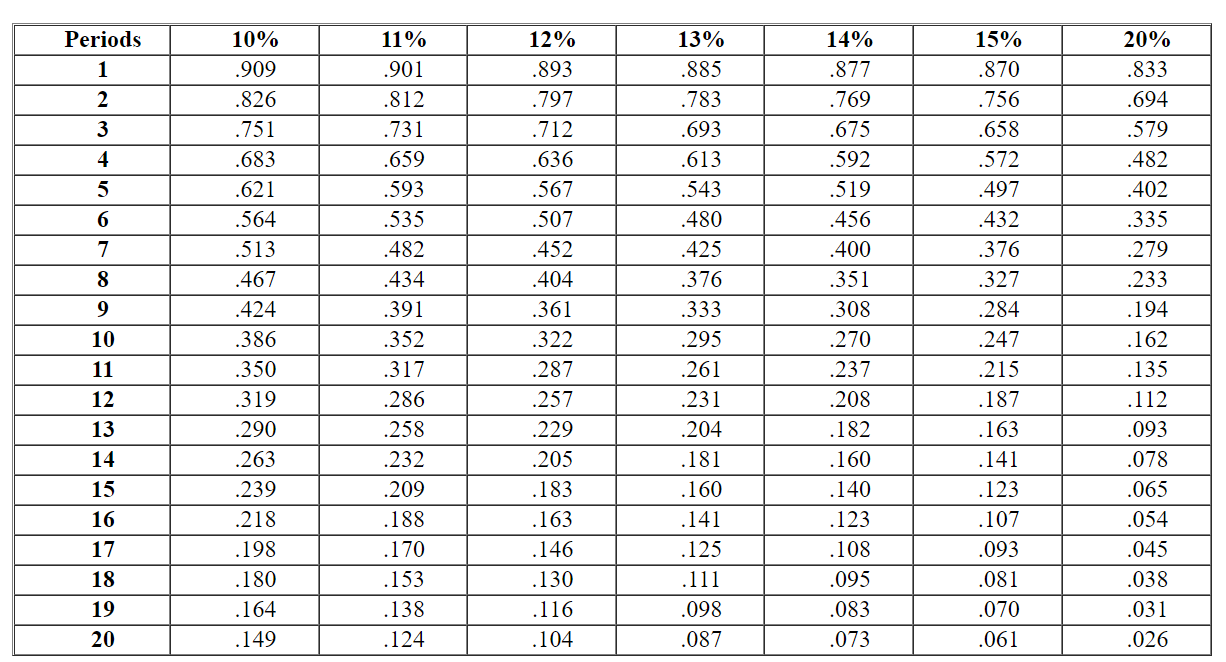

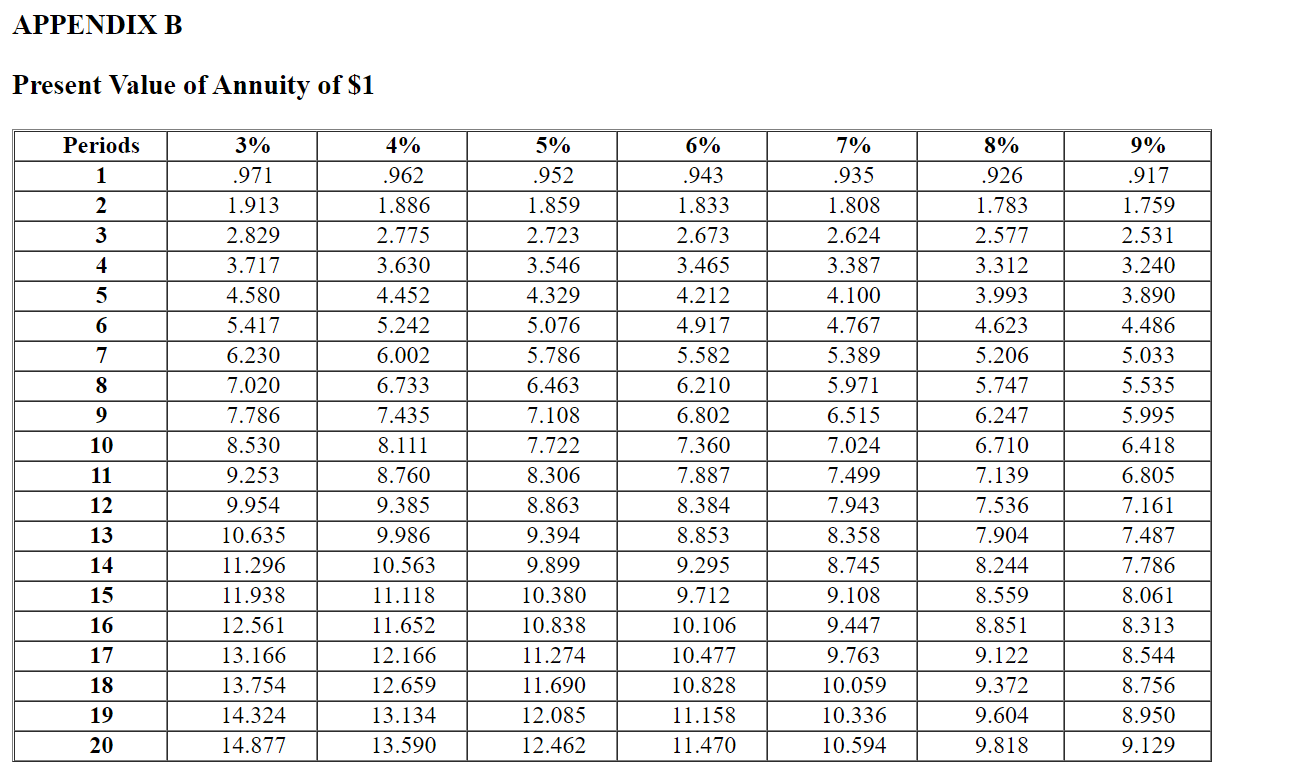

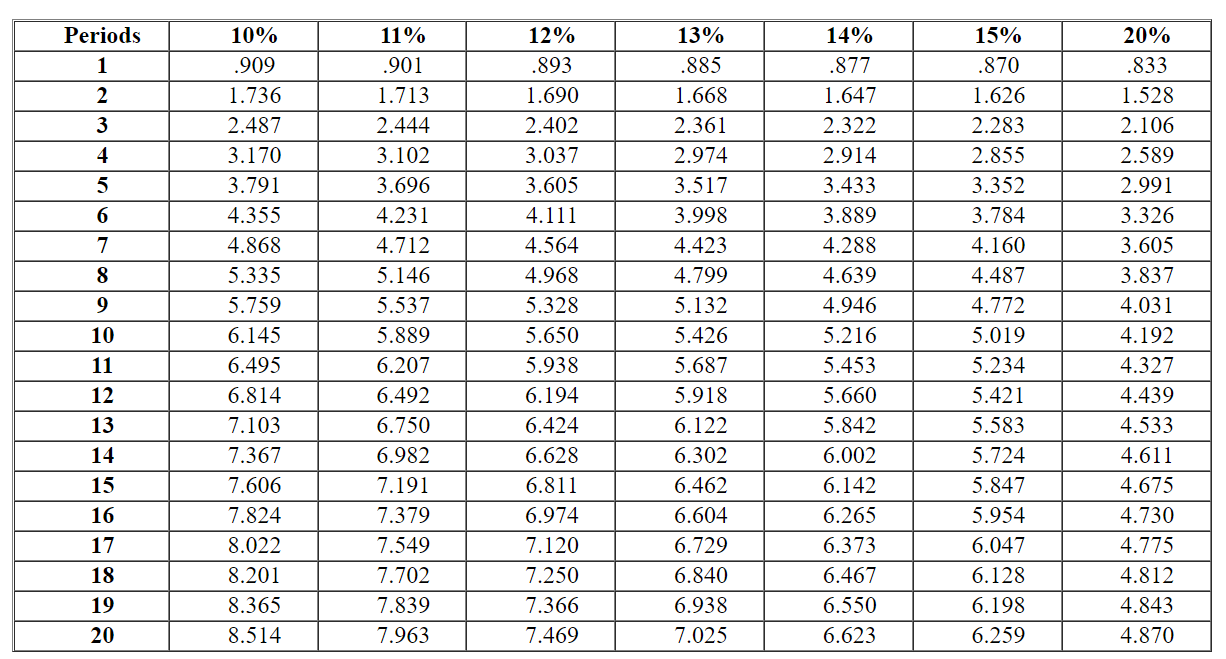

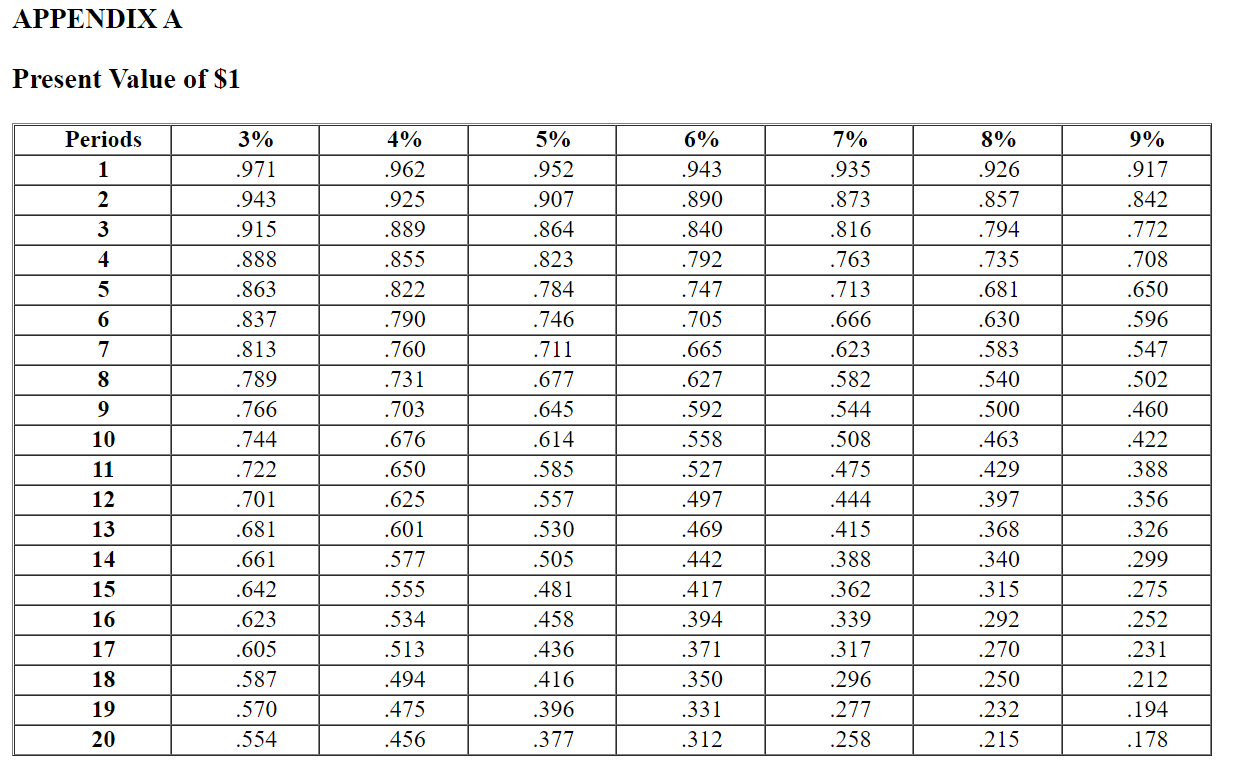

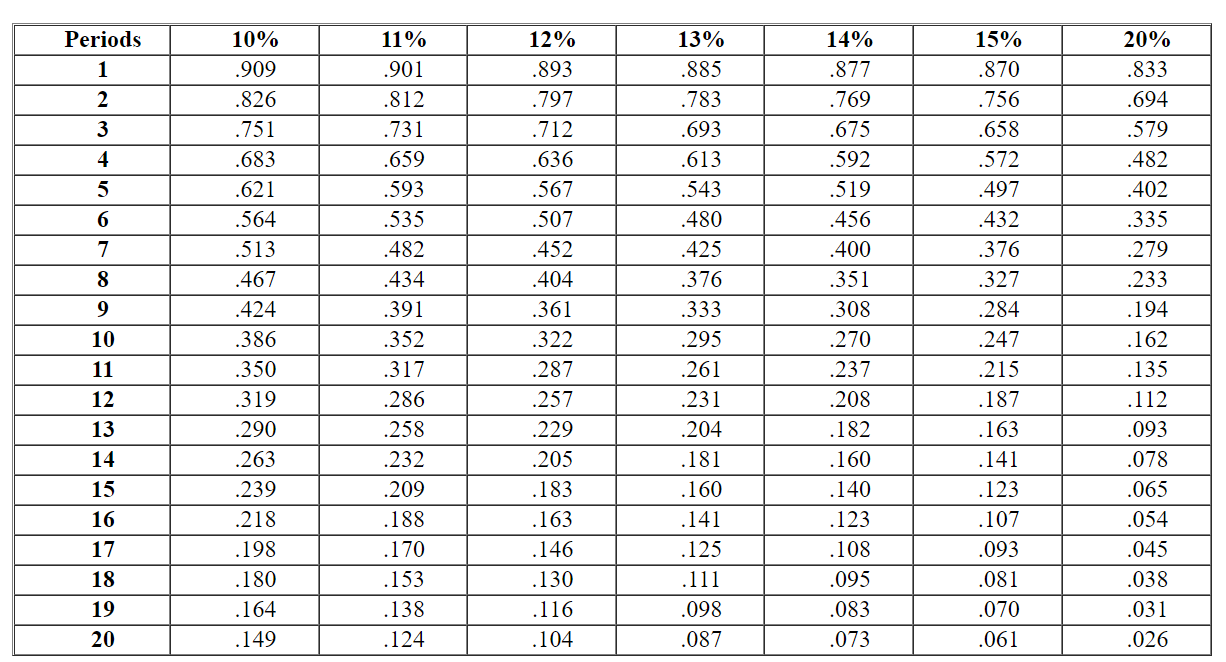

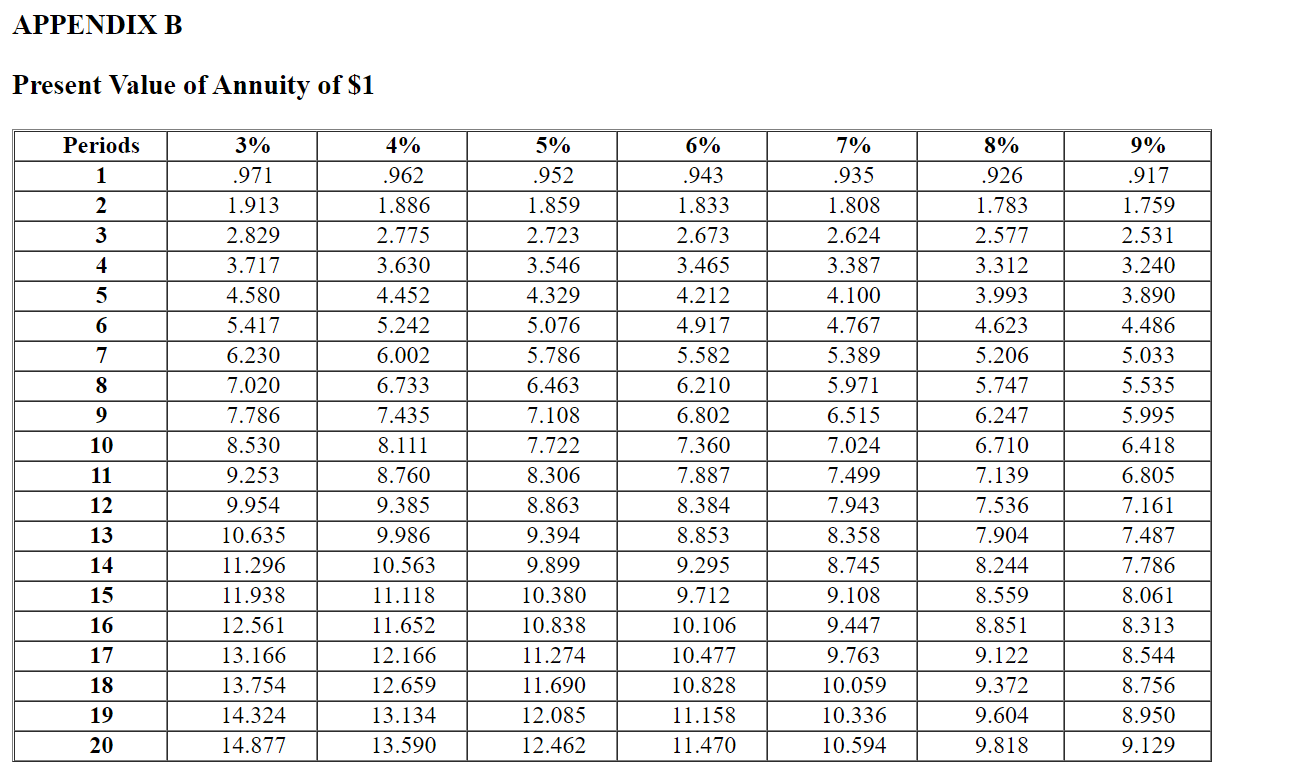

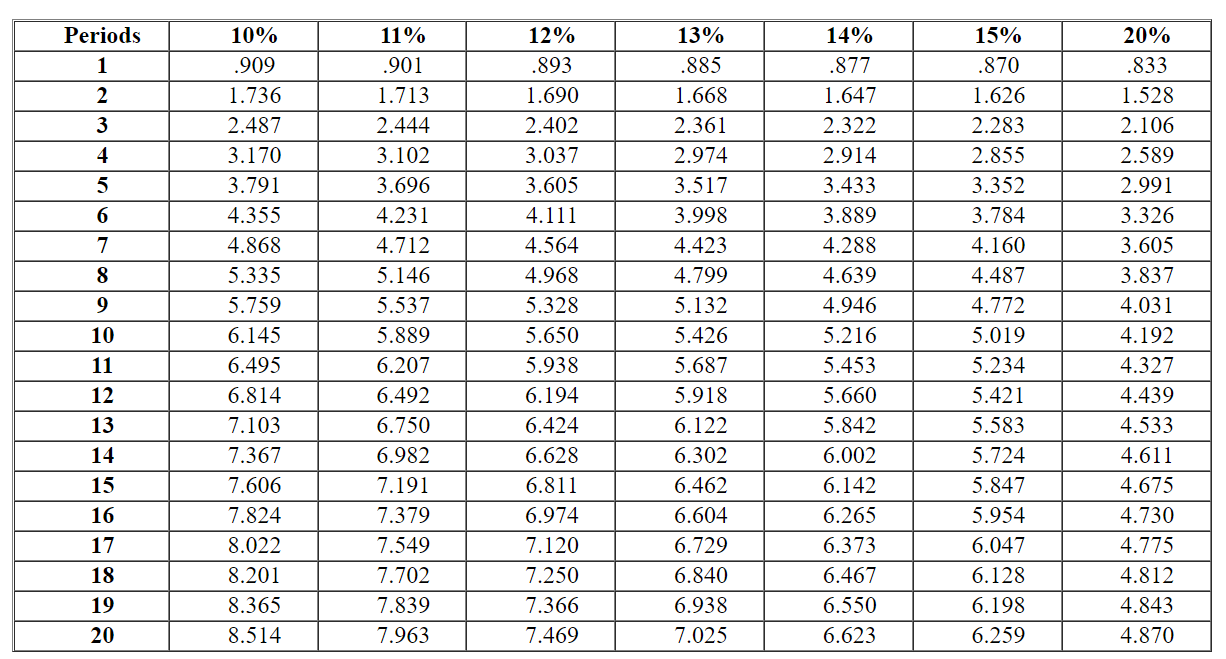

Firm B wants to hire Ms. Ali to manage its advertising department. The firm offered Ms. Ali a three-year employment contract under which it will pay her an $100,000 annual salary in years 0, 1, and 2. Ms. Ali projects that her salary will be taxed at a 25 percent rate in year 0 and a 40 percent rate in years 1 and 2. Firm Bs tax rate for the three-year period is 30 percent. Use Appendix A and Appendix B. Required: a. Assuming an 8 percent discount rate for both Firm B and Ms. Ali, compute the NPV of Ms. Alis after-tax cash flow from the employment contract and Firm Bs after-tax cost of the employment contract. b. To reduce her tax cost, Ms. Ali requests that the salary payment for year 0 be increased to $170,000 and the salary payments for years 1 and 2 be reduced to $65,000. How would this revision in the timing of the payments change your NPV computation for both parties? c-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Firm Bs after-tax cost under this proposal. c-2. From the firms perspective, is this proposal superior to its original offer ($100,000 annually for three years)? d-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Ms. Alis after-tax cash flow. d-2. Should Ms. Ali accept the original offer or the counterproposal?

Firm B wants to hire Ms. Ali to manage its advertising department. The firm offered Ms. Ali a three-year employment contract under which it will pay her an $100,000 annual salary in years 0, 1, and 2. Ms. Ali projects that her salary will be taxed at a 25 percent rate in year 0 and a 40 percent rate in years 1 and 2. Firm Bs tax rate for the three-year period is 30 percent. Use Appendix A and Appendix B. Required: a. Assuming an 8 percent discount rate for both Firm B and Ms. Ali, compute the NPV of Ms. Alis after-tax cash flow from the employment contract and Firm Bs after-tax cost of the employment contract. b. To reduce her tax cost, Ms. Ali requests that the salary payment for year 0 be increased to $170,000 and the salary payments for years 1 and 2 be reduced to $65,000. How would this revision in the timing of the payments change your NPV computation for both parties? c-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Firm Bs after-tax cost under this proposal. c-2. From the firms perspective, is this proposal superior to its original offer ($100,000 annually for three years)? d-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Ms. Alis after-tax cash flow. d-2. Should Ms. Ali accept the original offer or the counterproposal?

APPENDIXA Present Value of $1 Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 3% .971 .943 .915 .888 .863 .837 .813 .789 .766 .744 .722 .701 .681 .661 .642 .623 .605 .587 .570 .554 4% .962 .925 .889 .855 .822 .790 .760 .731 .703 .676 .650 .625 .601 .577 .555 .534 .513 .494 .475 .456 5% .952 .907 .864 .823 .784 .746 .711 .677 .645 .614 .585 .557 .530 .505 .481 .458 436 .416 .396 .377 6% .943 .890 .840 .792 .747 .705 .665 .627 .592 .558 527 .497 .469 .442 417 .394 .371 .350 .331 .312 7% .935 .873 .816 .763 .713 .666 .623 .582 .544 .508 .475 .444 .415 .388 .362 .339 .317 .296 .277 .258 8% .926 .857 .794 .735 .681 .630 .583 .540 .500 .463 .429 .397 .368 .340 .315 .292 .270 .250 .232 .215 9% .917 .842 .772 .708 .650 .596 .547 .502 .460 .422 .388 .356 .326 .299 .275 .252 .231 .212 .194 .178 17 18 19 20 Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 10% .909 .826 .751 .683 .621 .564 .513 .467 .424 .386 .350 .319 .290 .263 .239 .218 .198 .180 .164 .149 11% .901 .812 .731 .659 .593 .535 482 .434 .391 .352 .317 .286 .258 .232 .209 .188 .170 .153 .138 .124 12% .893 .797 .712 .636 .567 .507 .452 .404 .361 .322 .287 .257 .229 .205 .183 .163 .146 .130 .116 .104 13% .885 .783 .693 .613 .543 .480 .425 .376 .333 .295 .261 .231 .204 .181 .160 .141 .125 .111 .098 .087 14% .877 .769 .675 .592 .519 .456 .400 .351 .308 .270 .237 .208 .182 .160 .140 .123 .108 .095 .083 .073 15% .870 .756 .658 .572 .497 .432 .376 .327 .284 .247 .215 .187 .163 .141 .123 .107 .093 .081 .070 .061 20% .833 .694 .579 .482 .402 .335 .279 .233 .194 .162 .135 .112 .093 .078 .065 .054 .045 .038 .031 .026 14 15 16 17 18 19 20 APPENDIX B Present Value of Annuity of $1 8% Periods 1 2 3 4 5 6 7 8 9 10 11 3% .971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 4% .962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 5% .952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 6% .943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 7% .935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 .926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 9% .917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 12 13 14 15 16 17 18 19 Oo98 20 Periods 1 2 3 4 5 6 7 8 9 10 10% .909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 11% .901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 12% .893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 13% .885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 14% .877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 15% .870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 20% .833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 4.775 4.812 4.843 4.870 11 12 13 14 15 16 17 18 19 20

Firm B wants to hire Ms. Ali to manage its advertising department. The firm offered Ms. Ali a three-year employment contract under which it will pay her an $100,000 annual salary in years 0, 1, and 2. Ms. Ali projects that her salary will be taxed at a 25 percent rate in year 0 and a 40 percent rate in years 1 and 2. Firm Bs tax rate for the three-year period is 30 percent. Use Appendix A and Appendix B. Required: a. Assuming an 8 percent discount rate for both Firm B and Ms. Ali, compute the NPV of Ms. Alis after-tax cash flow from the employment contract and Firm Bs after-tax cost of the employment contract. b. To reduce her tax cost, Ms. Ali requests that the salary payment for year 0 be increased to $170,000 and the salary payments for years 1 and 2 be reduced to $65,000. How would this revision in the timing of the payments change your NPV computation for both parties? c-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Firm Bs after-tax cost under this proposal. c-2. From the firms perspective, is this proposal superior to its original offer ($100,000 annually for three years)? d-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Ms. Alis after-tax cash flow. d-2. Should Ms. Ali accept the original offer or the counterproposal?

Firm B wants to hire Ms. Ali to manage its advertising department. The firm offered Ms. Ali a three-year employment contract under which it will pay her an $100,000 annual salary in years 0, 1, and 2. Ms. Ali projects that her salary will be taxed at a 25 percent rate in year 0 and a 40 percent rate in years 1 and 2. Firm Bs tax rate for the three-year period is 30 percent. Use Appendix A and Appendix B. Required: a. Assuming an 8 percent discount rate for both Firm B and Ms. Ali, compute the NPV of Ms. Alis after-tax cash flow from the employment contract and Firm Bs after-tax cost of the employment contract. b. To reduce her tax cost, Ms. Ali requests that the salary payment for year 0 be increased to $170,000 and the salary payments for years 1 and 2 be reduced to $65,000. How would this revision in the timing of the payments change your NPV computation for both parties? c-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Firm Bs after-tax cost under this proposal. c-2. From the firms perspective, is this proposal superior to its original offer ($100,000 annually for three years)? d-1. Firm B responds to Ms. Alis request with a counterproposal. It will pay her $170,000 in year 0 but only $60,000 in years 1 and 2. Compute the NPV of Ms. Alis after-tax cash flow. d-2. Should Ms. Ali accept the original offer or the counterproposal?