Answered step by step

Verified Expert Solution

Question

1 Approved Answer

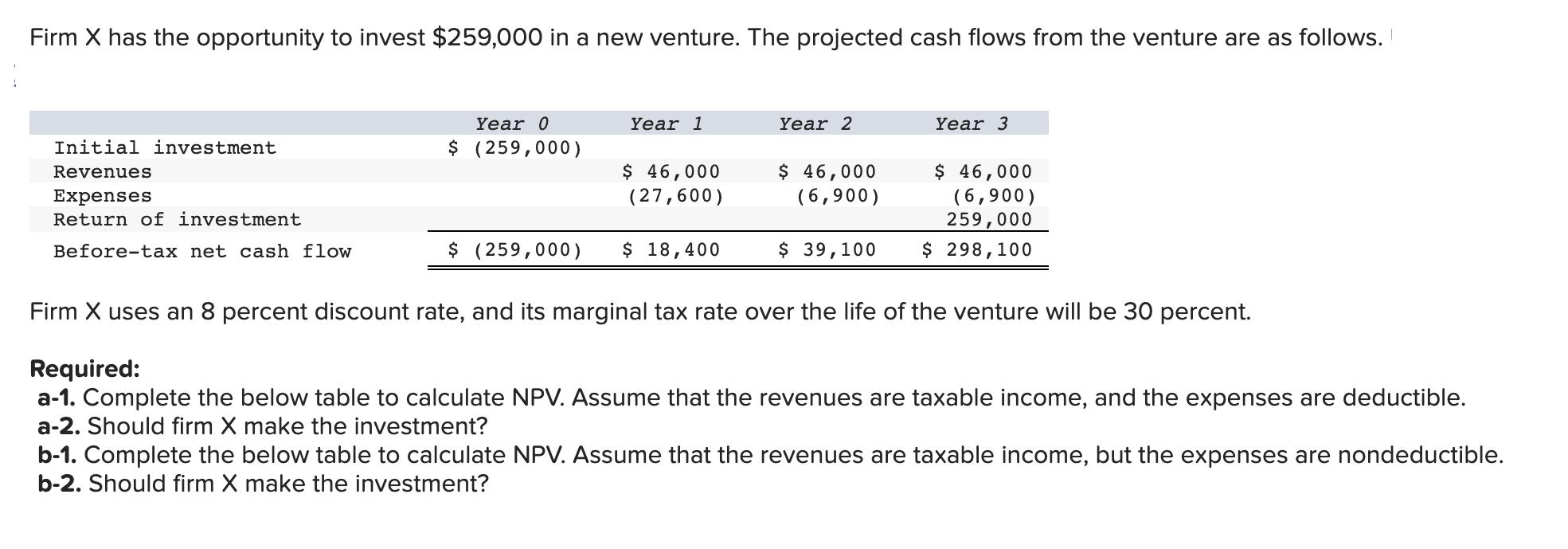

Firm X has the opportunity to invest $259,000 in a new venture. The projected cash flows from the venture are as follows. Initial investment

Firm X has the opportunity to invest $259,000 in a new venture. The projected cash flows from the venture are as follows. Initial investment Revenues Expenses Return of investment Before-tax net cash flow Year 0 $ (259,000) Year 1 $ 46,000 (27,600) $ (259,000) $ 18,400 Year 2 $ 46,000 (6,900) $ 39,100 Year 3 $ 46,000 (6,900) 259,000 $ 298,100 Firm X uses an 8 percent discount rate, and its marginal tax rate over the life of the venture will be 30 percent. Required: a-1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, and the expenses are deductible. a-2. Should firm X make the investment? b-1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, but the expenses are nondeductible. b-2. Should firm X make the investment?

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 2 al 3 4 5 6 7 8 9 10 11 12 13 14 a2 15 16 b1 17 18 19 20 21 22 23 24 25 26 27 28 b2 A B Rev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started