Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Firm X is considering building a plant that will manufacture heaters powered by natural gas. The plant will cost $1 million to build, which

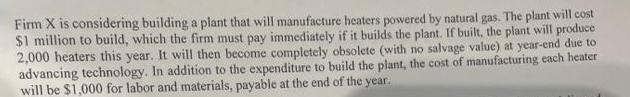

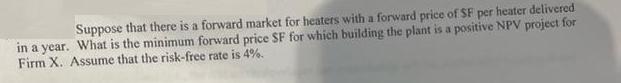

Firm X is considering building a plant that will manufacture heaters powered by natural gas. The plant will cost $1 million to build, which the firm must pay immediately if it builds the plant. If built, the plant will produce 2,000 heaters this year. It will then become completely obsolete (with no salvage value) at year-end due to advancing technology. In addition to the expenditure to build the plant, the cost of manufacturing each heater will be $1,000 for labor and materials, payable at the end of the year. Suppose that there is a forward market for heaters with a forward price of SF per heater delivered in a year. What is the minimum forward price SF for which building the plant is a positive NPV project for Firm X. Assume that the risk-free rate is 4%.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Initial Investent to bulid a plant 1000000 Additional expenses per year No of heaters produced ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started