Question

Firms A and B are identical except for their capital structure. A carries no debt, whereas B carries 60m of debt on which it pays

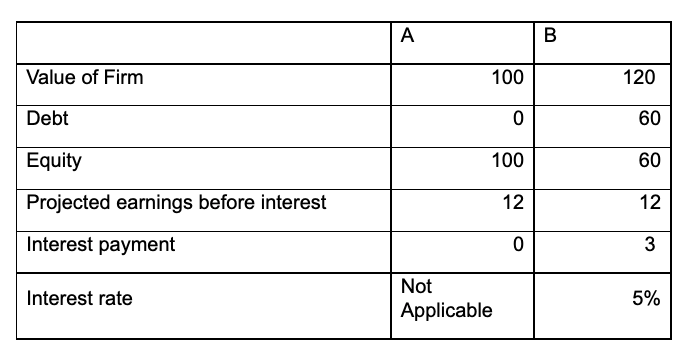

Firms A and B are identical except for their capital structure. A carries no debt, whereas B carries 60m of debt on which it pays a 5% interest rate. Assume no transaction costs, no taxes and risk-free debt. The relevant numbers are provided in the following table (in m):

a) What is the return to an investor holding a 10% stake in B (in '000)?

b) Consider an investor who wants to purchase a 20% stake in A. If he wished to replicate B's capital structure through homemade leverage, how much would he need to borrow to finance his position in m?

c) What is the return (after interests) to an investor who has invested 6m of own money and another 6m of borrowed money to buy 12m worth of A's shares (in '000)?

A B Value of Firm 100 120 Debt 0 60 Equity 100 60 Projected earnings before interest 12 12 Interest payment 0 3 Interest rate Not Applicable 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started