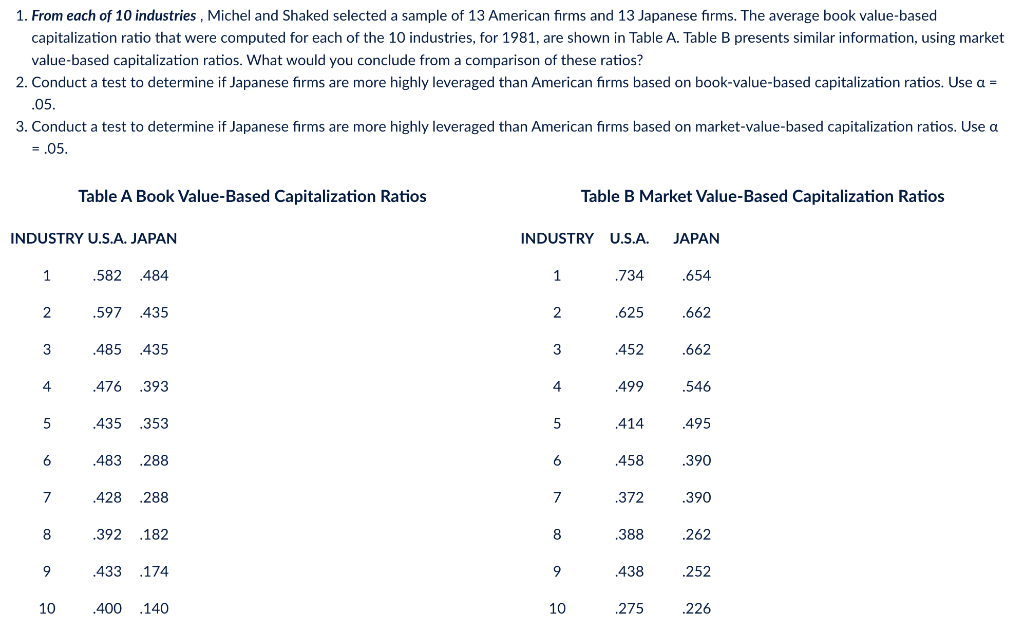

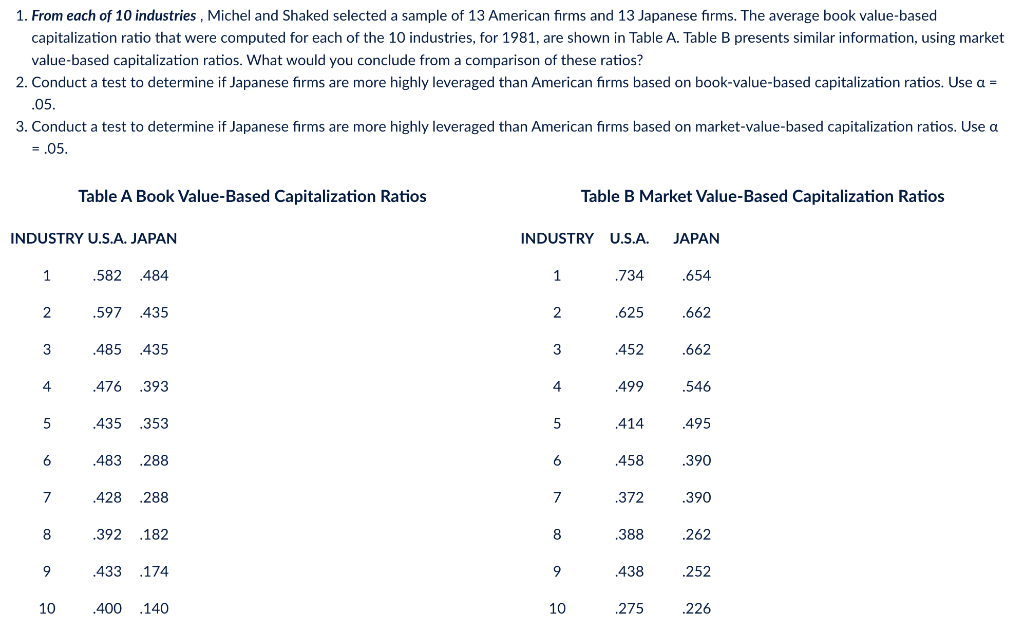

Firms raise funds to finance their operations by issuing debt to lenders and by issuing equity to shareholders. If the amount of debt employed by a firm is relative to the amount of equity, the firm is said to have a high degree of financial leverage. One measure of a firm's leverage is its capitalization ratio- the ratio of the value of a firm's equity to the total value of its equity plus debt.The smaller firm's capitalization ratio is, the more highly leveraged the firm is. The size of the capitalization ratio, however, depends on whether is computation is based on the accounting) book value of equity or the market value of equity. In a study comparing the leverage of American and Japanese firms, Michel and Shaked computed the capitalization ratios for a sample of American firms and for a sample of Japanese firms, using both book values and market values of equity. As expected, they observed that the shapes of the distributions of capitalization ratios differed between American and Japanese firms. Michel and Shaked were primarily interested in testing "the commonly held belief among Japanese businessmen, Japanese government officials, and the investment community worldwide that Japanese firms on average are more highly leveraged than their American counterparts." Materials Download the file below to help you work through the case discussion. Module 2 JMP.zip Discussion Question 1. From each of 10 industries , Michel and Shaked selected a sample of 13 American forms and 13 Japanese firms. The average book value-based capitalization ratio that were computed for each of the 10 industries, for 1981, are shown in Table A. Table B presents similar information, using market value-based capitalization ratios. What would you conclude from a comparison of these ratios? 2. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on book-value-based capitalization ratios. Use a = .05. 3. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on market value-based capitalization ratios. Use a = .05. 1. From each of 10 industries , Michel and Shaked selected a sample of 13 American firms and 13 Japanese firms. The average book value-based capitalization ratio that were computed for each of the 10 industries, for 1981, are shown in Table A. Table B presents similar information, using market value-based capitalization ratios. What would you conclude from a comparison of these ratios? 2. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on book-value-based capitalization ratios. Use a = .05. 3. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on market value-based capitalization ratios. Use a = .05. Table A Book Value-Based Capitalization Ratios Table B Market Value-Based Capitalization Ratios INDUSTRY U.S.A. JAPAN INDUSTRY U.S.A. JAPAN 1 .582 .484 1 .734 .654 2 .597 .435 2 .625 .662 3 485 435 3 452 .662 4 .476 .393 4 499 .546 5 435 .353 5 414 495 6 483 .288 6 458 .390 7 428 .288 7 .372 .390 8 .392 .182 8 .388 .262 9 433 .174 9 438 .252 10 400 .140 10 275 .226 Firms raise funds to finance their operations by issuing debt to lenders and by issuing equity to shareholders. If the amount of debt employed by a firm is relative to the amount of equity, the firm is said to have a high degree of financial leverage. One measure of a firm's leverage is its capitalization ratio- the ratio of the value of a firm's equity to the total value of its equity plus debt.The smaller firm's capitalization ratio is, the more highly leveraged the firm is. The size of the capitalization ratio, however, depends on whether is computation is based on the accounting) book value of equity or the market value of equity. In a study comparing the leverage of American and Japanese firms, Michel and Shaked computed the capitalization ratios for a sample of American firms and for a sample of Japanese firms, using both book values and market values of equity. As expected, they observed that the shapes of the distributions of capitalization ratios differed between American and Japanese firms. Michel and Shaked were primarily interested in testing "the commonly held belief among Japanese businessmen, Japanese government officials, and the investment community worldwide that Japanese firms on average are more highly leveraged than their American counterparts." Materials Download the file below to help you work through the case discussion. Module 2 JMP.zip Discussion Question 1. From each of 10 industries , Michel and Shaked selected a sample of 13 American forms and 13 Japanese firms. The average book value-based capitalization ratio that were computed for each of the 10 industries, for 1981, are shown in Table A. Table B presents similar information, using market value-based capitalization ratios. What would you conclude from a comparison of these ratios? 2. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on book-value-based capitalization ratios. Use a = .05. 3. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on market value-based capitalization ratios. Use a = .05. 1. From each of 10 industries , Michel and Shaked selected a sample of 13 American firms and 13 Japanese firms. The average book value-based capitalization ratio that were computed for each of the 10 industries, for 1981, are shown in Table A. Table B presents similar information, using market value-based capitalization ratios. What would you conclude from a comparison of these ratios? 2. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on book-value-based capitalization ratios. Use a = .05. 3. Conduct a test to determine if Japanese firms are more highly leveraged than American firms based on market value-based capitalization ratios. Use a = .05. Table A Book Value-Based Capitalization Ratios Table B Market Value-Based Capitalization Ratios INDUSTRY U.S.A. JAPAN INDUSTRY U.S.A. JAPAN 1 .582 .484 1 .734 .654 2 .597 .435 2 .625 .662 3 485 435 3 452 .662 4 .476 .393 4 499 .546 5 435 .353 5 414 495 6 483 .288 6 458 .390 7 428 .288 7 .372 .390 8 .392 .182 8 .388 .262 9 433 .174 9 438 .252 10 400 .140 10 275 .226