Answered step by step

Verified Expert Solution

Question

1 Approved Answer

first 3 parts of the problem are correct. All one problem You want to buy a $650,000 house. If you plan to make a 20%

first 3 parts of the problem are correct. All one problem

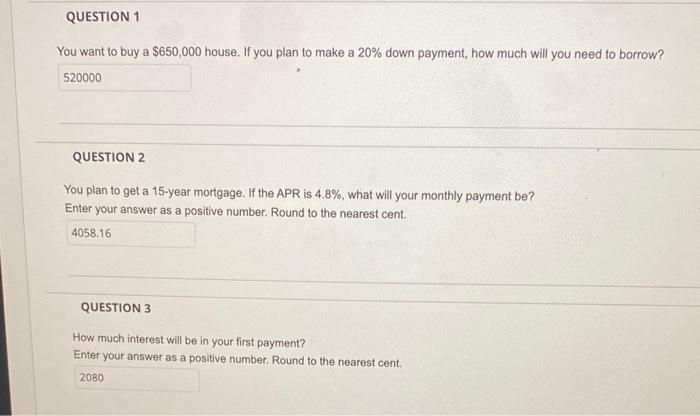

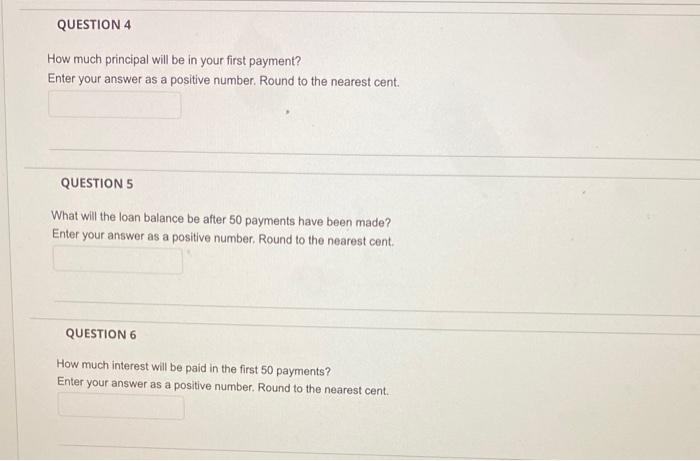

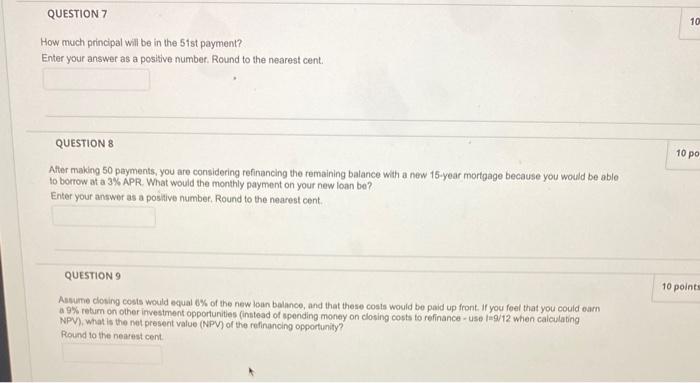

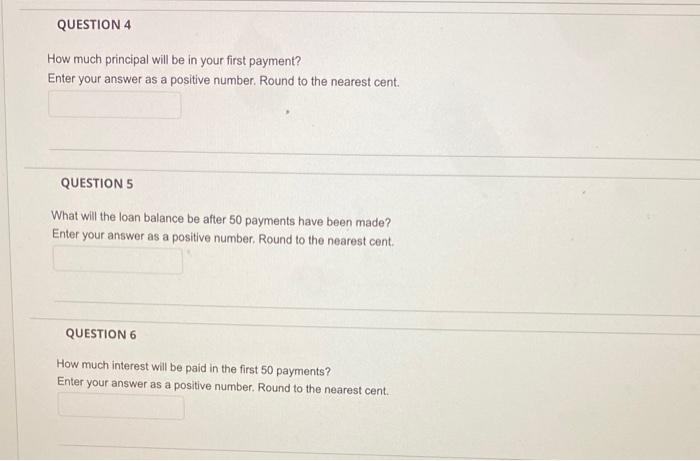

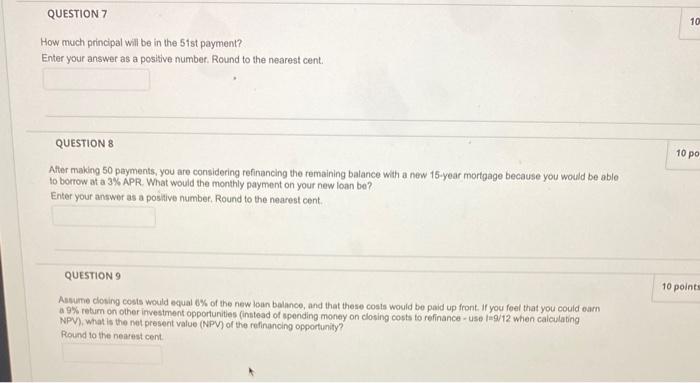

You want to buy a $650,000 house. If you plan to make a 20% down payment, how much will you need to borrow? QUESTION 2 You plan to get a 15-year mortgage. If the APR is 4.8%, what will your monthly payment be? Enter your answer as a positive number. Round to the nearest cent. QUESTION 3 How much interest will be in your first payment? Enter your answer as a positive number. Round to the nearest cent. How much principal will be in your first payment? Enter your answer as a positive number. Round to the nearest cent. QUESTION 5 What will the loan balance be after 50 payments have been made? Enter your answer as a positive number. Round to the nearest cent. QUESTION 6 How much interest will be paid in the first 50 payments? Enter your answer as a positive number. Round to the nearest cent. How much principal will be in the 5 ist payment? Enter your answer as a positive number. Round to the nearest cent. QUESTION 8 Atter making 50 payments, you are considering refinancing the remaining balance with a new 15 -year mortgage because you would be able to borrow at a 3% APR. What would the monthly payment on your new loan be? Enter your answer as a positilie number. Round to the nearest cent. QUESTION 9 Aswume closing costs would equal 6% of the new loan balance, and that these costs would be paid up front. If you feel that you could oarn a 9% retum on other investment opportunities (intead of upending money on closing costs to refinance - use f=9/12 when calculating NPV), what is the net present value (NPV) of the refinancing opportunity? Round to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started