Answered step by step

Verified Expert Solution

Question

1 Approved Answer

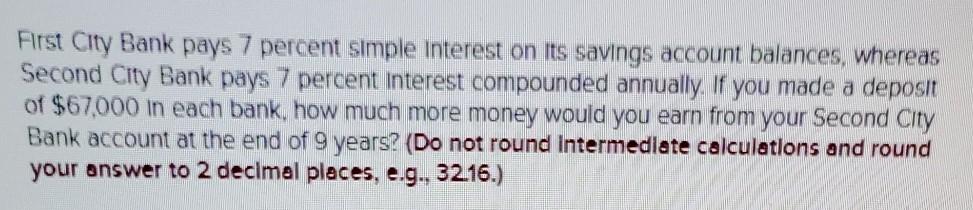

First City Bank pays 7 percent simple interest on Its savings account balances, whereas Second City Bank pays 7 percent Interest compounded annually. If you

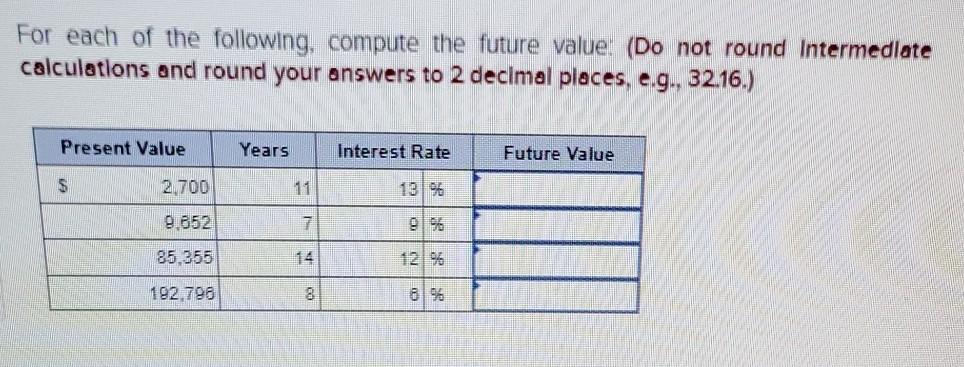

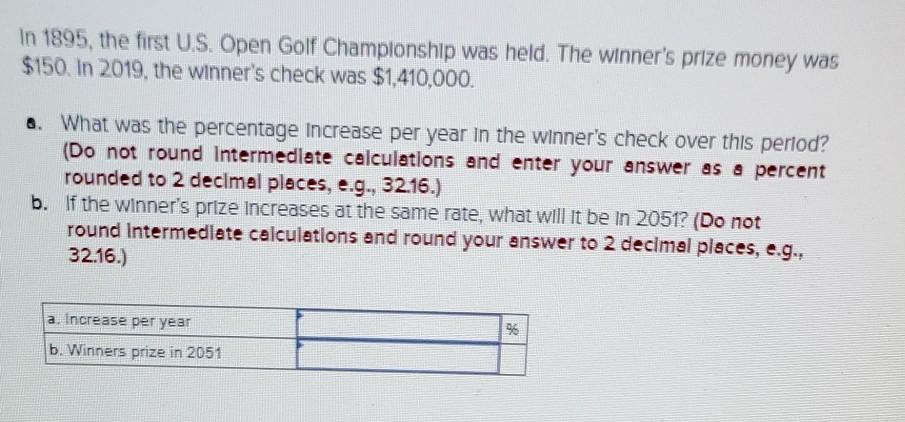

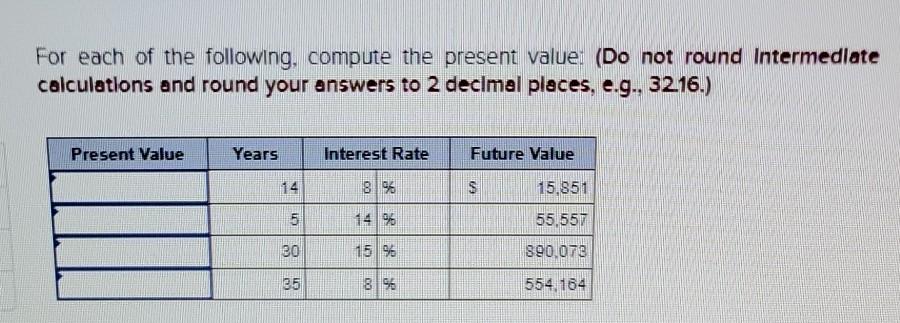

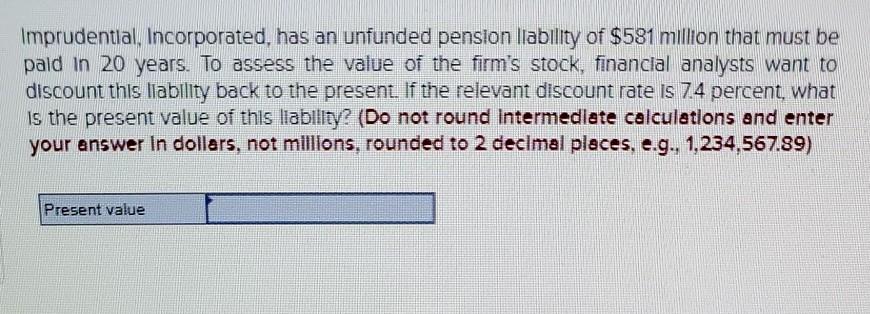

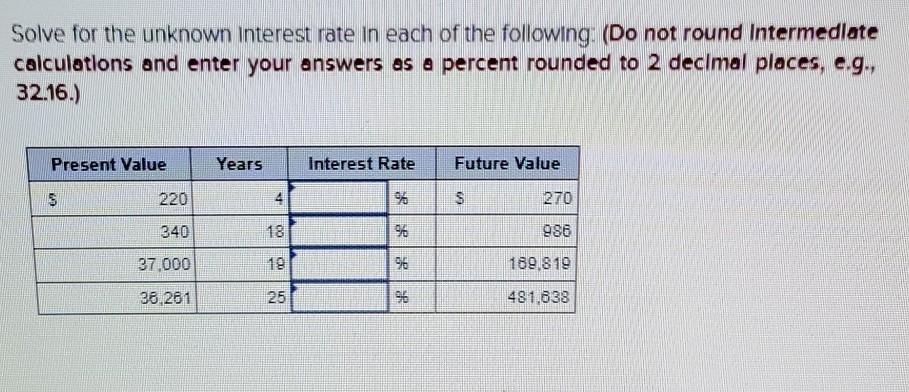

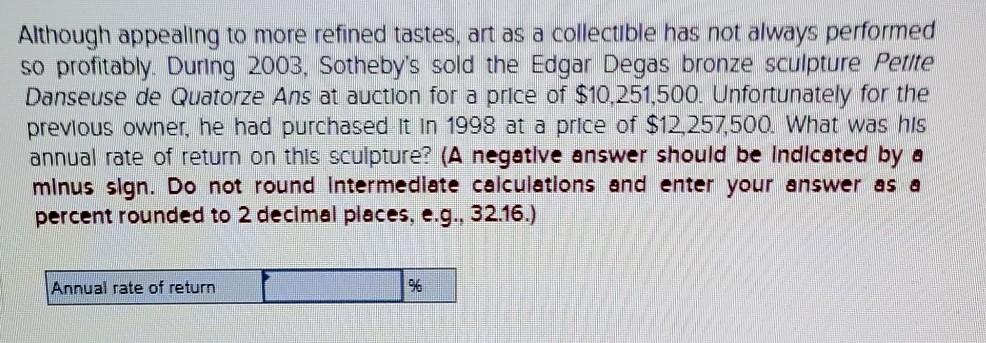

First City Bank pays 7 percent simple interest on Its savings account balances, whereas Second City Bank pays 7 percent Interest compounded annually. If you made a deposit of $67,000 in each bank, how much more money would you earn from your Second City Bank account at the end of 9 years? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 3216.) For each of the following, compute the future value: (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present Value Years Interest Rate Future Value 5 2,700 11 13 6 9.652 7 85.355 14 12% 192.790 8 8 % In 1895, the first US Open Golf Champlonship was held. The winner's prize money was $150. In 2019, the winner's check was $1,410,000. 4. What was the percentage increase per year in the winner's check over this period? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the winner's prize increases at the same rate, what will it be in 2051? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Increase per year 96 b. Winners prize in 2051 For each of the following, compute the present value: (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 3216.) Present Value Years Interest Rate Future Value 14 18% s 15,851 5 14 % 55,557 30 15 % 890.078 35 896 554 164 Imprudential, Incorporated, has an unfunded pension liability of $581 million that must be pald in 20 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 74 percent, what is the present value of this liability? (Do not round Intermediate calculations and enter your answer In dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89) Present value Solve for the unknown Interest rate in each of the following: (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Present Value Years Interest Rate Future Value S 220 4 2560 $ 270 340 18 % 986 37.000 19 96 169,819 38.261 25 R. 481,838 Although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2003. Sotheby's sold the Edgar Degas bronze sculpture Petite Danseuse de Quatorze Ans at auction for a price of $10,251,500. Unfortunately for the previous owner, he had purchased It In 1998 at a price of $12,257,500. What was his annual rate of return on this sculpture? (A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Annual rate of return 946

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started