Answered step by step

Verified Expert Solution

Question

1 Approved Answer

First drop down options: deposit insurance fund, bank insurance fund, savings association insurance fund Second drop down options: DIF, NCUSIF Third drop down options: $378,500,

First drop down options: deposit insurance fund, bank insurance fund, savings association insurance fund

Second drop down options: DIF, NCUSIF

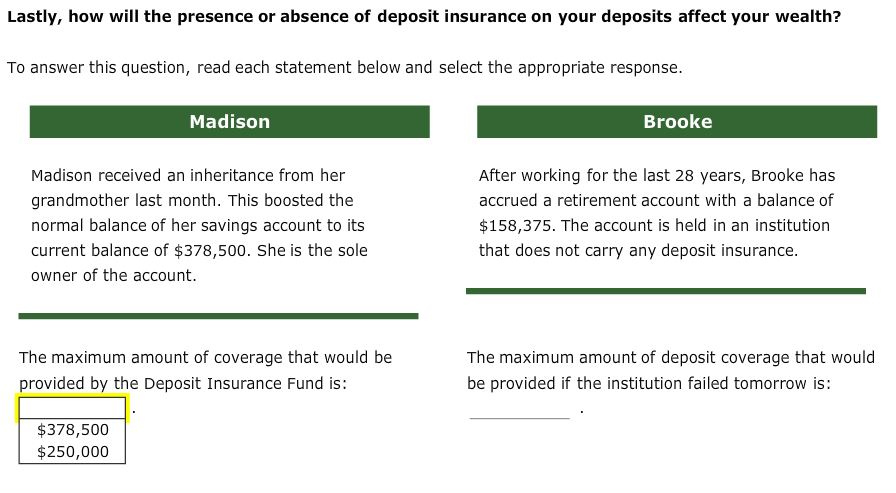

Third drop down options: $378,500, $250,000

Fourth drop down options: $0, $250,000

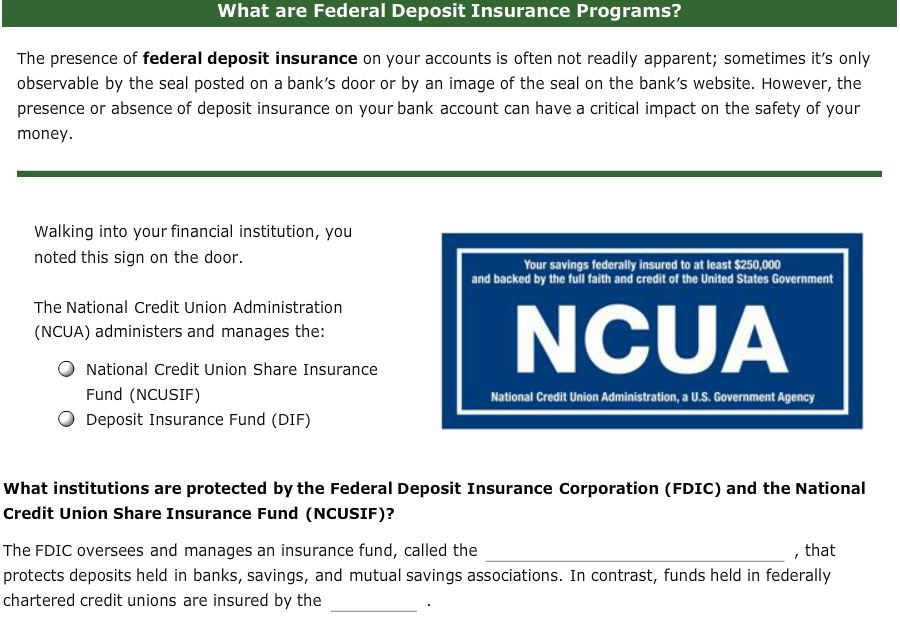

What are Federal Deposit Insurance Programs? The presence of federal deposit insurance on your accounts is often not readily apparent; sometimes it's only observable by the seal posted on a bank's door or by an image of the seal on the bank's website. However, the presence or absence of deposit insurance on your bank account can have a critical impact on the safety of your money Walking into your financial institution, you noted this sign on the door. Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government The National Credit Union Administration (NCUA) administers and manages the: NCUA National Credit Union Share Insurance Fund (NCUSIF) National Credit Union Administration, a U.S. Government Agency O Deposit Insurance Fund (DIF) What institutions are protected by the Federal Deposit Insurance Corporation (FDIC) and the National Credit Union Share Insurance Fund (NCUSIF)? The FDIC oversees and manages an insurance fund, called the protects deposits held in banks, savings, and mutual savings associations. In contrast, funds held in federally chartered credit unions are insured by the nd (NCUSiF)posit , that Lastly, how will the presence or absence of deposit insurance on your deposits affect your wealth? To answer this question, read each statement below and select the appropriate response. Madisorn Brooke Madison received an inheritance from her grandmother last month. This boosted the normal balance of her savings account to its current balance of $378,500. She is the sole owner of the account. After working for the last 28 years, Brooke has accrued a retirement account with a balance of $158,375. The account is held in an institution that does not carry any deposit insurance The maximum amount of coverage that would be provided by the Deposit Insurance Fund is The maximum amount of deposit coverage that would be provided if the institution failed tomorrow is: $378,500 $250,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started