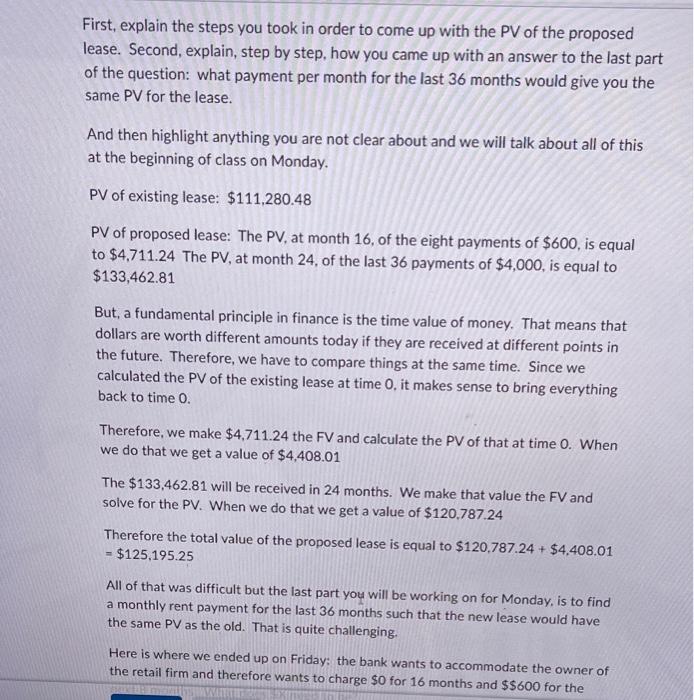

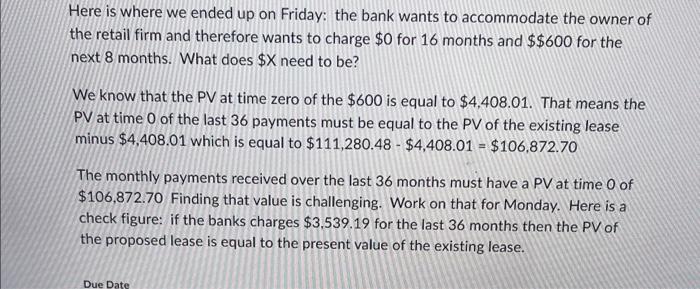

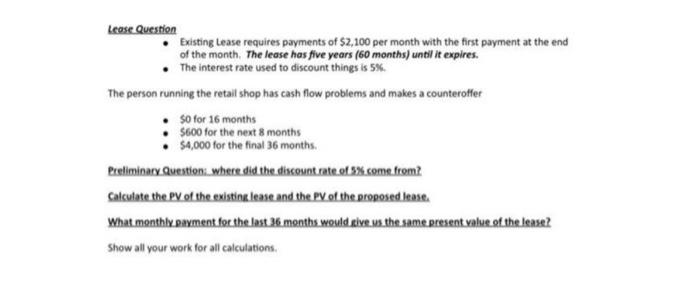

First, explain the steps you took in order to come up with the PV of the proposed lease. Second, explain, step by step, how you came up with an answer to the last par of the question: what payment per month for the last 36 months would give you the same PV for the lease. And then highlight anything you are not clear about and we will talk about all of this at the beginning of class on Monday. PV of existing lease: $111,280.48 PV of proposed lease: The PV, at month 16 , of the eight payments of $600, is equal to $4,711.24 The PV, at month 24 , of the last 36 payments of $4,000, is equal to $133,462.81 But, a fundamental principle in finance is the time value of money. That means that dollars are worth different amounts today if they are received at different points in the future. Therefore, we have to compare things at the same time. Since we calculated the PV of the existing lease at time 0 , it makes sense to bring everything back to time 0 . Therefore, we make $4,711.24 the FV and calculate the PV of that at time 0 . When we do that we get a value of $4,408.01 The $133,462.81 will be received in 24 months. We make that value the FV and solve for the PV. When we do that we get a value of $120,787.24 Therefore the total value of the proposed lease is equal to $120,787.24+$4,408.01 =$125,195.25 All of that was difficult but the last part you will be working on for Monday, is to find a monthly rent payment for the last 36 months such that the new lease would have the same PV as the old. That is quite challenging. Here is where we ended up on Friday: the bank wants to accommodate the owner of the retail firm and therefore wants to charge $0 for 16 months and $600 for the Here is where we ended up on Friday: the bank wants to accommodate the owner of the retail firm and therefore wants to charge $0 for 16 months and $600 for the next 8 months. What does $X need to be? We know that the PV at time zero of the $600 is equal to $4,408.01. That means the PV at time 0 of the last 36 payments must be equal to the PV of the existing lease minus $4,408.01 which is equal to $111,280.48$4,408.01=$106,872.70 The monthly payments received over the last 36 months must have a PV at time 0 of $106,872.70 Finding that value is challenging. Work on that for Monday. Here is a check figure: if the banks charges $3,539.19 for the last 36 months then the PV of the proposed lease is equal to the present value of the existing lease. Leose Question - Existing Lease requires payments of $2,100 per month with the first payment at the end of the month. The lease has five years (60 months) until it expires. - The interest rate used to discount things is 5K. The person running the retail shop has cash flow problems and makes a counteroffer - So for 16 months - $600 for the next 8 months - $4,000 for the final 36 months. Ereliminary Question: where did the discount rate of 5% come from? Calculate the PV of the existing lease and the PV of the proposed lease. What monthly payment for the last 36 months would sive us the same present value of the lease? Show all your work for all calculations. First, explain the steps you took in order to come up with the PV of the proposed lease. Second, explain, step by step, how you came up with an answer to the last par of the question: what payment per month for the last 36 months would give you the same PV for the lease. And then highlight anything you are not clear about and we will talk about all of this at the beginning of class on Monday. PV of existing lease: $111,280.48 PV of proposed lease: The PV, at month 16 , of the eight payments of $600, is equal to $4,711.24 The PV, at month 24 , of the last 36 payments of $4,000, is equal to $133,462.81 But, a fundamental principle in finance is the time value of money. That means that dollars are worth different amounts today if they are received at different points in the future. Therefore, we have to compare things at the same time. Since we calculated the PV of the existing lease at time 0 , it makes sense to bring everything back to time 0 . Therefore, we make $4,711.24 the FV and calculate the PV of that at time 0 . When we do that we get a value of $4,408.01 The $133,462.81 will be received in 24 months. We make that value the FV and solve for the PV. When we do that we get a value of $120,787.24 Therefore the total value of the proposed lease is equal to $120,787.24+$4,408.01 =$125,195.25 All of that was difficult but the last part you will be working on for Monday, is to find a monthly rent payment for the last 36 months such that the new lease would have the same PV as the old. That is quite challenging. Here is where we ended up on Friday: the bank wants to accommodate the owner of the retail firm and therefore wants to charge $0 for 16 months and $600 for the Here is where we ended up on Friday: the bank wants to accommodate the owner of the retail firm and therefore wants to charge $0 for 16 months and $600 for the next 8 months. What does $X need to be? We know that the PV at time zero of the $600 is equal to $4,408.01. That means the PV at time 0 of the last 36 payments must be equal to the PV of the existing lease minus $4,408.01 which is equal to $111,280.48$4,408.01=$106,872.70 The monthly payments received over the last 36 months must have a PV at time 0 of $106,872.70 Finding that value is challenging. Work on that for Monday. Here is a check figure: if the banks charges $3,539.19 for the last 36 months then the PV of the proposed lease is equal to the present value of the existing lease. Leose Question - Existing Lease requires payments of $2,100 per month with the first payment at the end of the month. The lease has five years (60 months) until it expires. - The interest rate used to discount things is 5K. The person running the retail shop has cash flow problems and makes a counteroffer - So for 16 months - $600 for the next 8 months - $4,000 for the final 36 months. Ereliminary Question: where did the discount rate of 5% come from? Calculate the PV of the existing lease and the PV of the proposed lease. What monthly payment for the last 36 months would sive us the same present value of the lease? Show all your work for all calculations