Answered step by step

Verified Expert Solution

Question

1 Approved Answer

First Go Netflix's website and get the latest financial statements and letter to shareholders using the following steps: Go to netflix.com and scroll to the

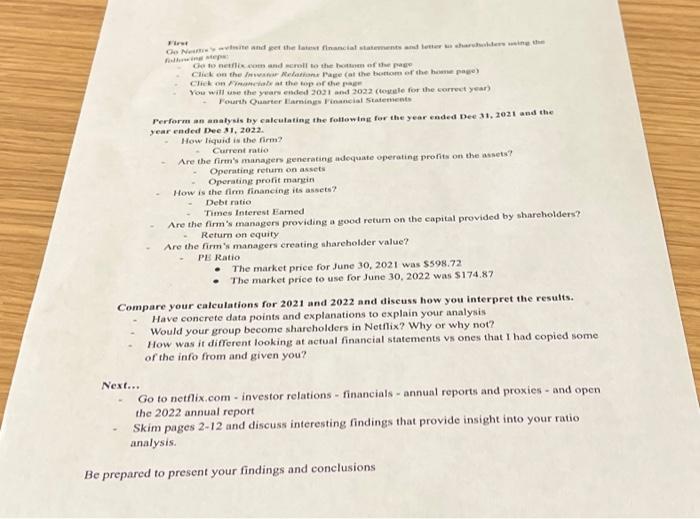

First Go Netflix's website and get the latest financial statements and letter to shareholders using the following steps: Go to netflix.com and scroll to the bottom of the page Click on the Investor Relations Page (at the bottom of the home page) Click on Financials at the top of the page You will use the years ended 2021 and 2022 (toggle for the correct year) Fourth Quarter Earnings Financial Statements Next... Perform an analysis by calculating the following for the year ended Dec 31, 2021 and the year ended Dec 31, 2022. How liquid is the firm? Current ratio Are the firm's managers generating adequate operating profits on the assets? Operating return on assets Operating profit margin How is the firm financing its assets? Debt ratio Times Interest Earned Are the firm's managers providing a good return on the capital provided by shareholders? Return on equity Are the firm's managers creating shareholder value? PE Ratio The market price for June 30, 2021 was $598.72 The market price to use for June 30, 2022 was $174.87 Compare your calculations for 2021 and 2022 and discuss how you interpret the results. Have concrete data points and explanations to explain your analysis Would your group become shareholders in Netflix? Why or why not? How was it different looking at actual financial statements vs ones that I had copied some of the info from and given you? Go to netflix.com - investor relations - financials - annual reports and proxies - and open the 2022 annual report Skim pages 2-12 and discuss interesting findings that provide insight into your ratio analysis. Be prepared to present your findings and conclusions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started