Question

First, I clearly reveal that the ultimate goal is to say about (c). In (a), I got the optimal risky portfolio which maximizes the slope

First, I clearly reveal that the ultimate goal is to say about (c).

In (a), I got the optimal risky portfolio which maximizes the slope of the Capital Allocation Line, ( E(r)- r ) / sigma.

That is portfolio A with the value 5 (B: 4, C: 3.5, D: 3.75)

In (b), using given utility function, I got the proportion of risky assets in the overall optimal portfolio, which is 2.5.

Therefore, we should construct the overall optimal portfolio by risk-free asset(-150%) + risky assets(250%), which demands the short sales of risk-free asset.

However, as it is stated in (c), the additional restriction is given that he cannot have short sales for the risk-free.

Because we cannot make use of short sales for portfolio A and the optimal proportion for it, I think the best ways we can take would be [ (1) with portfolio A, constructing the overall optimal portfolio by risky assets(100%) + risk-free asset(0%) ] or [ (2) with portfolio B which is ranked as the second in maximizing the slope of the CAL in (a), constructing the overall optimal portfolio by risky assets(66%) + risk-free asset(33%).

Actually, he can maximize his utility by (1) not (2). But I wonder whether we can say portfolio is 'the optimal risky portfolio.'. By separation theory, consideration of utility is separated in the process of determining the optimal risky portfolio. Should we throw the portfolio away by the fact that the optimal risky assets proportion of 250% cannot be reached? What is the optimal risky portfolio between portfolio A or B? Or can there be other choices?

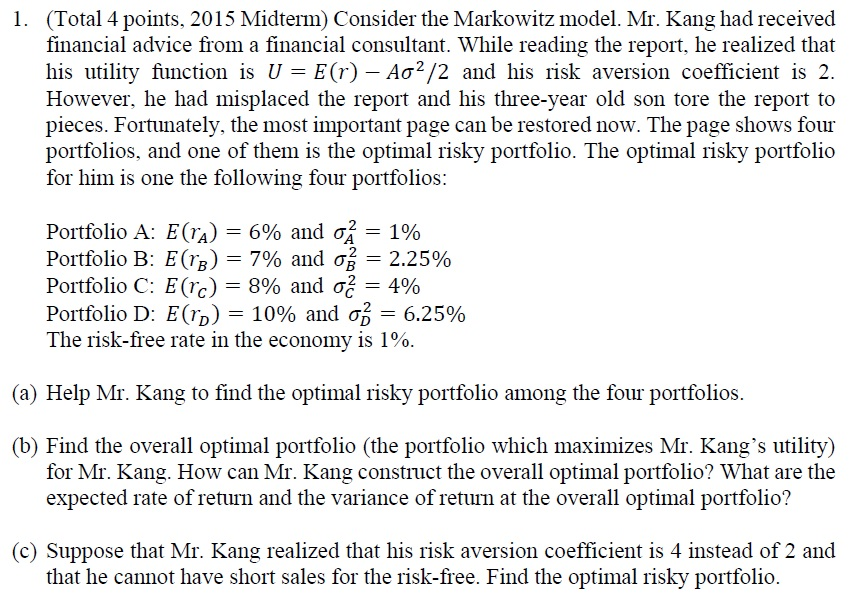

1. (Total 4 points, 2015 Midterm) Consider the Markowitz model. Mr. Kang had received financial advice from a financial consultant. While reading the report, he realized that his utility function is U = E(r) A02/2 and his risk aversion coefficient is 2. However, he had misplaced the report and his three-year old son tore the report to pieces. Fortunately, the most important page can be restored now. The page shows four portfolios, and one of them is the optimal risky portfolio. The optimal risky portfolio for him is one the following four portfolios: Portfolio A: E(ra) = 6% and o = 1% Portfolio B: Err) = 7% and on = 2.25% Portfolio C: Erc) = 8% and o = 4% Portfolio D: Erp) = 10% and on = 6.25% The risk-free rate in the economy is 1%. (a) Help Mr. Kang to find the optimal risky portfolio among the four portfolios. (b) Find the overall optimal portfolio (the portfolio which maximizes Mr. Kang's utility) for Mr. Kang. How can Mr. Kang construct the overall optimal portfolio? What are the expected rate of return and the variance of return at the overall optimal portfolio? (c) Suppose that Mr. Kang realized that his risk aversion coefficient is 4 instead of 2 and that he cannot have short sales for the risk-free. Find the optimal risky portfolio. 1. (Total 4 points, 2015 Midterm) Consider the Markowitz model. Mr. Kang had received financial advice from a financial consultant. While reading the report, he realized that his utility function is U = E(r) A02/2 and his risk aversion coefficient is 2. However, he had misplaced the report and his three-year old son tore the report to pieces. Fortunately, the most important page can be restored now. The page shows four portfolios, and one of them is the optimal risky portfolio. The optimal risky portfolio for him is one the following four portfolios: Portfolio A: E(ra) = 6% and o = 1% Portfolio B: Err) = 7% and on = 2.25% Portfolio C: Erc) = 8% and o = 4% Portfolio D: Erp) = 10% and on = 6.25% The risk-free rate in the economy is 1%. (a) Help Mr. Kang to find the optimal risky portfolio among the four portfolios. (b) Find the overall optimal portfolio (the portfolio which maximizes Mr. Kang's utility) for Mr. Kang. How can Mr. Kang construct the overall optimal portfolio? What are the expected rate of return and the variance of return at the overall optimal portfolio? (c) Suppose that Mr. Kang realized that his risk aversion coefficient is 4 instead of 2 and that he cannot have short sales for the risk-free. Find the optimal risky portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started