First image re-uploaded

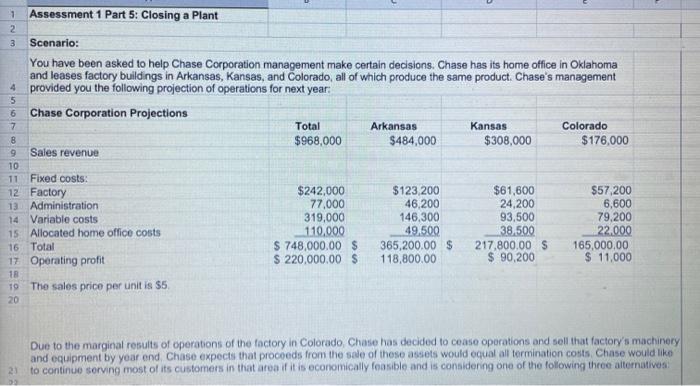

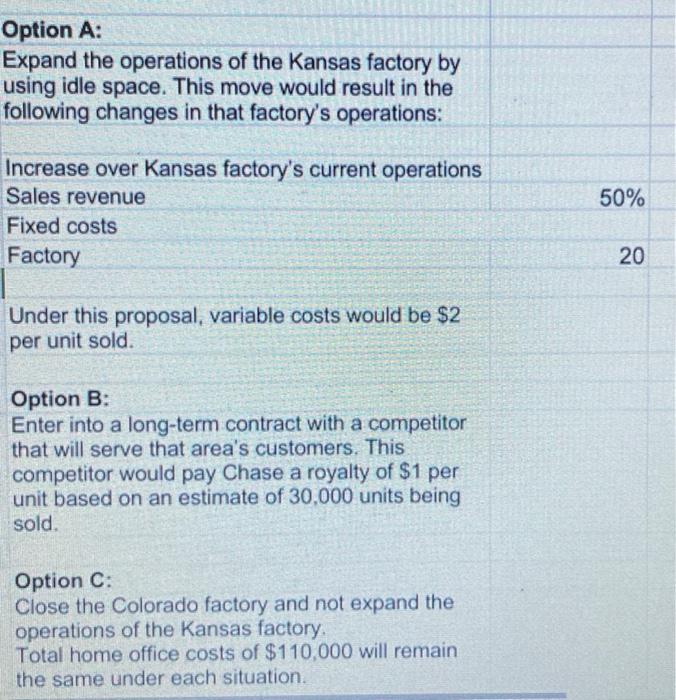

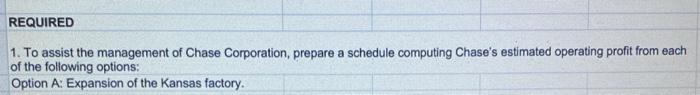

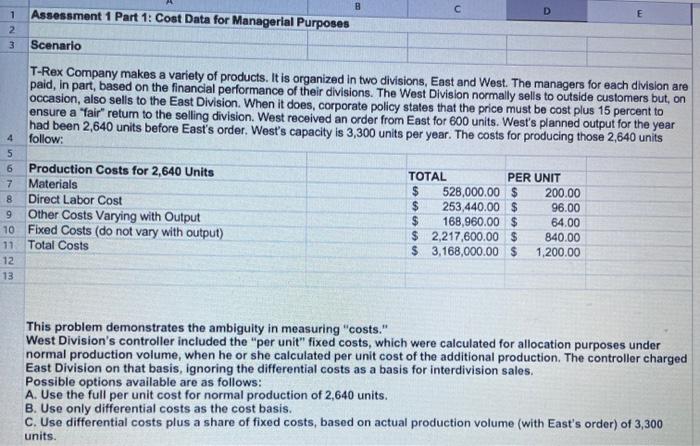

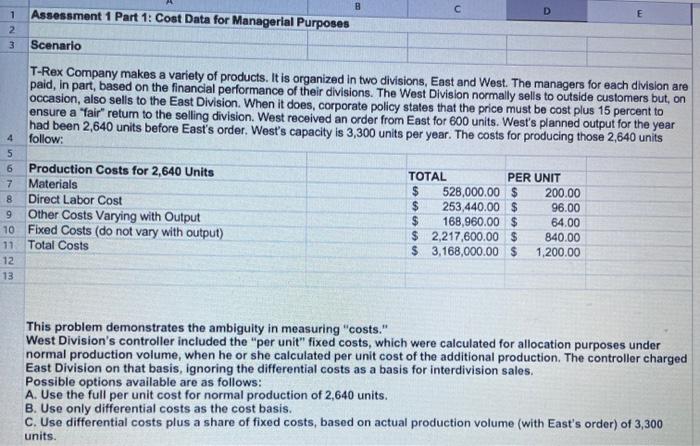

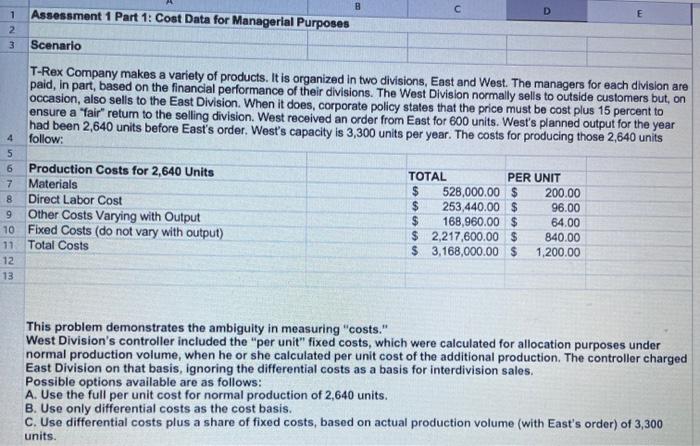

1 Assessment 1 Part 5: Closing a Plant 2 3 Scenario: You have been asked to help Chase Corporation management make certain decisions. Chase has its home office in Oklahoma and leases factory buildings in Arkansas, Kansas, and Colorado, all of which produce the same product. Chase's management 4 provided you the following projection of operations for next year. 5 6 Chase Corporation Projections 7 Total Arkansas Kansas Colorado B $968,000 $484,000 $308,000 $176,000 9 Sales revenue 10 11 Fixed costs 12 Factory $242.000 $123,200 $61,600 $57,200 13 Administration 77,000 46,200 24,200 Variable costs 319,000 146,300 93,500 79.200 15 Allocated home office costs 00 49.500 38,500 22.000 16 Total $ 748,000.00 $ 365,200.00 $ 217,800.00 $ 165,000.00 17 Operating profit $ 220,000.00 $ 118,800.00 $ 90,200 $ 11,000 18 TO The sales price per unit is $5 20 6,600 Due to the marginal results of operations of the factory in Colorado Chase has decided to cease operations and sell that factory's machinery and equipment by year end Chase expects that proceeds from the sale of these assets would equal al termination costs Chase would like to continuo serving most of its customers in that area if it is economically feasible and is considering one of the following three alternatives 23 Option A: Expand the operations of the Kansas factory by using idle space. This move would result in the following changes in that factory's operations: 50% Increase over Kansas factory's current operations Sales revenue Fixed costs Factory 20 Under this proposal, variable costs would be $2 per unit sold. Option B: Enter into a long-term contract with a competitor that will serve that area's customers. This competitor would pay Chase a royalty of $1 per unit based on an estimate of 30,000 units being sold. Option C: Close the Colorado factory and not expand the operations of the Kansas factory Total home office costs of $110,000 will remain the same under each situation, REQUIRED 1. To assist the management of Chase Corporation, prepare a schedule computing Chase's estimated operating profit from each of the following options: Option A: Expansion of the Kansas factory. Option B: Negotiation of the long-term contract on a royalty basis. Option C: Shutdown of the Colorado operations with no expansion at other locations. 3 5 62. Determine the best option for Chase Corporation and explain your rationale. B Assessment 1 Part 1: Cost Data for Managerial Purposes D E 1 2 3 Scenario T-Rex Company makes a variety of products. It is organized in two divisions, East and West. The managers for each division are paid, in part, based on the financial performance of their divisions. The West Division normally sells to outside customers but, on occasion, also sells to the East Division. When it does, corporate policy states that the price must be cost plus 15 percent to ensure a "fair" return to the selling division. West received an order from East for 600 units. West's planned output for the year had been 2,640 units before East's order. West's capacity is 3,300 units per year. The costs for producing those 2,640 units follow: 5 6 7 8 9 10 11 12 13 Production Costs for 2,640 Units Materials Direct Labor Cost Other Costs Varying with Output Fixed Costs (do not vary with output) Total Costs TOTAL PER UNIT $ 528,000.00 $ 200.00 $ 253,440.00 $ 96.00 $ 168,960.00 $ 64.00 $ 2,217,600.00 $ 840.00 $ 3,168,000.00 $ 1,200.00 This problem demonstrates the ambiguity in measuring "costs." West Division's controller included the "per unit" fixed costs, which were calculated for allocation purposes under normal production volume, when he or she calculated per unit cost of the additional production. The controller charged East Division on that basis, ignoring the differential costs as a basis for interdivision sales. Possible options available are as follows: A. Use the full per unit cost for normal production of 2,640 units. B. Use only differential costs as the cost basis. C. Use differential costs plus a share of fixed costs, based on actual production volume (with East's order) of 3,300 units. 1 Assessment 1 Part 5: Closing a Plant 2 3 Scenario: You have been asked to help Chase Corporation management make certain decisions. Chase has its home office in Oklahoma and leases factory buildings in Arkansas, Kansas, and Colorado, all of which produce the same product. Chase's management 4 provided you the following projection of operations for next year. 5 6 Chase Corporation Projections 7 Total Arkansas Kansas Colorado B $968,000 $484,000 $308,000 $176,000 9 Sales revenue 10 11 Fixed costs 12 Factory $242.000 $123,200 $61,600 $57,200 13 Administration 77,000 46,200 24,200 Variable costs 319,000 146,300 93,500 79.200 15 Allocated home office costs 00 49.500 38,500 22.000 16 Total $ 748,000.00 $ 365,200.00 $ 217,800.00 $ 165,000.00 17 Operating profit $ 220,000.00 $ 118,800.00 $ 90,200 $ 11,000 18 TO The sales price per unit is $5 20 6,600 Due to the marginal results of operations of the factory in Colorado Chase has decided to cease operations and sell that factory's machinery and equipment by year end Chase expects that proceeds from the sale of these assets would equal al termination costs Chase would like to continuo serving most of its customers in that area if it is economically feasible and is considering one of the following three alternatives 23 Option A: Expand the operations of the Kansas factory by using idle space. This move would result in the following changes in that factory's operations: 50% Increase over Kansas factory's current operations Sales revenue Fixed costs Factory 20 Under this proposal, variable costs would be $2 per unit sold. Option B: Enter into a long-term contract with a competitor that will serve that area's customers. This competitor would pay Chase a royalty of $1 per unit based on an estimate of 30,000 units being sold. Option C: Close the Colorado factory and not expand the operations of the Kansas factory Total home office costs of $110,000 will remain the same under each situation, REQUIRED 1. To assist the management of Chase Corporation, prepare a schedule computing Chase's estimated operating profit from each of the following options: Option A: Expansion of the Kansas factory. Option B: Negotiation of the long-term contract on a royalty basis. Option C: Shutdown of the Colorado operations with no expansion at other locations. 3 5 62. Determine the best option for Chase Corporation and explain your rationale. B Assessment 1 Part 1: Cost Data for Managerial Purposes D E 1 2 3 Scenario T-Rex Company makes a variety of products. It is organized in two divisions, East and West. The managers for each division are paid, in part, based on the financial performance of their divisions. The West Division normally sells to outside customers but, on occasion, also sells to the East Division. When it does, corporate policy states that the price must be cost plus 15 percent to ensure a "fair" return to the selling division. West received an order from East for 600 units. West's planned output for the year had been 2,640 units before East's order. West's capacity is 3,300 units per year. The costs for producing those 2,640 units follow: 5 6 7 8 9 10 11 12 13 Production Costs for 2,640 Units Materials Direct Labor Cost Other Costs Varying with Output Fixed Costs (do not vary with output) Total Costs TOTAL PER UNIT $ 528,000.00 $ 200.00 $ 253,440.00 $ 96.00 $ 168,960.00 $ 64.00 $ 2,217,600.00 $ 840.00 $ 3,168,000.00 $ 1,200.00 This problem demonstrates the ambiguity in measuring "costs." West Division's controller included the "per unit" fixed costs, which were calculated for allocation purposes under normal production volume, when he or she calculated per unit cost of the additional production. The controller charged East Division on that basis, ignoring the differential costs as a basis for interdivision sales. Possible options available are as follows: A. Use the full per unit cost for normal production of 2,640 units. B. Use only differential costs as the cost basis. C. Use differential costs plus a share of fixed costs, based on actual production volume (with East's order) of 3,300 units