Answered step by step

Verified Expert Solution

Question

1 Approved Answer

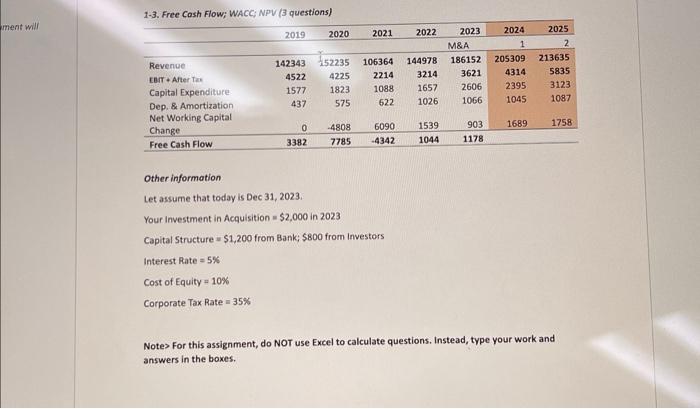

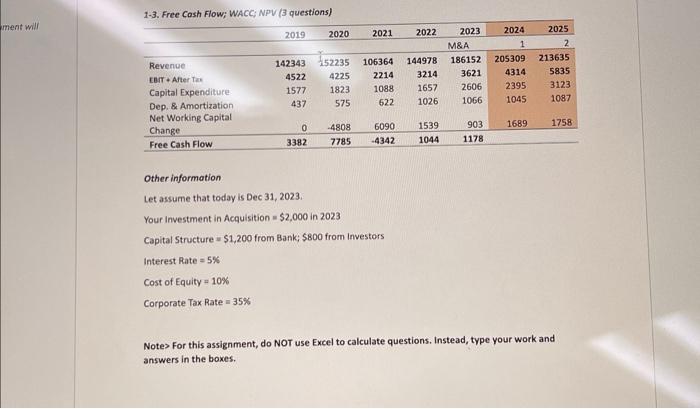

first picture is data! please help with this. questions 1-7 i keep getting it wrong thank you!! 1-3. Free Cosh Flow: WACC; NPV (3 questions)

first picture is data!

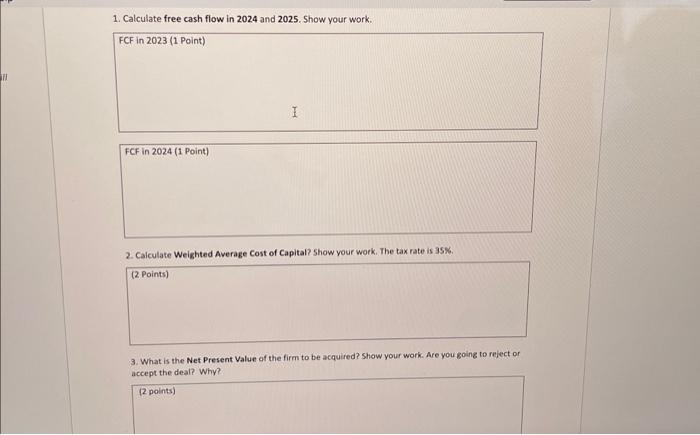

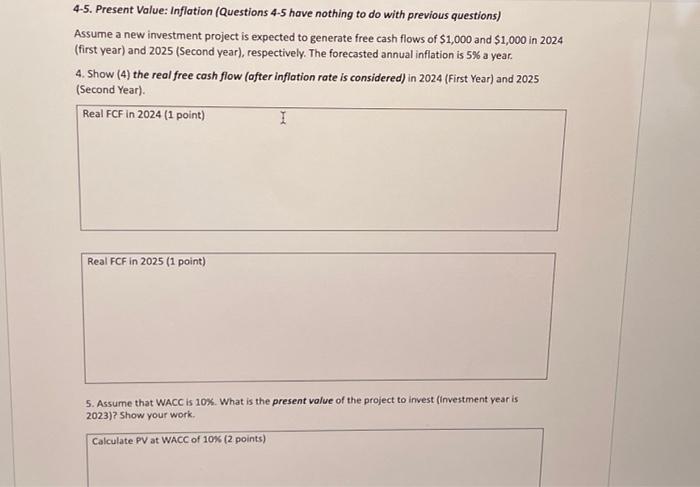

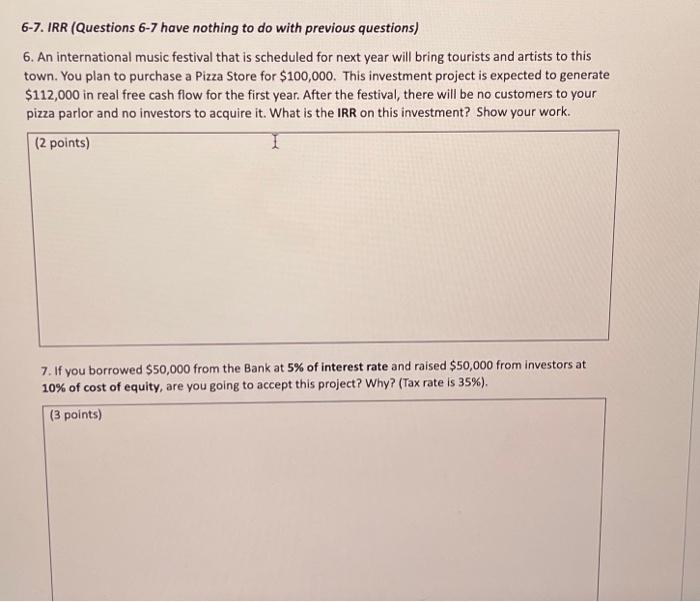

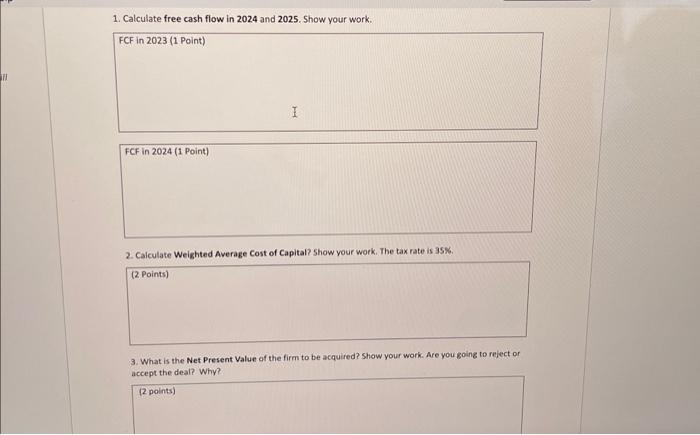

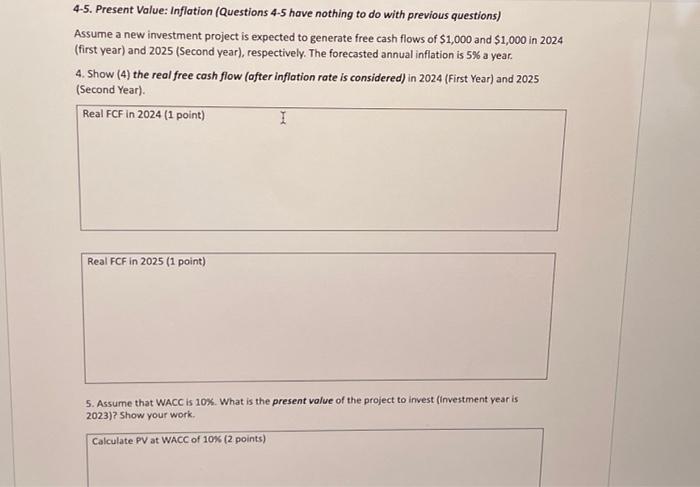

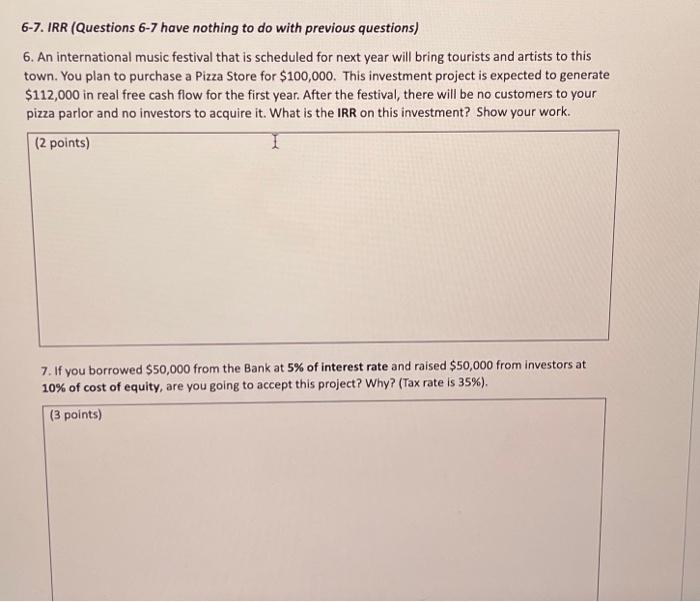

1-3. Free Cosh Flow: WACC; NPV (3 questions) Other information Let assume that today is Dec 31, 2023. Your Investment in Acquisition =$2,000 in 2023 Capital Structure =$1,200 from Bank; $800 from investors Interest Rate =5% Cost of Equity =10% Corporate Tax Rate =35% Note> For this assignment, do NOT use Excel to calculate questions. Instead, type your work and answers in the boxes. 4-5. Present Value: Inflation (Questions 4-5 have nothing to do with previous questions) Assume a new investment project is expected to generate free cash flows of $1,000 and $1,000 in 2024 (first year) and 2025 (Second year), respectively. The forecasted annual inflation is 5% a year. 4. Show (4) the real free cash flow (after inflation rote is considered) in 2024 (First Year) and 2025 (Second Year). 5. Assume that WACC is 10%. What is the present volue of the project to invest (investment year is 2023)? Show your work. 6-7. IRR (Questions 6-7 have nothing to do with previous questions) 6. An international music festival that is scheduled for next year will bring tourists and artists to this town. You plan to purchase a Pizza Store for $100,000. This investment project is expected to generate $112,000 in real free cash flow for the first year. After the festival, there will be no customers to your pizza parlor and no investors to acquire it. What is the IRR on this investment? Show your work. 7. If you borrowed $50,000 from the Bank at 5% of interest rate and raised $50,000 from investors at 10% of cost of equity, are you going to accept this project? Why? (Tax rate is 35% ). 1. Calculate free cash flow in 2024 and 2025. Show your work. 3. What is the Net Present Value of the firm to be acquired? Show your work. Are you going to reject or. accept the deal? Why? 1-3. Free Cosh Flow: WACC; NPV (3 questions) Other information Let assume that today is Dec 31, 2023. Your Investment in Acquisition =$2,000 in 2023 Capital Structure =$1,200 from Bank; $800 from investors Interest Rate =5% Cost of Equity =10% Corporate Tax Rate =35% Note> For this assignment, do NOT use Excel to calculate questions. Instead, type your work and answers in the boxes. 4-5. Present Value: Inflation (Questions 4-5 have nothing to do with previous questions) Assume a new investment project is expected to generate free cash flows of $1,000 and $1,000 in 2024 (first year) and 2025 (Second year), respectively. The forecasted annual inflation is 5% a year. 4. Show (4) the real free cash flow (after inflation rote is considered) in 2024 (First Year) and 2025 (Second Year). 5. Assume that WACC is 10%. What is the present volue of the project to invest (investment year is 2023)? Show your work. 6-7. IRR (Questions 6-7 have nothing to do with previous questions) 6. An international music festival that is scheduled for next year will bring tourists and artists to this town. You plan to purchase a Pizza Store for $100,000. This investment project is expected to generate $112,000 in real free cash flow for the first year. After the festival, there will be no customers to your pizza parlor and no investors to acquire it. What is the IRR on this investment? Show your work. 7. If you borrowed $50,000 from the Bank at 5% of interest rate and raised $50,000 from investors at 10% of cost of equity, are you going to accept this project? Why? (Tax rate is 35% ). 1. Calculate free cash flow in 2024 and 2025. Show your work. 3. What is the Net Present Value of the firm to be acquired? Show your work. Are you going to reject or. accept the deal? Why please help with this. questions 1-7 i keep getting it wrong

thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started