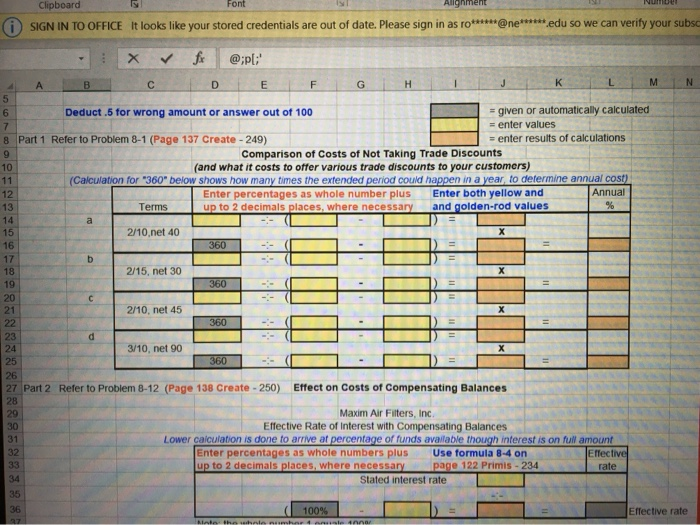

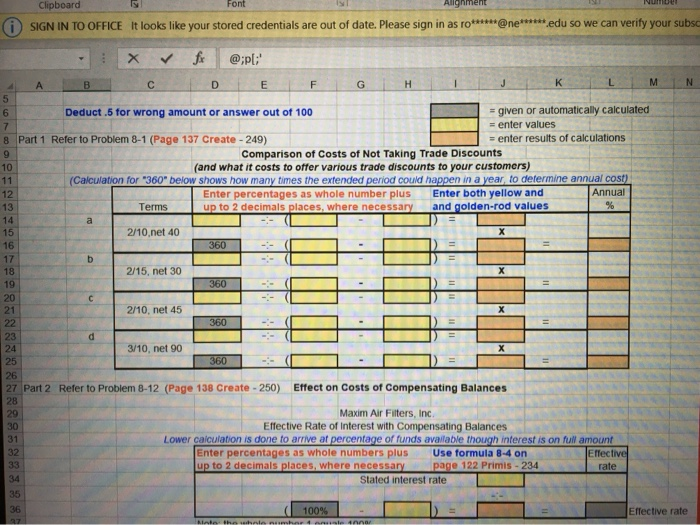

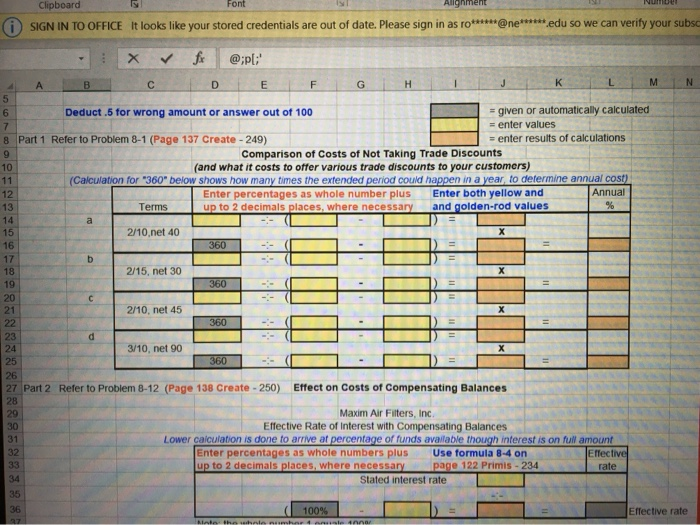

first Picture is the question problem the following two questions are the information needed to solve those two problems.

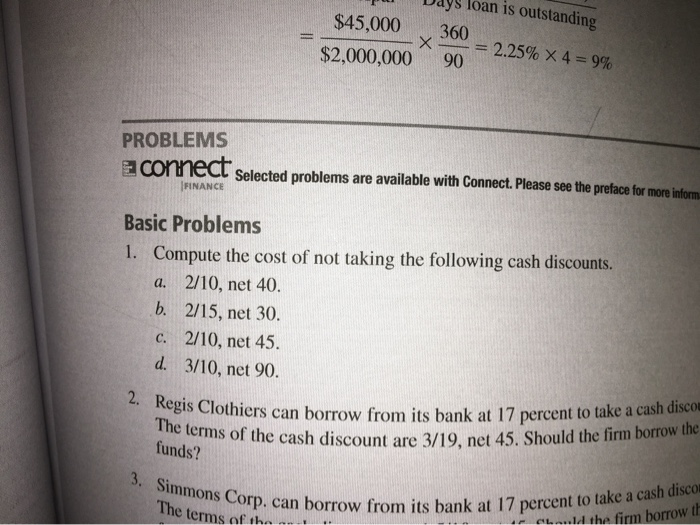

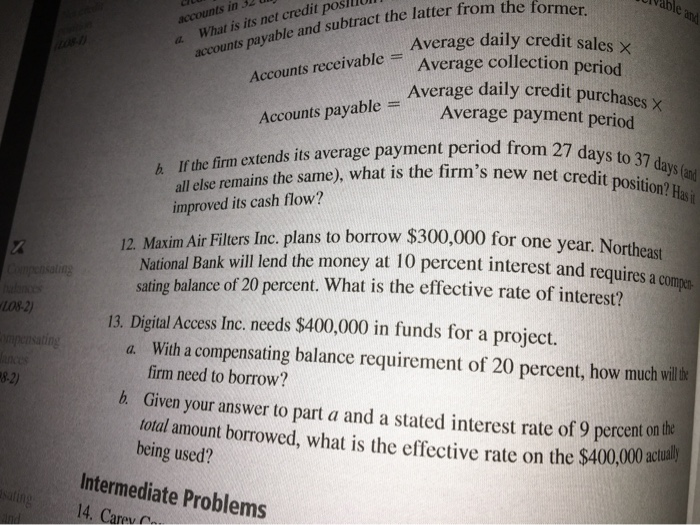

nment vum Clipboard Font SIGN IN TO OFFICE It looks like your stored credentials are out of date. Please sign in as ro******@ne******edu so we can verify your subsc X fr @;p[;' N B 9 " b A D E F G H K L M 5 6 Deduct.5 for wrong amount or answer out of 100 = given or automatically calculated 7 = enter values 8 Part 1 Refer to Problem 8-1 (Page 137 Create - 249) = enter results of calculations Comparison of Costs of Not Taking Trade Discounts 10 (and what it costs to offer various trade discounts to your customers) 11 (Calculation for "360" below shows how many times the extended period could happen in a year, to determine annual cost) 12 Enter percentages as whole number plus Enter both yellow and Annual 13 Terms up to 2 decimals places, where necessary and golden-rod values % 14 a 15 2/10.net 40 16 360 17 18 2/15, net 30 19 360 -- 20 21 2/10, net 45 22 360 23 24 3/10, net 90 25 360 26 27 Part 2 Refer to Problem 8-12 (Page 138 Create - 250) Effect on Costs of Compensating Balances 28 29 Maxim Air Filters, Inc. 30 Effective Rate of interest with Compensating Balances 31 Lower calculation is done to arrive at percentage of funds available though interest is on full amount 32 Enter percentages as whole numbers plus Use formula 8-4 on Effective 33 up to 2 decimals places, where necessary page 122 Primis - 234 rate 34 Stated interest rate 35 HUDHI d 36 100% hehen 4 Effective rate 40 3. Simmons Corp. can borrow from its bank at 17 percent to take a cash discom loan is outstanding 2.25% X 4 = 9% 2. Regis Clothiers can borrow from its bank at 17 percent to take a cash disco The terms of the cash discount are 3/19, net 45. Should the firm borrow the $45,000 360 $2,000,000 90 PROBLEMS a connect Selected problems are available with Connect. Please see the preface for more inform Basic Problems 1. Compute the cost of not taking the following cash discounts. a. 2/10, net 40. b. 2/15, net 30. c. 2/10, net 45. d. 3/10, net 90. FINANCE funds? The terms of the Chld the firm borrow th all else remains the same), what is the firm's new net credit position? Hasi dle an accounts in What is its net credit accounts payable and subtract the latter from the former. Average daily credit sales X Average daily credit purchases X b If the firm extends its average payment period from 27 days to 31 days and 12. Maxim Air Filters Inc. plans to borrow $300,000 for one year. Northeast National Bank will lend the money at 10 percent interest and requires a compan Average collection period Average payment period Accounts receivable = Accounts payable improved its cash flow? z Compensating ILO8-2) sating balance of 20 percent. What is the effective rate of interest? 13. Digital Access Inc. needs $400,000 in funds for a project. a. With a compensating balance requirement of 20 percent, how much will the firm need to borrow? b. Given your answer to part a and a stated interest rate of 9 percent on the total amount borrowed, what is the effective rate on the $400,000 actually being used? Intermediate Problems 14. Carey nment vum Clipboard Font SIGN IN TO OFFICE It looks like your stored credentials are out of date. Please sign in as ro******@ne******edu so we can verify your subsc X fr @;p[;' N B 9 " b A D E F G H K L M 5 6 Deduct.5 for wrong amount or answer out of 100 = given or automatically calculated 7 = enter values 8 Part 1 Refer to Problem 8-1 (Page 137 Create - 249) = enter results of calculations Comparison of Costs of Not Taking Trade Discounts 10 (and what it costs to offer various trade discounts to your customers) 11 (Calculation for "360" below shows how many times the extended period could happen in a year, to determine annual cost) 12 Enter percentages as whole number plus Enter both yellow and Annual 13 Terms up to 2 decimals places, where necessary and golden-rod values % 14 a 15 2/10.net 40 16 360 17 18 2/15, net 30 19 360 -- 20 21 2/10, net 45 22 360 23 24 3/10, net 90 25 360 26 27 Part 2 Refer to Problem 8-12 (Page 138 Create - 250) Effect on Costs of Compensating Balances 28 29 Maxim Air Filters, Inc. 30 Effective Rate of interest with Compensating Balances 31 Lower calculation is done to arrive at percentage of funds available though interest is on full amount 32 Enter percentages as whole numbers plus Use formula 8-4 on Effective 33 up to 2 decimals places, where necessary page 122 Primis - 234 rate 34 Stated interest rate 35 HUDHI d 36 100% hehen 4 Effective rate 40 3. Simmons Corp. can borrow from its bank at 17 percent to take a cash discom loan is outstanding 2.25% X 4 = 9% 2. Regis Clothiers can borrow from its bank at 17 percent to take a cash disco The terms of the cash discount are 3/19, net 45. Should the firm borrow the $45,000 360 $2,000,000 90 PROBLEMS a connect Selected problems are available with Connect. Please see the preface for more inform Basic Problems 1. Compute the cost of not taking the following cash discounts. a. 2/10, net 40. b. 2/15, net 30. c. 2/10, net 45. d. 3/10, net 90. FINANCE funds? The terms of the Chld the firm borrow th all else remains the same), what is the firm's new net credit position? Hasi dle an accounts in What is its net credit accounts payable and subtract the latter from the former. Average daily credit sales X Average daily credit purchases X b If the firm extends its average payment period from 27 days to 31 days and 12. Maxim Air Filters Inc. plans to borrow $300,000 for one year. Northeast National Bank will lend the money at 10 percent interest and requires a compan Average collection period Average payment period Accounts receivable = Accounts payable improved its cash flow? z Compensating ILO8-2) sating balance of 20 percent. What is the effective rate of interest? 13. Digital Access Inc. needs $400,000 in funds for a project. a. With a compensating balance requirement of 20 percent, how much will the firm need to borrow? b. Given your answer to part a and a stated interest rate of 9 percent on the total amount borrowed, what is the effective rate on the $400,000 actually being used? Intermediate Problems 14. Carey