Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIRST Question: Calculate the following performance indicators relating to the proposal: NPV based on a cost of capital of 12%. IRR. Payback period in both

FIRST Question: Calculate the following performance indicators relating to the proposal:

- NPV based on a cost of capital of 12%.

- IRR.

- Payback period in both nominal and present-value terms? Do these indicators suggest that the project should be undertaken?

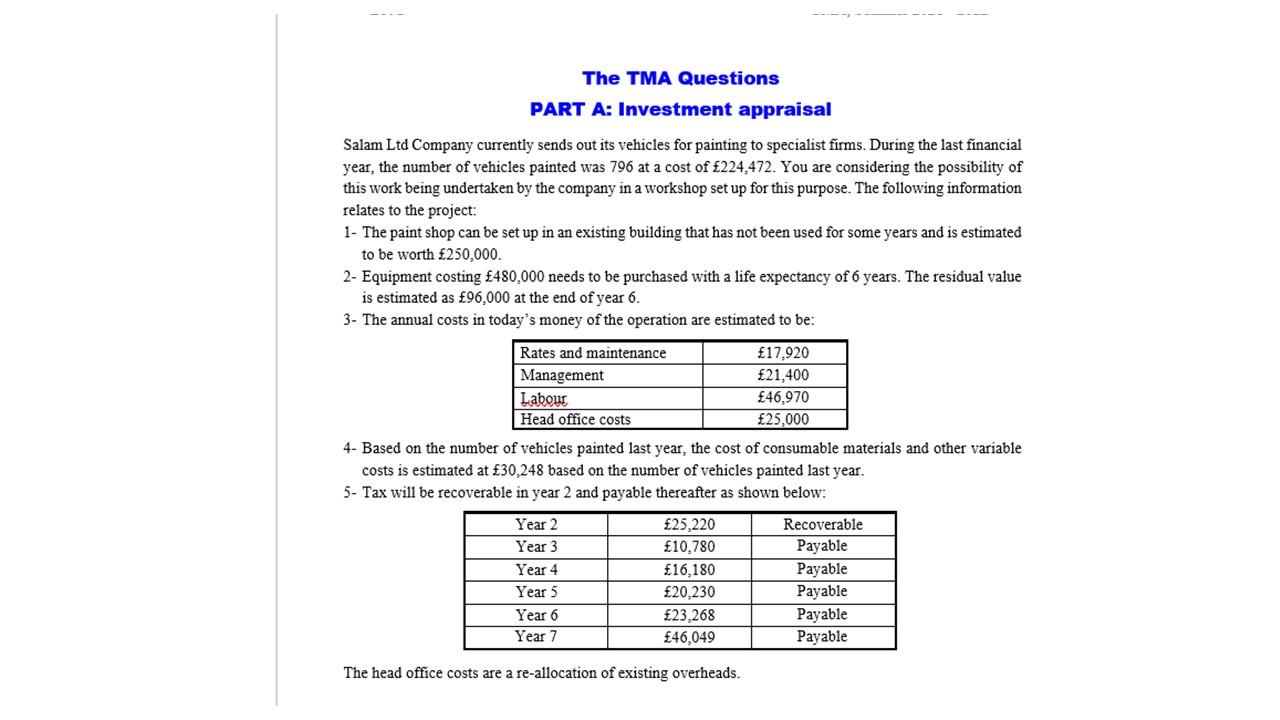

Salam Ltd Company currently sends out its vehicles for painting to specialist firms. During the last financial year, the number of vehicles painted was 796 at a cost of 224,472. You are considering the possibility of this work being undertaken by the company in a workshop set up for this purpose. The following information relates to the project: 1- The paint shop can be set up in an existing building that has not been used for some years and is estimated to be worth 250,000. 2- Equipment costing 480,000 needs to be purchased with a life expectancy of 6 years. The residual value is estimated as 96,000 at the end of year 6 . 3- The annual costs in today's money of the operation are estimated to be: 4- Based on the number of vehicles painted last year, the cost of consumable materials and other variable costs is estimated at 30,248 based on the number of vehicles painted last year. 5- Tax will be recoverable in year 2 and payable thereafter as shown below: The head office costs are a re-allocation of existing overheads

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started