Answered step by step

Verified Expert Solution

Question

1 Approved Answer

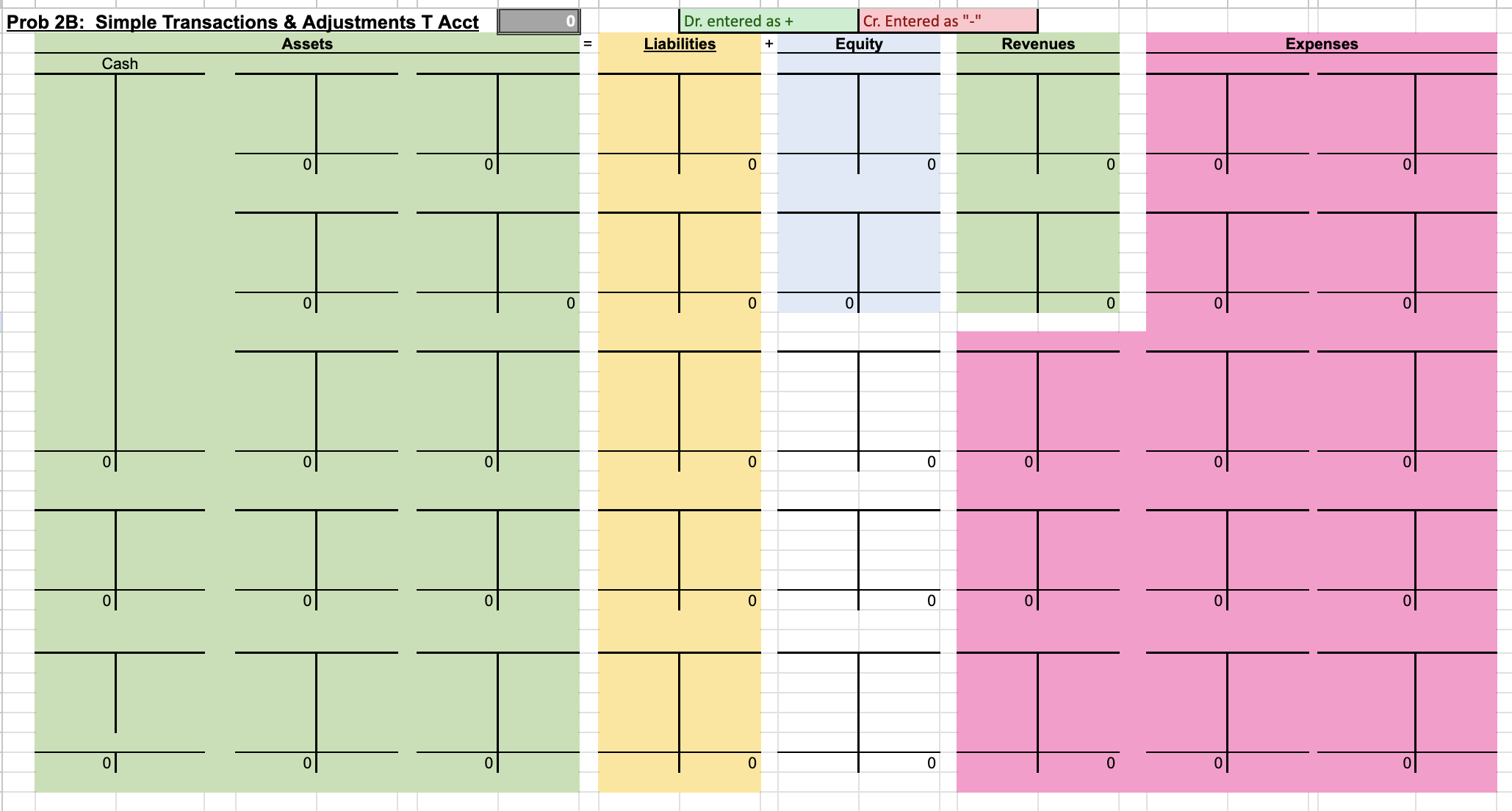

First step is to do the Balance Sheet. Second step is to do the Adjustments. Third step is to do the Journal entries. Fourth step

First step is to do the Balance Sheet. Second step is to do the Adjustments. Third step is to do the Journal entries. Fourth step is to do the T Acct. If an expert can please complete this as soon as possible I would really appreciate it. Please and thank you in advance

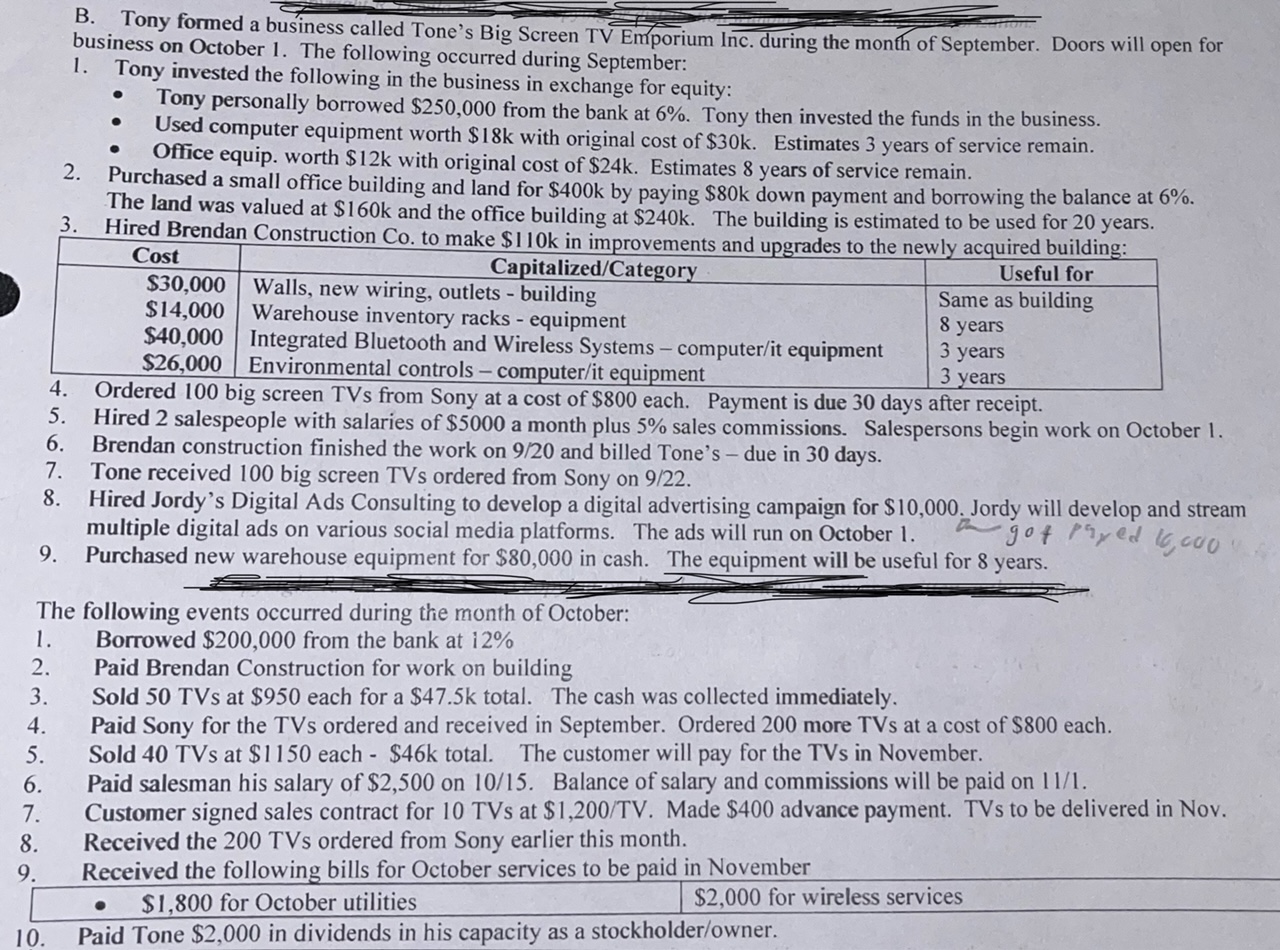

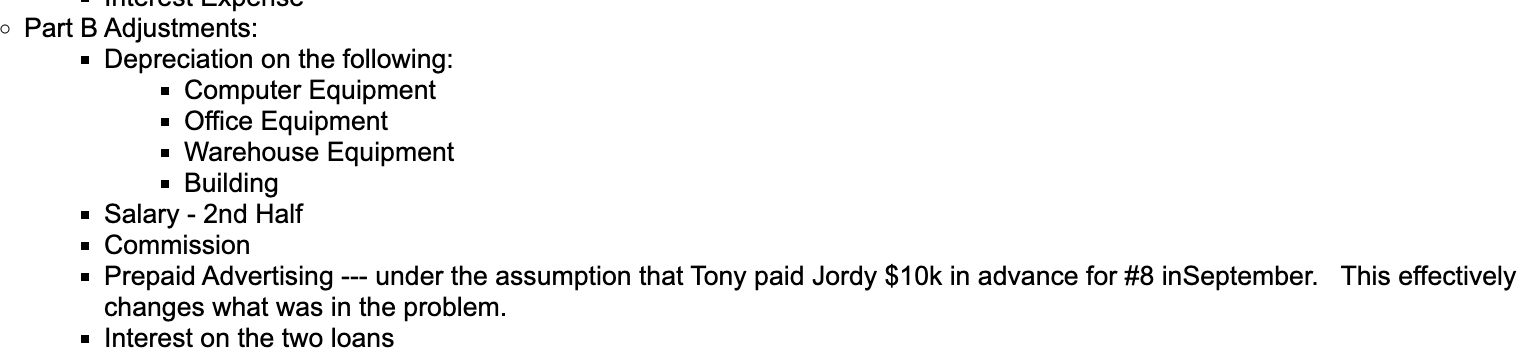

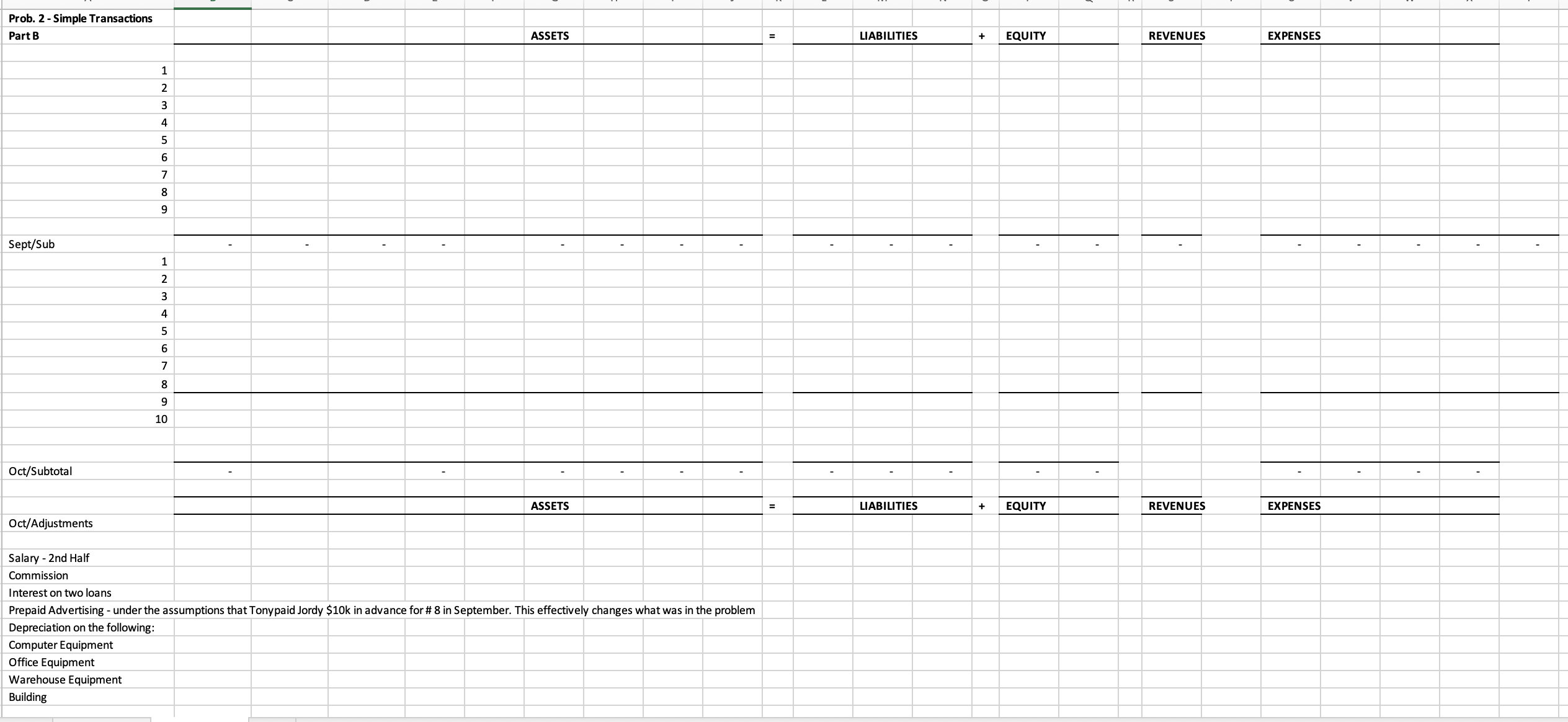

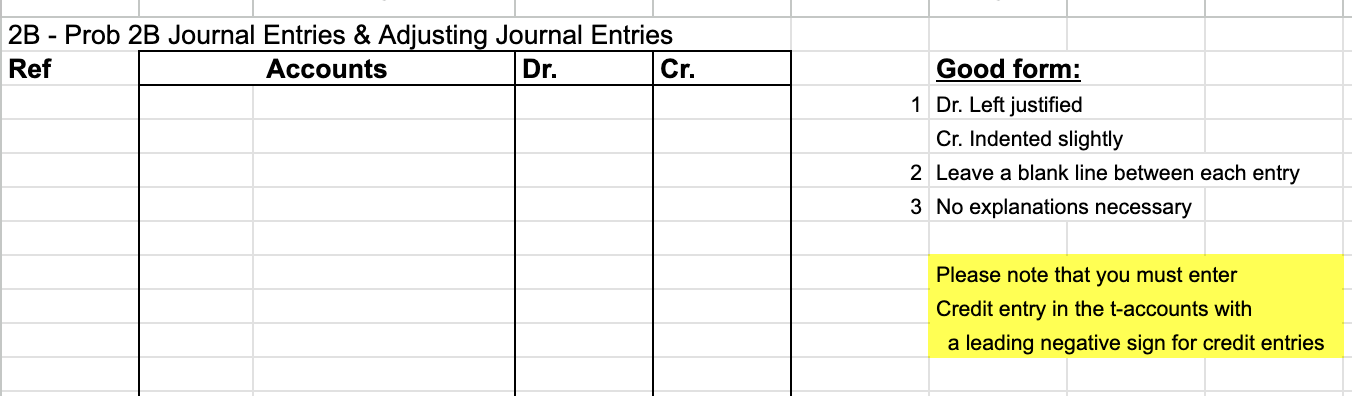

2B - Prob 2B Journal Entries \& Adjusting Journal Entries Ref Good form: 1 Dr. Left justified Cr. Indented slightly 2 Leave a blank line between each entry 3 No explanations necessary Please note that you must enter Credit entry in the t-accounts with a leading negative sign for credit entries Part B Adjustments: - Depreciation on the following: - Computer Equipment - Office Equipment - Warehouse Equipment - Building - Salary - 2nd Half - Commission - Prepaid Advertising --- under the assumption that Tony paid Jordy $10k in advance for \#8 inSeptember. This effectively changes what was in the problem. - Interest on the two loans B. Tony formed a business called Tone's Big Screen TV Emporium Inc. during the month of September. Doors will open for business on October 1. The following occurred during September: 1. Tony invested the following in the business in exchange for equity: - Tony personally borrowed $250,000 from the bank at 6%. Tony then invested the funds in the business. - Used computer equipment worth $18k with original cost of $30k. Estimates 3 years of service remain. - Office equip. worth $12k with original cost of $24k. Estimates 8 years of service remain. 2. Purchased a small office building and land for $400k by paying $80k down payment and borrowing the balance at 6%. The land was valued at $160k and the office building at $240k. The building is estimated to be used for 20 years. 3. Hired Brendan Construction Co. to make $110k in imnrovements and unoradac to tha nawile anmirad 5. Hired 2 salespeople with salaries of $5000 a month plus 5% sales commissions. Salespersons begin work on October 1. 6. Brendan construction finished the work on 9/20 and billed Tone's - due in 30 days. 7. Tone received 100 big screen TVs ordered from Sony on 9/22. 8. Hired Jordy's Digital Ads Consulting to develop a digital advertising campaign for $10,000. Jordy will develop and stream multiple digital ads on various social media platforms. The ads will run on October 1. 9. Purchased new warehouse equipment for $80,000 in cash. The equipment will be useful for 8 years. The following events occurred during the month of October: 1. Borrowed $200,000 from the bank at 12% 2. Paid Brendan Construction for work on building 3. Sold 50TVs at $950 each for a $47.5k total. The cash was collected immediately. 4. Paid Sony for the TVs ordered and received in September. Ordered 200 more TVs at a cost of $800 each. 5. Sold 40TVs at $1150 each - $46k total. The customer will pay for the TVs in November. 6. Paid salesman his salary of $2,500 on 10/15. Balance of salary and commissions will be paid on 11/1. 7. Customer signed sales contract for 10 TVs at $1,200/TV. Made $400 advance payment. TVs to be delivered in Nov. 8. Received the 200 TVs ordered from Sony earlier this month. 9. Received the following bills for October services to be paid in November Record October Adjustments for both Part PROBLEM 2.23: Simple Transactions REQUIRED: (1) Record transactions (2) Prepare any necessary adjustments (3) Prepare financial statements. 2B - Prob 2B Journal Entries \& Adjusting Journal Entries Ref Good form: 1 Dr. Left justified Cr. Indented slightly 2 Leave a blank line between each entry 3 No explanations necessary Please note that you must enter Credit entry in the t-accounts with a leading negative sign for credit entries Part B Adjustments: - Depreciation on the following: - Computer Equipment - Office Equipment - Warehouse Equipment - Building - Salary - 2nd Half - Commission - Prepaid Advertising --- under the assumption that Tony paid Jordy $10k in advance for \#8 inSeptember. This effectively changes what was in the problem. - Interest on the two loans B. Tony formed a business called Tone's Big Screen TV Emporium Inc. during the month of September. Doors will open for business on October 1. The following occurred during September: 1. Tony invested the following in the business in exchange for equity: - Tony personally borrowed $250,000 from the bank at 6%. Tony then invested the funds in the business. - Used computer equipment worth $18k with original cost of $30k. Estimates 3 years of service remain. - Office equip. worth $12k with original cost of $24k. Estimates 8 years of service remain. 2. Purchased a small office building and land for $400k by paying $80k down payment and borrowing the balance at 6%. The land was valued at $160k and the office building at $240k. The building is estimated to be used for 20 years. 3. Hired Brendan Construction Co. to make $110k in imnrovements and unoradac to tha nawile anmirad 5. Hired 2 salespeople with salaries of $5000 a month plus 5% sales commissions. Salespersons begin work on October 1. 6. Brendan construction finished the work on 9/20 and billed Tone's - due in 30 days. 7. Tone received 100 big screen TVs ordered from Sony on 9/22. 8. Hired Jordy's Digital Ads Consulting to develop a digital advertising campaign for $10,000. Jordy will develop and stream multiple digital ads on various social media platforms. The ads will run on October 1. 9. Purchased new warehouse equipment for $80,000 in cash. The equipment will be useful for 8 years. The following events occurred during the month of October: 1. Borrowed $200,000 from the bank at 12% 2. Paid Brendan Construction for work on building 3. Sold 50TVs at $950 each for a $47.5k total. The cash was collected immediately. 4. Paid Sony for the TVs ordered and received in September. Ordered 200 more TVs at a cost of $800 each. 5. Sold 40TVs at $1150 each - $46k total. The customer will pay for the TVs in November. 6. Paid salesman his salary of $2,500 on 10/15. Balance of salary and commissions will be paid on 11/1. 7. Customer signed sales contract for 10 TVs at $1,200/TV. Made $400 advance payment. TVs to be delivered in Nov. 8. Received the 200 TVs ordered from Sony earlier this month. 9. Received the following bills for October services to be paid in November Record October Adjustments for both Part PROBLEM 2.23: Simple Transactions REQUIRED: (1) Record transactions (2) Prepare any necessary adjustments (3) Prepare financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started