Answered step by step

Verified Expert Solution

Question

1 Approved Answer

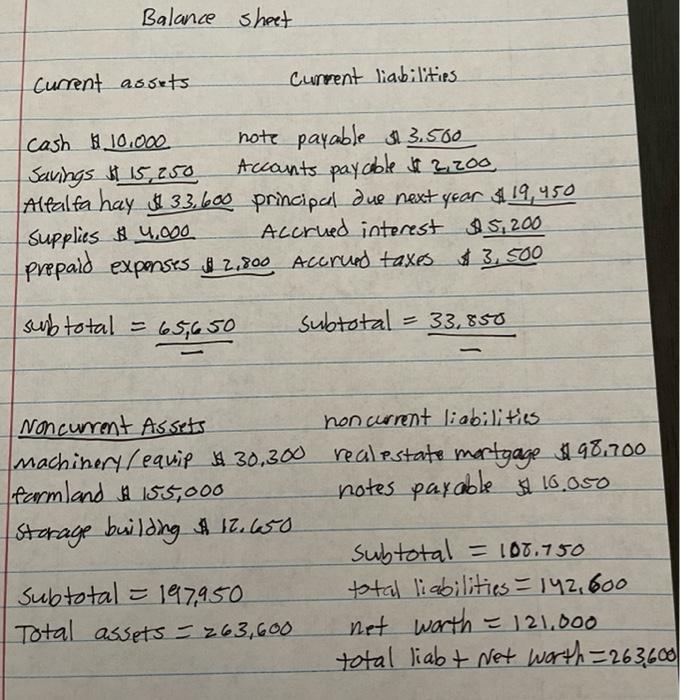

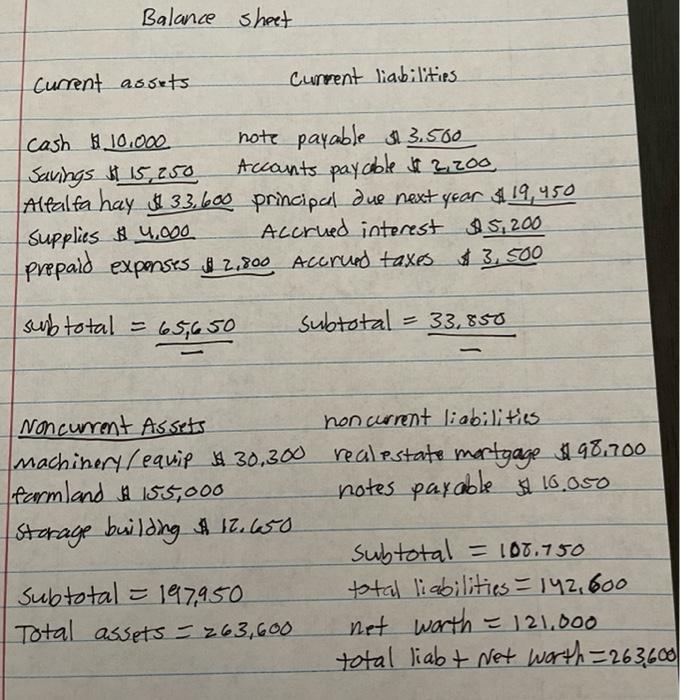

FIRST TWO ARE USED TO ANSWER THE FOLLOWING ANSWER ACCORDINGLY PLEASE AND THANK YOU!! Balance sheet Current assets Current liabilities cash $ 10.000 note payable

FIRST TWO ARE USED TO ANSWER THE FOLLOWING ANSWER ACCORDINGLY PLEASE AND THANK YOU!!

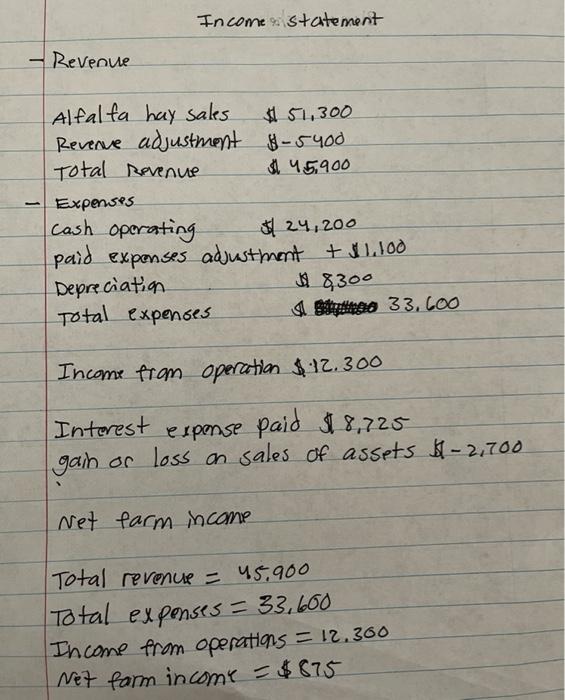

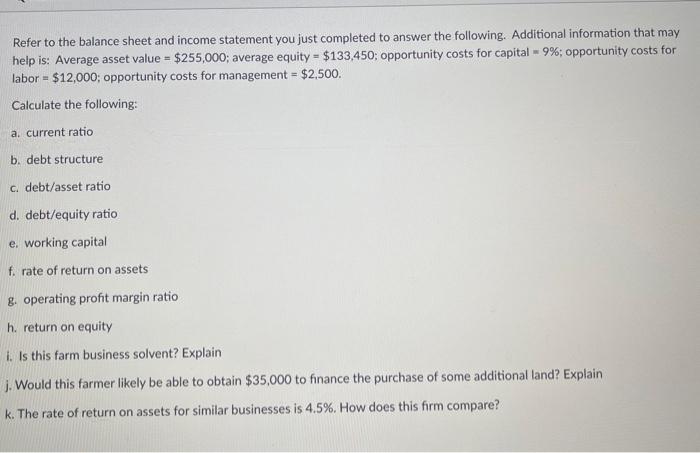

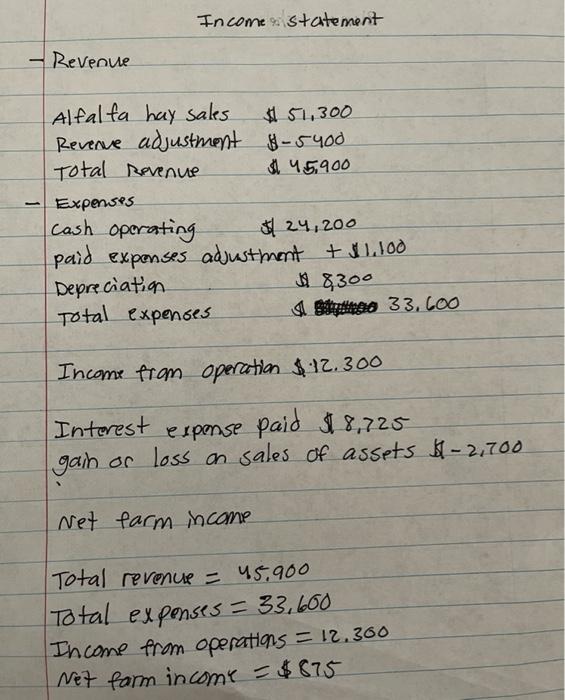

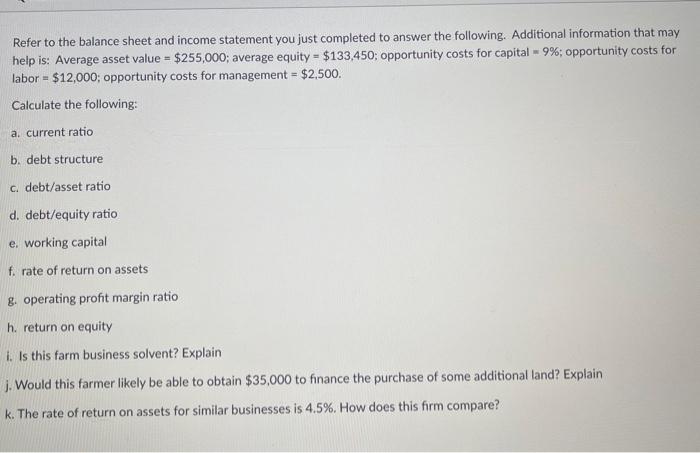

Balance sheet Current assets Current liabilities cash $ 10.000 note payable $13.500 Savings t 15,250 Accounts payable $3,200. Alfalta hay $33,600 principal due next year $19,450 supplies $ 4.000 Accrued interest $5,200 prepaid expenses $2,800 Accrued taxes $3,500 sub total = 65,650 subtotal = 33,850 . Noncurrent Assets non current liabilities machinery / equip 30.300 realestate martgage 98.700 farmland & 155,000 notes parable $16.050 storage building & 13.650 subtotal = 100.750 Subtotal = 197,950 total liabilities = 142,600 Total assets = 263,600 net worth = 121,000 total liab+ Net worth=263,600 Income Statement 90 - Revenue Alfalfa hay sales # 51,300 Revenue adjustment $-5400 Total Revenue 45.900 Expenses cash operating $24,200 paid expenses adjustment + $1.100 Depreciation Ju 8300 Total expenses sa 33.600 Income from operation $12.300 Interest expense paid $18,725 gain or loss on sales of assets -2,700 Net farm income Total revenue = 45.900 Total expenses = 33,600 Income from operations = 12.300 Net form income = $875 Refer to the balance sheet and income statement you just completed to answer the following. Additional information that may help is: Average asset value = $255,000; average equity = $133,450; opportunity costs for capital - 9%; opportunity costs for labor - $12,000; opportunity costs for management = $2,500. Calculate the following: a. current ratio b. debt structure c. debt/asset ratio d. debt/equity ratio e, working capital f. rate of return on assets g. operating profit margin ratio h. return on equity 1. Is this farm business solvent? Explain j. Would this farmer likely be able to obtain $35,000 to finance the purchase of some additional land? Explain k. The rate of return on assets for similar businesses is 4.5%. How does this firm compare

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started