Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first-year operation of ABC Company is 2016. Below is B/S and I/S of ABC Company for 2016. As an analyst, you think that Allowance

The first-year operation of ABC Company is 2016.

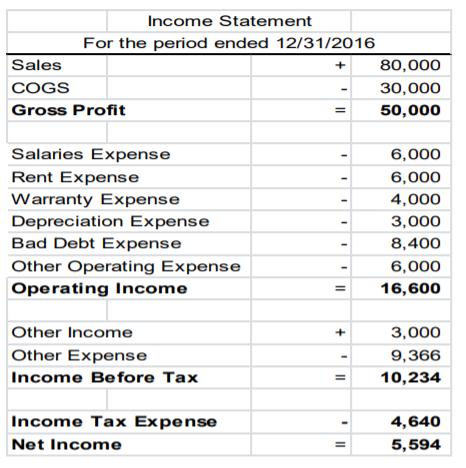

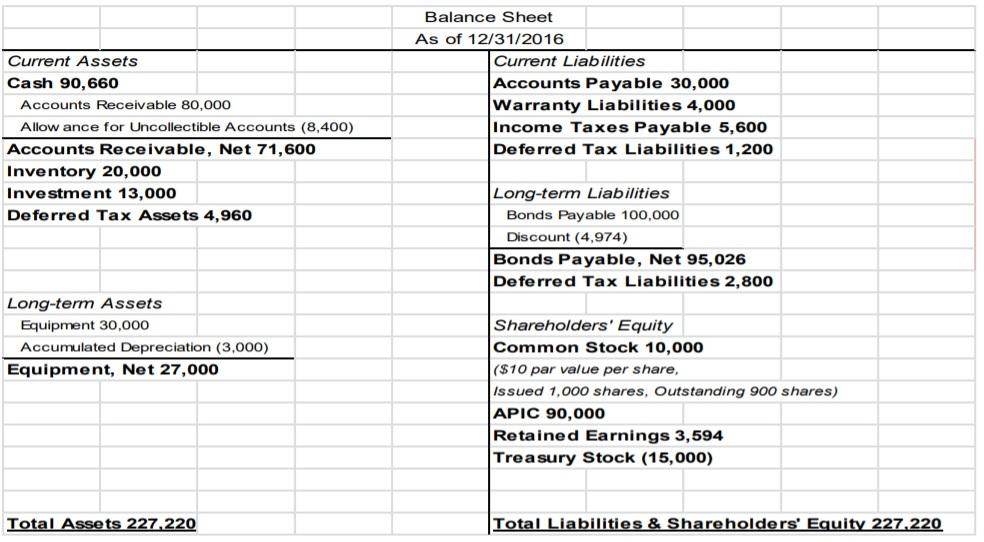

Below is B/S and I/S of ABC Company for 2016. As an analyst, you think that “Allowance for Uncollectible Accounts” seems understated. You think the appropriate amount based on industry-standard should be $12,000. Restate I/S and B/S as of 12/31/2016, assuming “Allowance for Uncollectible Accounts” is $12,000. Assume that tax rate is 40%.

Income Statement For the period ended 12/31/2016 Sales 80,000 COGS 30,000 Gross Profit 50,000 Salaries Expense 6,000 Rent Expense 6,000 Warranty Expense 4,000 Depreciation Expense Bad Debt Expense 3,000 8,400 Other Operating Expense Operating Income 6,000 16,600 Other Income 3,000 Other Expense 9,366 Income Before Tax 10,234 Income Tax Expense 4,640 Net Income 5,594

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Allowance for uncollectible accounts is a contra asset account on the stability sheet representing accounts receivable the company does not ant...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

636153722d90d_235291.pdf

180 KBs PDF File

636153722d90d_235291.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started