Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fischer Company borrowed $47,280 from National bank on August 1 for three months; 5% interest is payable the first of each month, starting September

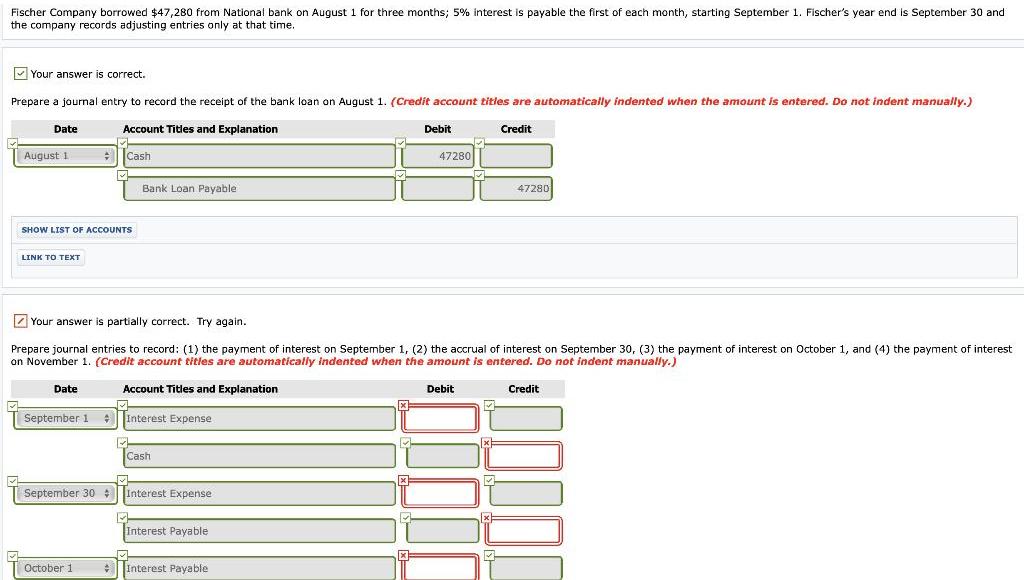

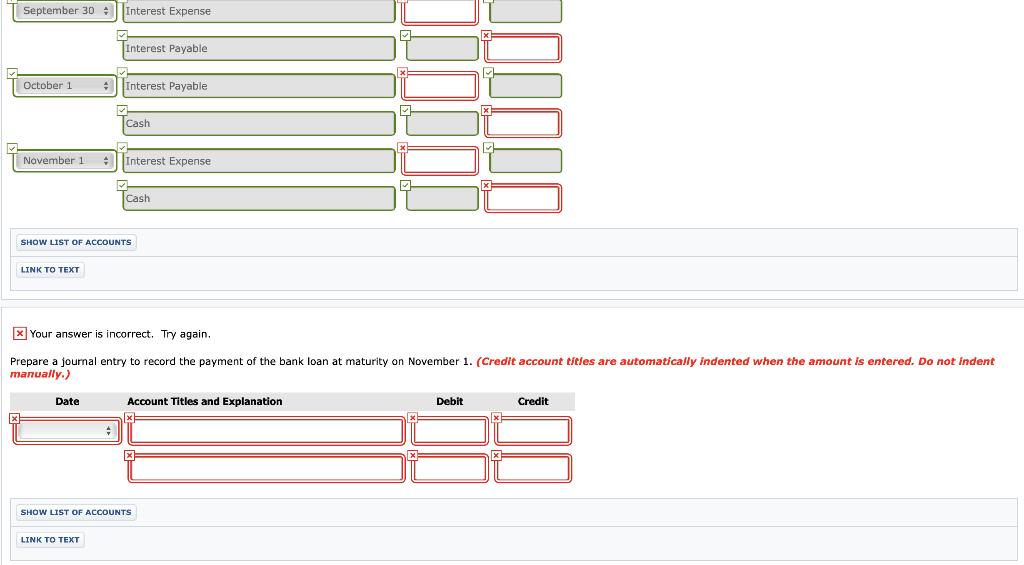

Fischer Company borrowed $47,280 from National bank on August 1 for three months; 5% interest is payable the first of each month, starting September 1. Fischer's year end is September 30 and the company records adjusting entries only at that time. Your answer is correct. Prepare a journal entry to record the receipt of the bank loan on August 1. (Credit account tities are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit August 1 Cash 47280 Bank Loan Payable 47280 SHOW LIST OF ACCOUNTS LINK TO TT Z Your answer is partially correct. Try again. Prepare journal entries to record: (1) the payment of interest on September 1, (2) the accrual of interest on September 30, (3) the payment of interest on October 1, and (4) the payment of interest on November 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit T September 1 +| Interest Expense Cash September 30 Interest Expense Interest Payable T October 1 *Interest Payable T September 30 :Interest Expense Interest Payable October 1 :Interest Payable Cash November 1 : Interest Expense Cash SHOW LIST OF ACCOUNTS LINK TO TEXT x Your answer is incorrect. Try again. Prepare a journal entry to record the payment of the bank loan at maturity on November 1. (Credit account titles are automatically indented when the anmount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A B C E 1 Date Accounts title and explanation Debit Credit Aug01 Cash 47280 3 Bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started