Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fish Pies Inc. (FPI) has recently announced its intention to acquire Hamburgers 'R Us (HRU). FPI has identified potential annual gains from the acquisition

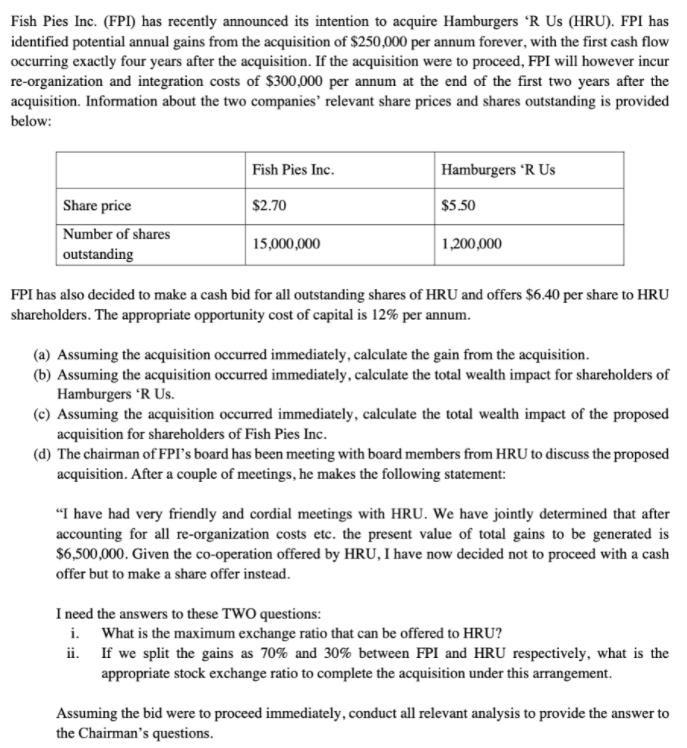

Fish Pies Inc. (FPI) has recently announced its intention to acquire Hamburgers 'R Us (HRU). FPI has identified potential annual gains from the acquisition of $250,000 per annum forever, with the first cash flow occurring exactly four years after the acquisition. If the acquisition were to proceed, FPI will however incur re-organization and integration costs of $300,000 per annum at the end of the first two years after the acquisition. Information about the two companies' relevant share prices and shares outstanding is provided below: Fish Pies Inc. Hamburgers 'R Us Share price $2.70 $5.50 Number of shares 15,000,000 1,200,000 outstanding FPI has also decided to make a cash bid for all outstanding shares of HRU and offers $6.40 per share to HRU shareholders. The appropriate opportunity cost of capital is 12% per annum. (a) Assuming the acquisition occurred immediately, calculate the gain from the acquisition. (b) Assuming the acquisition occurred immediately, calculate the total wealth impact for shareholders of Hamburgers 'R Us. (c) Assuming the acquisition occurred immediately, calculate the total wealth impact of the proposed acquisition for shareholders of Fish Pies Inc. (d) The chairman of FPI's board has been meeting with board members from HRU to discuss the proposed acquisition. After a couple of meetings, he makes the following statement: "I have had very friendly and cordial meetings with HRU. We have jointly determined that after accounting for all re-organization costs etc. the present value of total gains to be generated is $6,500,000. Given the co-operation offered by HRU, I have now decided not to proceed with a cash offer but to make a share offer instead. I need the answers to these TWO questions: i. What is the maximum exchange ratio that can be offered to HRU? ii. If we split the gains as 70% and 30% between FPI and HRU respectively, what is the appropriate stock exchange ratio to complete the acquisition under this arrangement. Assuming the bid were to proceed immediately, conduct all relevant analysis to provide the answer to the Chairman's questions.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started