Answered step by step

Verified Expert Solution

Question

1 Approved Answer

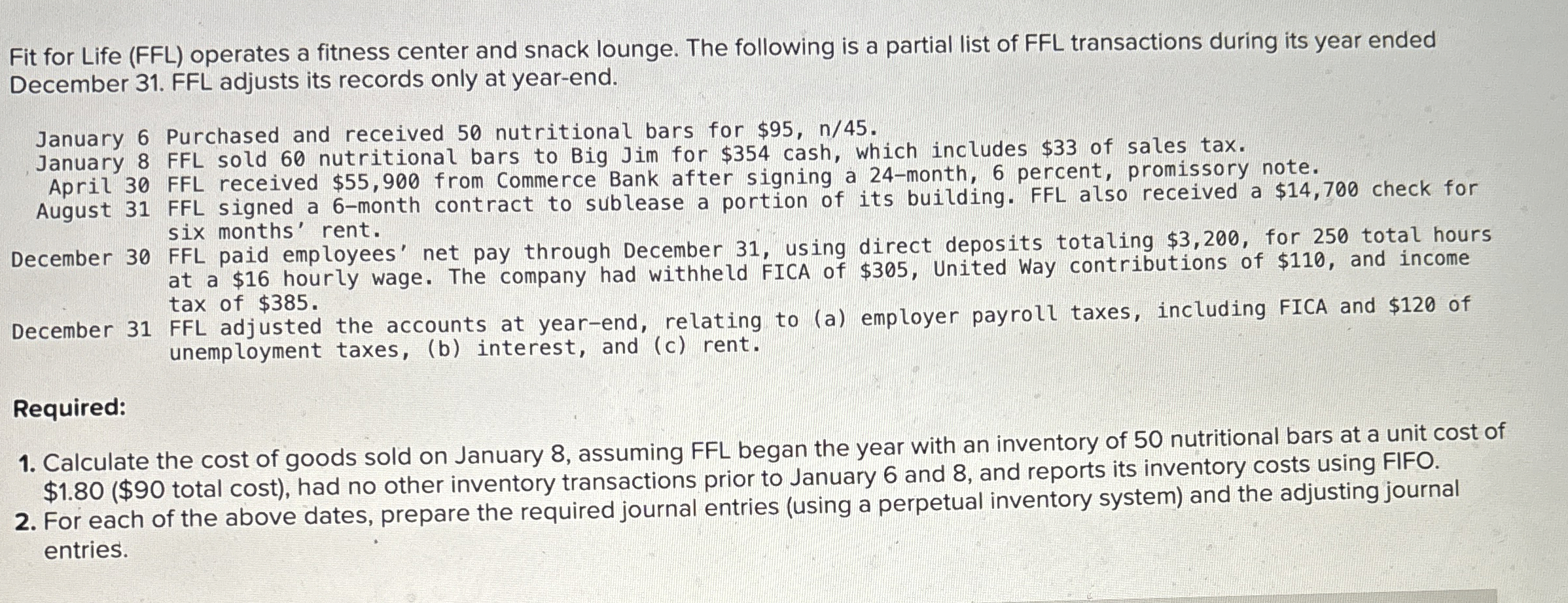

Fit for Life ( FFL ) operates a fitness center and snack lounge. The following is a partial list of FFL transactions during its year

Fit for Life FFL operates a fitness center and snack lounge. The following is a partial list of FFL transactions during its year ended December FFL adjusts its records only at yearend.

January Purchased and received nutritional bars for $

January FFL sold nutritional bars to Big Jim for $ cash, which includes $ of sales tax.

April FFL received $ from Commerce Bank after signing a month, percent, promissory note.

August FFL signed a month contract to sublease a portion of its building. FFL also received a $ check for six months' rent.

December FFL paid employees' net pay through December using direct deposits totaling $ for total hours at a $ hourly wage. The company had withheld FICA of $ United Way contributions of $ and income tax of $

December FFL adjusted the accounts at yearend, relating to a employer payroll taxes, including FICA and $ of unemployment taxes, b interest, and c rent.

Required:

Calculate the cost of goods sold on January assuming FFL began the year with an inventory of nutritional bars at a unit cost of $ $ total cost had no other inventory transactions prior to January and and reports its inventory costs using FIFO.

For each of the above dates, prepare the required journal entries using a perpetual inventory system and the adjusting journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started