Answered step by step

Verified Expert Solution

Question

1 Approved Answer

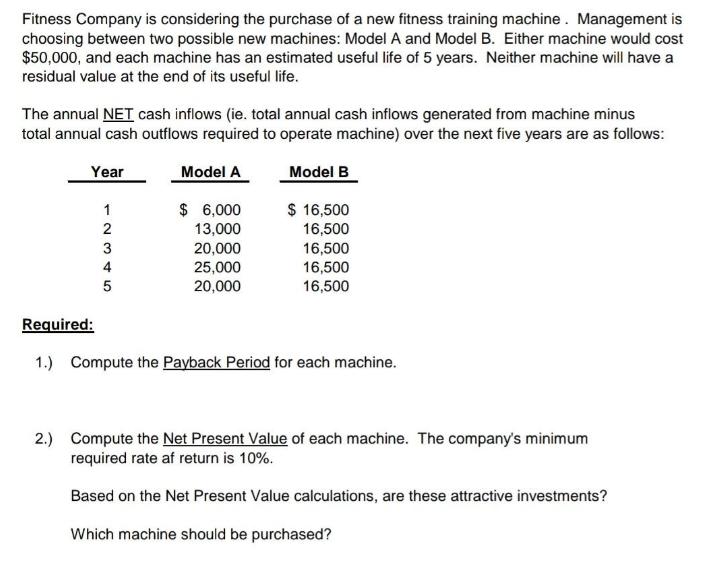

Fitness Company is considering the purchase of a new fitness training machine. Management is choosing between two possible new machines: Model A and Model

Fitness Company is considering the purchase of a new fitness training machine. Management is choosing between two possible new machines: Model A and Model B. Either machine would cost $50,000, and each machine has an estimated useful life of 5 years. Neither machine will have a residual value at the end of its useful life. The annual NET cash inflows (ie. total annual cash inflows generated from machine minus total annual cash outflows required to operate machine) over the next five years are as follows: Model A Model B Year 12345 5 $ 6,000 13,000 20,000 25,000 20,000 $ 16,500 16,500 16,500 16,500 16,500 Required: 1.) Compute the Payback Period for each machine. 2.) Compute the Net Present Value of each machine. The company's minimum required rate af return is 10%. Based on the Net Present Value calculations, are these attractive investments? Which machine should be purchased?

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started