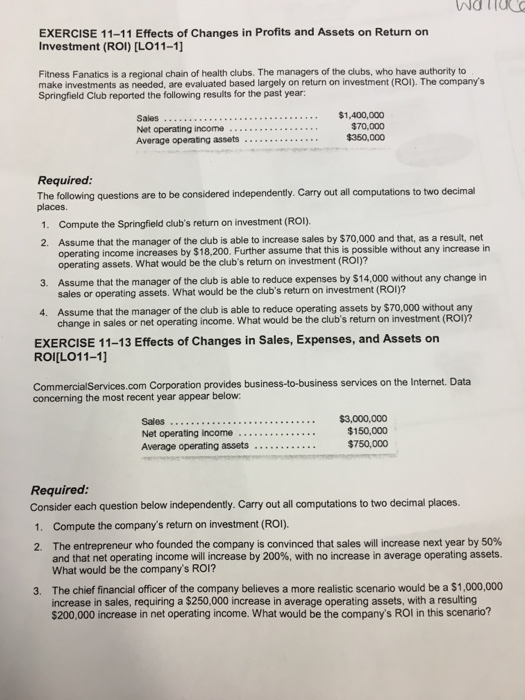

Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reportod the following results for the past year: Sales.......11.400.000 Net operating income......170.000 Average operaong assets.......$360.000 Required: The following questions are to be considered independently. Carry out all computations to two decimal places. Compute the Springfield club's return on investment (ROI) Assume that the manager of the club is able to increase sales by $70,000 and that, as a result, net operating income increases by $18,200. Further assume that this is possible without any increase in operating assets. What would be the club's return on investment (ROI)? Assume that the manager of the club s able to reduce expenses by $14.000 without any change in sales or operating assets. What would be the club's return on investment (ROI)? Assume that the manager of the club to able to reduce operating assets by $70,000 without any change sales or net operating income. What would be the club's return on investment (ROI)? EXERCISE 11-13 Effects of Changes in Sales, Expenses, and Assets on ROI[LO11-1] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below. Sales.......$3,000,000 Net operating income........$150,000 Average operating assets.......$750,000 Required: Consider each question below independently. Carry out all computations to two decimal places Compute the company's return on investment (ROI). The entrepreneur who founded the company is convinced that sales will increase next year by 50% and that net operating income will increase by 200%, with no increase in average operating assets. What would be the company's ROI? The chief financial officer of the company believes a more realistic scenario would be a $1.000,000 increase in sales, requiring a $250,000 increase in average operating assets, with a resulting $200,000 increase in net operating income What would be the company's ROI in this scenario