Question

Five Guys comprehensive decision making, develop a project for this company that will require the purchase of additional equipment, in a short-term decision-making scenario. Research

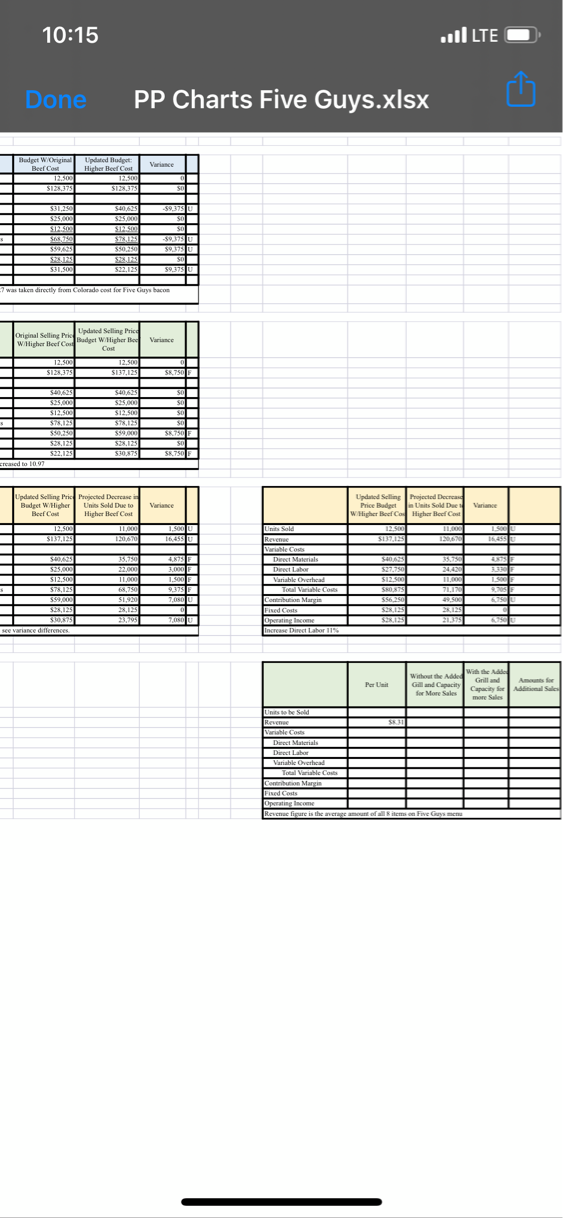

Five Guys comprehensive decision making, develop a project for this company that will require the purchase of additional equipment, in a short-term decision-making scenario. Research the cost of this equipment and develop an expectation regarding the cost savings for the company. Describe it fully and compute an incremental analysis for the company. Present your calculations in a supporting table, I have started the table for the new equipment. All numbers are fictitious, since financials are not shared but I am struggling with how to start off for the equipment. I took the average menu price for items sold at Five Guys. The equipment that I have in mind that has the biggest impact on Five Guys is a grill, so assuming Five Guys rented an additional grill how would the cost affect the company. An starting help would be appreciated.

10:15 Done PP Charts Five Guys.xlsx Budget W/Original Beef Cost 12.500 Updated Budget: Variance Higher Beef Cost 12.500 $128,375 $128,375 $31,250 540,625 -$9,375 U $25,000 $25,000 $12.500 $12.500 568,750 ST8125 $9.375 $59625 $50,250 $9,375 U $28,125 $28,123 $31,500 $22.125 $9,375 U 7 was taken directly from Colorado cost for Five Guys bacon Original Selling Pric Updated Selling Price WHigher Beef CoBudget W/Higher Be 12,500 $128,375 Cost Variance 12.500 $137,125 $40,625 $40,625 $25,000 $25,000 $12,500 $12,500 50 $78,125 $78,125 50 $50,250 $59,000 $8,750 $2,125 $28,125 $22,125 $30,875 $8,750 creased to 10.97 .III LTE 3 Updated Selling Price Projected Decrease in Budget W/Higher Units Sold Due to Updated Selling Projected Decrease Variance Beef Cost Higher Beef Cost $137,125 11,000 120,670 1,500 Units Sold 16,455 U 12,500 $137,125 Price Budget W/Higher Beef Co in Units Sold Duc Variance Higher Beef Cost 11,000 120,670 16455 U Variable Costs $40,625 35.750 4875 F Direct Materials $40,625 $25,000 22,000 3,000 Direct Labor $27,750 24,420|||| $12,500 11,000 Variable Overhead $12,500 1500F $78,125 68,750 9.375 Total Variable Costs $80.875 71,170 9,705 $59,000 51,920 7,080 Contribution Margin $56,250 6.750 U $28,125 Fixed Costs $28,125 28,125 $30,875 23,795 Operating Income $28,125 see variance differences Increase Direct Labor 11% Without the Added With the Addo Per Unit Gill and Capacity for More Sales Grill and Capacity for more Sales Amounts for Additional Sales Units to be Sold Revenue Variable Costs Direct Materials Direct Labor Variable Overhead Total Variable Costs Contribution Margin Fixed Costs Operating Income Revenue figure is the average amount of all 8 items on Five Guys menu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started