five measures of solvency or profitability

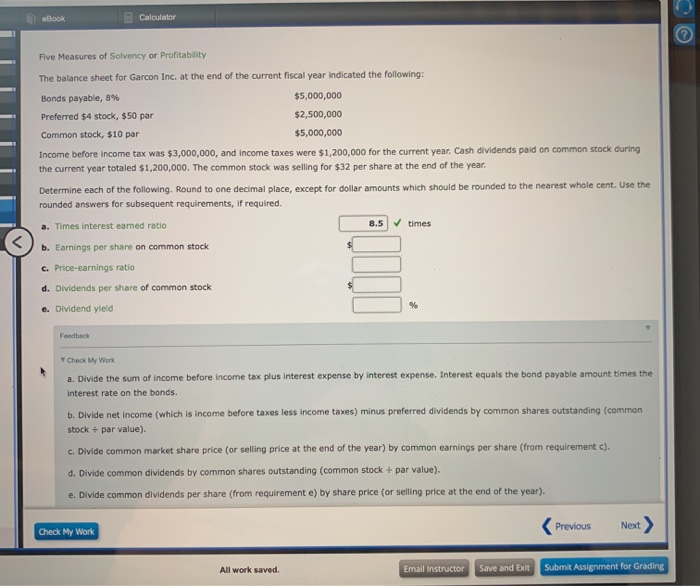

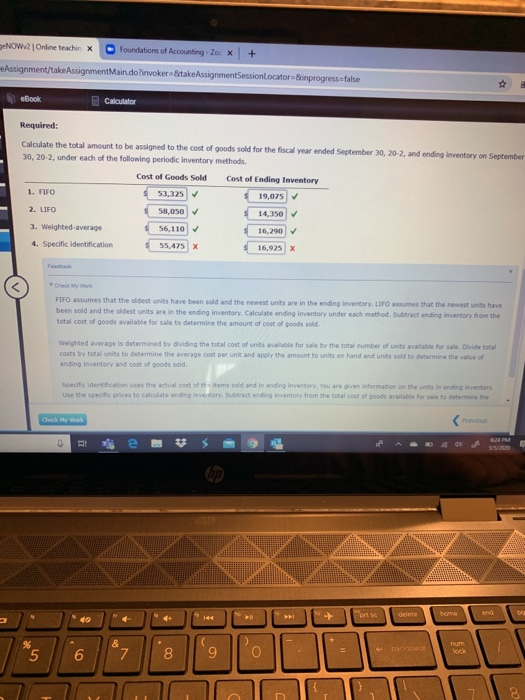

Book Calculator Five Measures of Solvency or Profitability The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 8% $5,000,000 Preferred $4 stock, $50 par $2,500,000 Common stock, $10 par $5,000,000 Income before income tax was $3,000,000, and income taxes were $1,200,000 for the current year. Cash dividends paid on common stock during the current year totaled $1,200,000. The common stock was selling for $32 per share at the end of the year. Determine each of the following. Round to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio 8.5 times b. Earnings per share on common stock c.Price-earnings ratio d. Dividends per share of common stock e. Dividend yield Check My Work a. Divide the sum of income before income tax plus interest expense by interest expense. Interest equals the bond payable amount times the interest rate on the bonds. b. Divide net income (which is income before taxes less income taxes) minus preferred dividends by common shares outstanding (common stock + par value) C. Divide common market share price (or selling price at the end of the year) by common earnings per share (from requirement c). d. Divide common dividends by common shares outstanding common stock + par value). e. Divide common dividends per share (from requirement e) by share price (or selling price at the end of the year). Check My Work All work saved. Email Instructor Save and Exit Submit Assignment for Grading HOW2 Online teachinx Foundations of Accounting-Zo x + assignment/take Assignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Book Calculator Required: Calculate the total amount to be assigned to the cost of goods sold for the fiscal Year ended September 30, 20-2, and ending inventory on September 30. 20-2. under each of the following periodic Inventory methods Cost of Goods Sold Cost of Ending Inventory 1. FIO $ 53,325 $ 19,075 2. LIFO 14,350 3. Weighted average 16,90 4. Specific identification $ 55,475 X 16,925 X been sold and the oldest are in the ending inventory. Calculate ending inventory under each method. Subtractanding inventory from the total cost of goods available for sale to determine the amount of cost od video We costs average is determined by wing the total cost of units be for sale by the total number of units totals to determine the average cost per unit and polythe amount to units on hand its sold be for sale m e the specific dentication uses the actual cost of the toms sold and in ending inventory you are given information on the units in ending inventory Previous home and 14h Po | + Coto |